Write something

Pinned

🔥 Ready to skip the confusion and get certified in AI Consulting like I did?

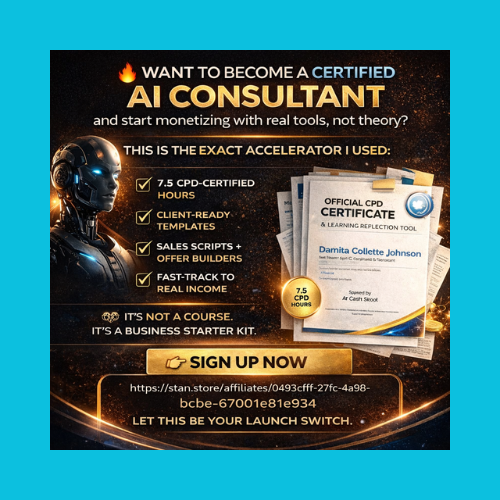

🔥 Want to become a certified AI consultant and start monetizing with real tools, not theory? This is the exact accelerator I used. ✅ 7.5 CPD-certified hours ✅ Client-ready templates ✅ Sales scripts + offer builders ✅ Fast-track to real income It’s not a course. It’s a business starter kit. → Sign up now through this link:👉 https://stan.store/affiliates/0493cfff-27fc-4a98-bcbe-67c01e81e934 No waiting. No guessing. Just execute. Let this be your launch switch.

0

0

Pinned

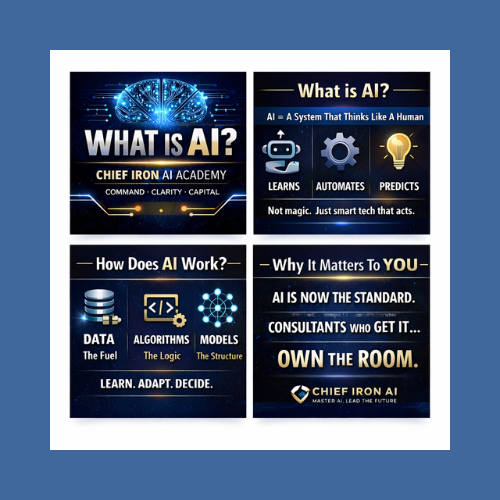

🧠 What Is AI? — Let’s Make It Clear, Now.

Chief Iron AI Academy — listen up. Before we talk tools, prompts, or profits… we build understanding. Because if you can’t define AI with clarity, you can’t consult on it with authority. So here it is — no fluff. 🔍 What Is AI? Artificial Intelligence (AI) is a system trained to think like a human — but faster, deeper, and always learning. It doesn’t mean robots with faces. It means software that learns patterns, makes decisions, and performs tasks without constant human input. This includes: - Chatbots that learn your customer’s tone. - Automation that handles repetitive tasks. - Prediction engines that forecast behavior, risk, or demand. AI is not magic. It’s just pattern recognition at speed and scale. ⚙️ How Does It Work? AI is powered by: - Data: The fuel (emails, images, numbers, voices, you name it) - Algorithms: The logic (rules, filters, decision trees) - Models: The structure (like GPT, trained on massive datasets) Put simply: “Feed it enough quality data, and AI starts making better decisions than most humans ever could.” 📌 Why It Matters To You You’re here to become an AI Consultant. That means you don’t just use tools — you explain them to business leaders with confidence. Your value is in translating AI into action: - Helping a law firm automate contracts. - Guiding a coach to scale content with generative AI. - Building systems that turn chaos into clarity. 🔑 Real-World Use Cases AI is already doing this: - Finance: Spotting fraud in real-time - Retail: Personalizing the customer journey - Health: Diagnosing patients faster than doctors - Education: Creating custom learning paths - Operations: Streamlining workflows with smart bots ✅ Your Move You are now responsible for this truth: “AI is not the future. AI is the standard. And consultants who understand it — own the room.” 📣 Drop a 💡 if this hit. Tell us below — which industry or client would you want to bring AI to first? You’re not learning AI. You’re mastering it.

Pinned

🔥 Welcome to Chief Iron AI Academy™

The #1 Skool for Creators, Coaches & Digital Product Builders who want to SCALE with AI. This isn’t just another AI group — it’s your launchpad for automated income, magnetic content, and AI-powered offers that convert. Whether you're just starting or scaling fast, here’s where elite solopreneurs and marketers come to learn: ✅ How to build 6‑figure content machines ✅ How to create & launch digital products with AI ✅ How to automate client systems, emails, & funnels ✅ How to repurpose one video into 20+ content pieces ✅ How to use ChatGPT, Canva, Notion, and more — tactically You’ll get plug-and-play prompts, live workflows, toolkits, and weekly community builds. We teach what works NOW. 🔗 If You’re Ready To: • Monetize your content without burnout • Launch digital offers faster than ever • Systemize your business with AI • Build a freedom-first business… Then you’re in the right place. 💬 New here? Introduce yourself and tell us: “What’s your #1 growth goal right now?” 🧠 Let’s build smarter. Create faster. Monetize daily. DOWNLOAD YOUR FREE EBOOK/JOURNAL TODAY! MOTTO: QUALITY over quantity!

🎯 GOAL: Transition from Franchise to Land

From Debtor/Trustee → To Grantor/Beneficiary From U.S. Taxable Person → To Private, Non-Adverse Principal 🔎 THE CODE TRAPS TO OVERCOME 🔗 26 USC § 61 – “Gross Income” (The Hook) - Definition: All income from whatever source derived is presumed taxable. - Includes: Wages, rents, pensions, business income, debt discharge, and trust income. - Presumption: You are a U.S. Person who voluntarily participates in this federal revenue system. 🔗 26 USC § 676 – “Power to Revoke” (The Escape Hatch) - If you, as Grantor, retain the power to revest title, you're treated as the owner of the trust. - IRS uses this to tax you directly on any trust income. - However, § 676 also affirms: the one who holds revocation power is the true owner and controlling party. 👉 Key Insight: IRS admits in § 676 that the one with revocation power controls the trust. Use that power not to stay liable, but to collapse the constructive trust. 🧱 STEP-BY-STEP REMEDY FRAMEWORK ✅ 1. Acknowledge the Constructive Trust Structure - By default, your estate (birth certificate, SSN) was placed into a Cesti Que Vie trust (see: 18 USC § 153; 26 USC § 673–677). - You're being treated as a trustee of a public trust operated for federal benefit. ✅ 2. Assert Your Role as Grantor + Beneficiary - Under 26 USC § 676, you as the Grantor can revoke the trust or demand title be revested. - Under trust law, you cannot simultaneously be Grantor, Beneficiary, and Trustee unless you revoke the administrative presumption. 🔑 Action: Draft and record a Revocation of Constructive Trust and a Notice of Private Status & Beneficial Interest. ✅ 3. Neutralize the Application of § 61 - § 61 applies to gross income of a U.S. person. - “U.S. person” is defined in 26 USC § 7701(a)(30) – includes individuals liable under contract or statutory agreement. - You're presumed liable unless rebutted. 🔑 Action: Include in your filing: - “I am not a ‘U.S. person’ as defined at 26 USC § 7701(a)(30). I am the living man/woman and the Grantor-Beneficiary of the named trust.” - Use UCC 1-308 (reservation of rights) and UCC 3-501 (demand for presentment of lawful claim).

0

0

🔥 Tired of Guessing How to Start? Let Us Build Your Automated AI Storefront in 7 Days.

You don’t need more tutorials. You need a DONE-FOR-YOU LAUNCH. We’re handing serious creators the exact shortcut to start making money with digital products — fast. 🎯 If you’ve got an idea, a niche, or even just a dream to earn online... this is for you. ⚡️ Done-For-You Digital Storefront — Built in 7 Days. Powered by AI. Designed to Sell. Stop watching. Start selling. If you’ve been waiting for the perfect moment to launch your digital product business — this is it. We’re handing creators, coaches, and service pros a complete business launch, done-for-you, delivered in a week. 🎯 No tech headaches. No funnels to figure out. No guessing. 💼 WHAT YOU GET: ✅ Your full AI-powered digital store (custom branded) ✅ Setup of products, payment systems, and automation ✅ Mobile-optimized and ready to sell 24/7 ✅ Ownership 100% yours — we build it, you grow it ✅ Delivered in 7 days or less This is NOT a course.This is NOT a template.This is a real build — for real results. 🔥 PERFECT FOR: - Coaches, consultants, or creators with digital offers - Entrepreneurs stuck in “setup mode” - Busy builders who want to monetize fast - Anyone who wants a branded storefront to drive income 🎯 LET’S LAUNCH: 🚨 Spots are limited and fill weekly. 👉 Click below to get your store built now 📦 No stress. No delays. Just done. Drop a comment or DM me “IRON STORE” if you want the private rundown. Let’s get you earning — not overthinking. #ChiefIronAcademy #DigitalProductLaunch #AIAutomation #DoneForYou #EntrepreneurTools #PassiveIncome #CreatorBusiness #BuildWithAI https://chiefironacademy.com/shop/8d29c671-56c0-4a2a-ab4b-18c6fe378e46?t=1769177768937

0

0

1-15 of 15

powered by

skool.com/chief-iron-ai-academy-6825

Turn expertise into predictable clients and sales using AI-powered systems—without launches, hype, or burnout. Built for coaches & course creators.

Suggested communities

Powered by