Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Ultimate 7-9 Figure Ecom Setup

831 members • Free

Davie's Free Ecom Course

71.5k members • Free

Ecomliberty

42.5k members • Free

Revolt Ecom

23.8k members • Free

Elites Coaching

3.1k members • Free

High Ticket Ecom Mastermind

13k members • Free

Ecom Growth Blueprint

914 members • Free

eCom Messiah

7.5k members • Free

Project HTS

862 members • Free

4 contributions to Ultimate 7-9 Figure Ecom Setup

Tax structure for trading

Hello, good afternoon! My economic activity is trading (forex, indices, cryptocurrencies), the profits obtained from trading are in cryptocurrencies (usdt, bitcoin, litecoin). What would be the appropriate tax structure for me?

1 like • Mar '25

Hey Guys, in this case a US LLC + Dubai Residency could be a good option because in this case the LLC can be used for your business activities and to cash out the crypto later and you can avoid the capital gains tax because you are living in a place with no capital gains tax (Dubai). Also it is pretty simple and straightforward to set up. (For more info I can recommend you to watch this videos: (US LLC https://www.youtube.com/watch?v=CY1EmLlOfPk and Cash Out Crypto: https://www.youtube.com/watch?v=RurNg1GdarA)

Have you seen Samuel’s latest conversation with Difaino?🔥

https://m.youtube.com/watch?v=-V9JcgfJxZU

Who is new here? 😃

Feel free to introduce yourself by sharing who you are, how long you are in ecom, how much revenue you making, what challenges you face at the moment and how you can help others.

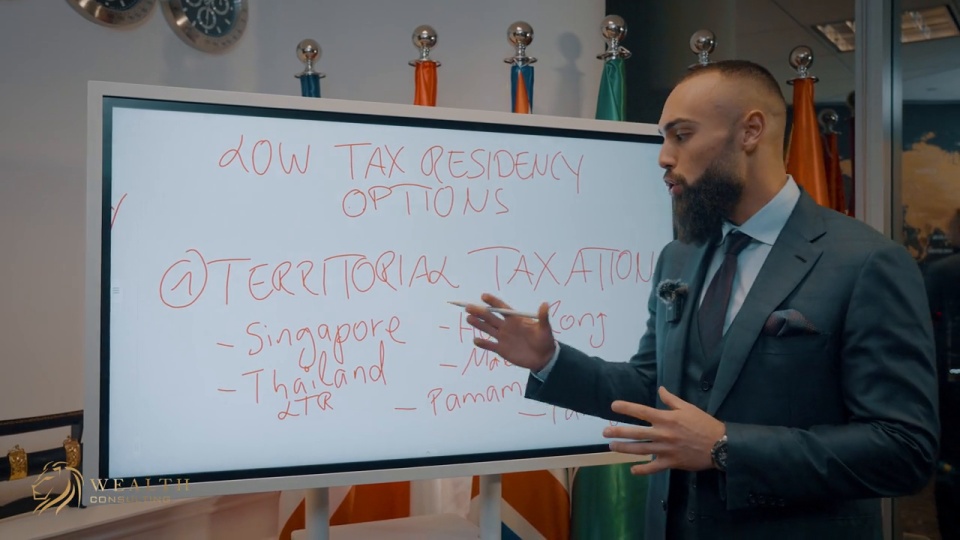

Wealth Consulting Blueprint Content LEAKED

I LEAKED exclusive content from the Wealth Consulting Blueprint....on how to pay 0% tax😬 ps.: please dont tell Samuel🙄🤫 (this is no official tax advice, please consult you tax advisor)

1-4 of 4