Write something

Errors ⚠️

Hey y’all, I’m still dropping gems and new money methods using credit real soon. This app had me slow down cause some payments issues , but trust I’ve been cooking up some major plays behind the scenes. Stay tuned!

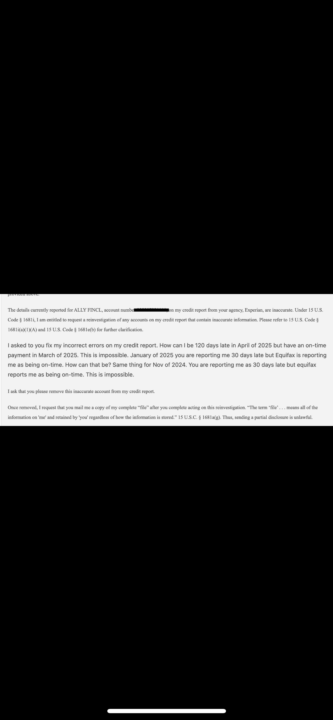

HOW TO GET EXPERIAN TO PAY YOU $7,500

1. You find these very obvious errors on your credit report 2. You create a 1681i letter explaining the errors 3. You mail the letter to Experian via certified mail and notarized 4. They respond saying the information is verified 5. You call the lender/furnisher asking did they receive the dispute because if they received the dispute and did not correct the error, you're gonna sue them also. 6. Apply for credit and get denied to add a lil pain n suffering to the mix. 7. Contact me. I'm a consumer law paralegal who will put the lawsuit directly on the attorneys desk. 8. You receive a check and the account deleted from your credit report. PLEASE SEE ATTACHED PHOTOS FOR AN EXAMPLE. Photo 1 - I went into great details the errors on the credit report Photo 2 - Dispute results from Experian that clearly show the dispute was completed and the incorrect late payments not removed.

0

0

LETTER TEMPLATE

🔥 FREE 💎 👇🏾 [Your Name] [Your Address] [City, State ZIP Code] [Email Address] [Date] To: [Equifax / Experian / TransUnion – Choose or send to all three] [Dispute Department Address – insert correct bureau address] RE: Formal Dispute of Inaccurate Information Under FCRA Accounts in Question: [List Account Names & Numbers] To Whom It May Concern, I am formally disputing the accuracy and completeness of the following entries on my credit report as provided by your bureau under my name and Social Security number. The following accounts contain inaccurate and unverifiable information: • [Account Name, Last 4 Digits] – Late Payments (MM/YY to MM/YY) • [Collection Agency Name / Account] – Placed in collections without proper validation According to the Fair Credit Reporting Act (FCRA), you are legally required to ensure all information you report is accurate, complete, and verifiable. Under FCRA § 611 [15 U.S.C. § 1681i], I am invoking my right to dispute these items and request an immediate investigation. LEGAL VIOLATIONS AND GROUNDS FOR REMOVAL: 1. Failure to maintain maximum accuracy – FCRA § 607(b) [15 U.S.C. § 1681e(b)] You are required to have reasonable procedures in place to ensure maximum accuracy. Reporting unverifiable or outdated negative data is a direct violation of this. 2. Failure to validate debt – FDCPA § 809 (15 U.S. Code § 1692g) The collections reported were never properly validated by the debt collector in writing upon my request. Continuing to report them without validation is a violation of my rights under the Fair Debt Collection Practices Act. 3. Obsolete information reporting – FCRA § 605(a) If any of these negative accounts are over 7 years old from the date of first delinquency, they must be removed immediately as they are now obsolete. 4. Reinsertion of previously deleted or disputed data – FCRA § 611(a)(5)(B) If any of these accounts were previously removed and reinserted without notifying me within five business days, this is a direct breach of federal law.

0

0

Build Credit With $0 fees & 100pts 🏆

https://current.com/get-started/?utm_source=google_brand_search&utm_campaign=google-brand_web_core_conversion__all___exact_conv&utm_campaignid=1623204629&utm_adgroup=current&utm_content=65739345270&utm_term=668246659829&utm_keyword=current&gad_source=1&gad_campaignid=1623204629&gbraid=0AAAAADNr9aH52OUvHgk2ZN_Wfg2AdsDvY&gclid=Cj0KCQjw0LDBBhCnARIsAMpYlAoqtgjcn9dKEWB2EFUuDRU0HAPMlpid1u8bccPVD5JEfnnnfEg167kaArmrEALw_wcB

0

0

REMOVE LATE PAYMENTS 📑

Handle late payments as potential billing mistakes under the Truth in Lending Act (15 U.S. Code §1666). If the creditor can’t prove the charges were valid and that you received the statements properly, that late payment needs to be removed. Send your dispute directly to the creditor not the credit bureaus and ask for: - Proof that they sent your billing statements - The actual due dates - Their official process for handling missed payments If they can’t provide that info, they’re not in compliance. You’re not pleading you’re holding them accountable.

0

0

1-30 of 32

skool.com/cash-talk-business-6096

Helping entrepreneurs master credit, Airbnb, Turo, Facebook ads, crypto, dropshipping, and social media to create wealth and freedom.

Powered by