Activity

Mon

Wed

Fri

Sun

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

What is this?

Less

More

Memberships

Global Business Growth Club

1.9k members • Free

29 contributions to Global Business Growth Club

IRS 1120 and 5472 for an LLC founded in 27-12-2024

Do you need to file 1120 and 5472 for 2024 for an LLC founded in 27-12-2024?

Business Expense Charge Back

I need to charge another business for an expense I made on their bhalf. When the chargeback is paid, it will come as revenue - And therefore taxable. What's the best way to bill costs back ? thank you

0 likes • May 5

@P S : there are 2 options of what you can do: 1) Bill them as a Disbursement or Reimbursement: Disbursement/Reimbursement structure means you bill only for the actual expenses incurred — no markup, no profit. You should attach receipts and clearly indicate that this is a pass-through expense. Use language like: "Reimbursement for out-of-pocket expenses incurred on behalf of [Client's Name], per agreement". This be classified in your books as a contra expense or liability offset, not as revenue, thus avoiding income tax on the reimbursed amount. 2) Bill them as Revenue but Offset by Expense (If simpler). If you don't set up a pass-through structure, the reimbursement will be taxable income (revenue).In that case, the expense you incurred should also be on your books as an expense, so you get an expense deduction to offset the taxable income (though timing differences can arise). This could be simpler to administer, but you have to report both the income and the expense, and your margins/profitability metrics may be distorted. Also, timing mismatches could result in temporary tax liabilities. Good luck!

Business Address Proof of Address (using an EIN letter from IRS?)

I was watching a video where JB was talking about proof of business address and that he uses sub-lease agreements for his clients. But given the business has to have the EIN in the same address, why couldn't the EIN letter from the IRS be uses to prove the business address? Anyone have any thoughts on this?

1 like • May 5

@Brandon Smith: An EIN letter from the IRS (Form SS-4 Notice CP 575) does contain a business address, but: - The address is simply what was provided when applying for the EIN. - The IRS does not verify or validate the physical presence of the business at that address. - This address can easily be changed by filing a form (Form 8822-B), so it's not considered a strong or verifiable proof of physical presence. Banks and payment processors often require proof that shows you are actively operating from a location, not just that you submitted an address on a form.

Urgentttt - Help

Can anyone here guide me - if my foreign owned single member LLC is formed in Nov 2024 - when is my Federal tax filing deadline? Thanks

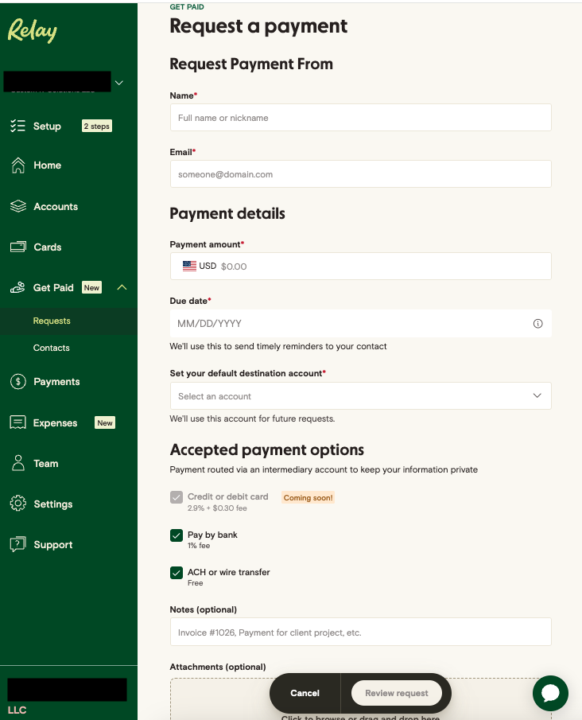

Exciting Update from RelayFi: Credit & Debit Card Payment Processing Coming Soon

RelayFi will be supporting debit and credit card payment processing directly within their online platform. Payments processed will have the familiar Stripe pricing structure (2.9% + $0.30 per transaction), making it an excellent alternative to Stripe for those, who is already approved by Relay. It will be possible to: - Request payments via credit/debit card directly in RelayFi. - Enjoy simplified accounting and reconciliation by managing both banking and payment requests in one place. More details: RelayFi Payment Requests Overview Processing Fees, Settlement Timelines & Limits Here's how the new feature looks (see screenshot for UI preview):

1 like • May 4

@Vlad Million: I applied at the end of December 2023 and got approved in early January 2024, when the rules were more lenient than they are now. As I recall, the online application process was lengthy, but still manageable. However, they later sent me a long questionnaire by email, where I had to describe my business case in detail, including past history and future projections, and attach a large number of supporting documents. It was really exhausting... It was not about having or not having a website or about having or not having an ITIN. If you travel to the U.S. and open a brick-and-mortar business bank account, they don’t ask for more than what’s required in the standard questionnaires.

1 like • May 4

@Vlad Million: In my case, I switched from being a permanent employee to a freelance consultant, but I remained with the same U.S. employer. I provided Relay with all the supporting documents related to my situation, so my past history and future projections were well covered. I did not submit an ITIN, as I simply do not have one. Regarding the timeline: I applied in the last week of December 2023, which means the application fell under the 2023 compliance rules. > your home address with your local (non-U.S.) bank statement Yes, I used it as proof of address.

1-10 of 29

@vitaly-kliger-2607

digital nomad | freelance data engineer | LLC owner

Active 17d ago

Joined Jan 20, 2025

Netherlands

Powered by