Write something

Pinned

Welcome to the "Passive Investing" Community!

Hi, I’m Mika! 👋 Welcome to our community for passive investing enthusiasts! Whether you’re brand new to investing, looking to grow your portfolio with ETFs, or just want a low-stress way to build wealth, you’re in the perfect place. This space is all about: 💡 Simple, step-by-step strategies for passive investing 📈 Support to help you stay on track and confident 🤝 Connecting with like-minded people on the same financial journey To get started, let’s break the ice: 🗣️ Introduce yourself and share a pic of your favorite spot to plan your investments! I’d love to see where you’ll be joining us from. I’m so excited to be on this journey with you. Let’s build a brighter financial future—together! 🚀

0

0

How the Enocomy works 🤓

In his video, Ray Dalio does a great job of explaining how the economy works. If you want to understand the basics of the economy, this video is definitely worth watching!

0

0

📊 Why You Should Consider ETFs in Your Investment Portfolio

Hi everyone! 👋 If you're looking for a simple and effective way to diversify your investments, Exchange-Traded Funds (ETFs) could be a great option! What is an ETF? An ETF is a type of investment fund that holds a collection of assets (like stocks, bonds, or commodities) and is traded on a stock exchange, similar to individual stocks. Why ETFs are Great for Beginners: 1. Diversification: With just one ETF, you can invest in a wide range of assets, reducing the risk of putting all your money into a single stock or sector. 2. Lower Fees: ETFs usually have lower management fees compared to mutual funds, making them a cost-effective option. 3. Liquidity: Since ETFs are traded on exchanges, you can buy and sell them anytime during market hours, just like individual stocks. 4. Accessibility: You don’t need a lot of money to get started. Some ETFs allow you to invest with small amounts, making them accessible to beginners. Example: If you want to invest in the broader stock market, you could consider an S&P 500 ETF. This ETF tracks the performance of the 500 largest companies in the U.S. (like Apple, Microsoft, and Amazon), allowing you to invest in a diverse group of companies with just one purchase. 💬 Have you invested in ETFs yet? Or do you have any questions about how they work? Drop your thoughts or questions below – let's discuss!

0

0

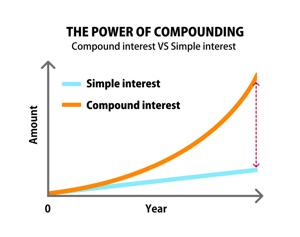

💡 The Power of Compound Interest

Hi everyone! 👋 Compound interest is one of the most powerful concepts in investing. It’s the process where you earn interest on both your initial investment and the interest that’s been added to it. Why it works: 1. Earnings build on earnings: As your investment grows, the interest you earn compounds, meaning you earn interest on the interest itself. 2. The earlier, the better: The longer your money has to grow, the more powerful compounding becomes. Even small investments can grow significantly over time. 3. It accelerates growth: The longer you leave your money invested, the faster it can grow, which is why investing early and staying invested is key. Example: If you invest $10,000 at 10% interest annually for 20 years, your investment would grow to around $67,275! That's the power of compound interest at work. 💬 Have you seen the effects of compound interest in your investments? Share your thoughts or ask any questions below!

0

0

📈 What is Dollar-Cost Averaging (DCA)?

Hi everyone! 👋 Dollar-Cost Averaging (DCA) is an investing strategy where you invest a fixed amount of money at regular intervals (e.g., weekly or monthly), regardless of market conditions. Why DCA is a Smart Strategy: 1. Reduces market volatility impact: You buy more when prices are low and less when prices are high, averaging out the cost over time. 2. Avoids emotional investing: DCA takes the guesswork out of timing the market, helping you stay consistent and avoid reacting to short-term price changes. 3. Ideal for long-term growth: It’s a simple and effective way to build wealth steadily, especially if you're investing for retirement or other long-term goals. Example: If you invest $500 every month, some months you might buy more shares when prices are low, and fewer when prices are high. Over time, this strategy can lower your average cost per share. 💬 Do you use Dollar-Cost Averaging? Let me know how it’s worked for you or ask any questions below!

0

0

1-5 of 5

skool.com/aphasia-8420

I’m Mika, passionate about passive investing. I’m here to help you grow wealth and reach your financial goals stress-free with ETFs! :)

Powered by