Write something

Bull vs Bears Clash as Bitcoin Desperately Tries to Find Support!

Right now were in a classic bulls vs bears market with bears currently winning the tug of war but how long will it last? We could possibly see Bitcoin bounce of $92k following by and end of year rally but Bears have another plan as major Bitcoin OG's are rotating out of Bitcoin as they possibly try to scoop it up at lower prices. However the global supply of money and money printing has ramped up and the Fed has indicated an end to QT in December. We could possibly see the market ramp back up as we move forward to the end of November and as we get closer to Congress possibly passing the digital asset market clarity act before Thanksgiving. This is the perfect time to figure out a strategy like DCA or simply do nothing and let the market decide the next clear trend before you make a trade. Either way its a day by day type of market and also paying close attention to major drivers of macro economics like tariffs, trade and Congress right now.

Bitcoin is STILL Bullish End of Year? Here's Why!

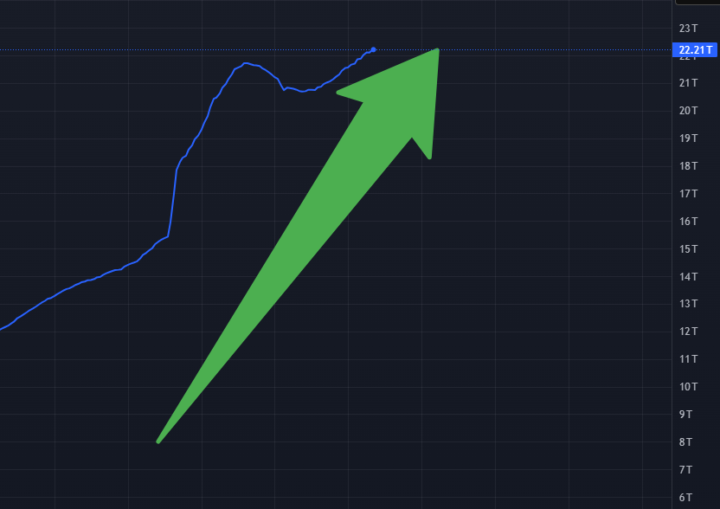

Long term holders of BTC seems to be selling while new buyers are entering at the moment. It has caused choppy sideways action. Once sellers and traders are exhausted from selling I believe we should see Bitcoin continue its late end of year rally. End of year remains one of the strongest for crypto performance historically speaking. Investors like Tom Lee from Fund Strat is still calling for a possible $150-200k Bitcoin end of year as well. Furthermore we see an increase of liquidity into the US and global economy when we look at the supply of money or "US M2" or Global M2 charts. This is usually a good indicator to watch in terms of how Bitcoin might perform in the coming weeks. So despite the short term sell pressure I think we finish the year quite strong. Here is a chart of the US Money Supply (US M2) hitting an all time high and we should see it hit even higher levels through the end of the year with the Fed cutting rates twice already and possibly a third time.

BNB Season Is Here While The Rest of the Market Slumps!

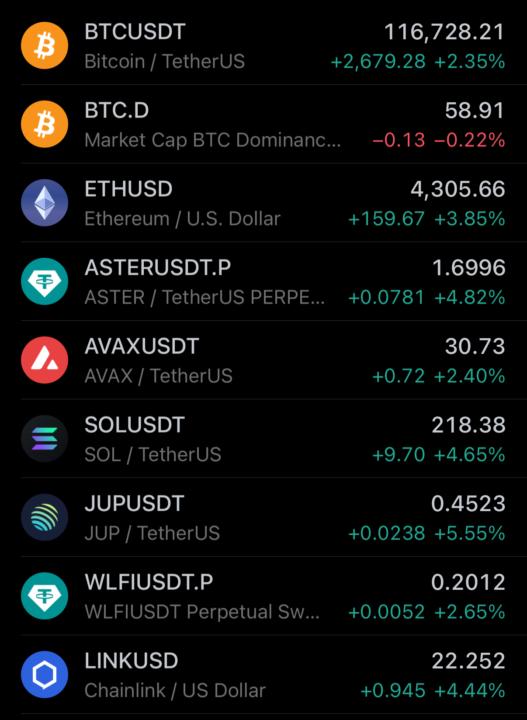

BNB has flipped XRP! The Binance effect is fully here after the launch of the decentralized exchange called $ASTER. Aster works perfectly well with BNB since i t benefits BNB directly. Since BNB has been pumping and setting all time highs the entire BNB ecosystem on BSC has been popping off. I have been being degenerate and buying memes like $PUP and it went from $5m mc to $28m mc and I was able to accumulate the dip around $1m mc. $PUP seemed like it could be a no brainer dog themed meme coin much like WIF or Bonk on Solana since BNB doesn't have a top dog or animal themed meme. WIF and Bonk's market caps combined are over $2b! Don't copy me though but these are the opportunities out here in the market that present themselves. I fully expect the BNB ecosystem to continue to have its day in the sun and even steal some market share away from Solana. I don't know how long this will last but right now the market is choosing the BNB ecosystem so be prepared to lock in and stay curious!

3

0

Aster Update: Looking Good On The Charts!

Aster corrected some but also has been trending up and breaking through resistance levels to set a new support level. Things could get interesting here for $ASTER. Looks like buying the dips and just holding is the move. Most of this is just relative to BTC and ETH moves. The narrative is also another catalyst for $ASTER since CZ (former Binance founder) is very bullish on ASTER. Also the perp/dex narrative is still strong and growth should remain positive since Hyperliquid drove this narrative for so long. A strong competitor like ASTER is very healthy for the market and will push these two major dex's to release better features for end users. As long as the narrative remains strong I expect ASTER to perform well.

3

0

USA Government Shuts Down And Crypto Pumps! 🐂

It’s interesting to note that the market has completely shrugged off the shut down and remains bullish overall. Now this might not be the catalyst pumping crypto since October otherwise known as “Uptober” is finally here! October has traditionally been a great month for crypto in previous cycles. Definitely very positive news for the crypto market. Q4 is slated to be the best performing quarter this year, mainly pertaining to altcoins! Time to lock in!

3

0

1-9 of 9

skool.com/degendads

Two dads, one mission: help you master crypto! Learn Bitcoin, Ethereum, DeFi, NFTs & Web3 with real alpha, insights & authentic community vibes.

Powered by