Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

The Way Better Living Academy

44 members • $47/month

(Free)Credit Repair Made Easy

2.3k members • Free

Coach Capital

2k members • Free

Lets Geaux Hustle

7.8k members • $17/month

Ms Financial Credit Mentorship

45 members • Free

M

Me.Jay’sCreditPlays

71 members • Free

Prosperity Lab

16.6k members • Free

21 contributions to Lets Geaux Hustle

Holiday Tradeline ‼️‼️‼️🎄🎄$50 off

GM!! Tradeline !! $29k 15 Years 2% utilzation Report date 08DEC2024 ‼️‼️‼️📊📊📉📈

5

0

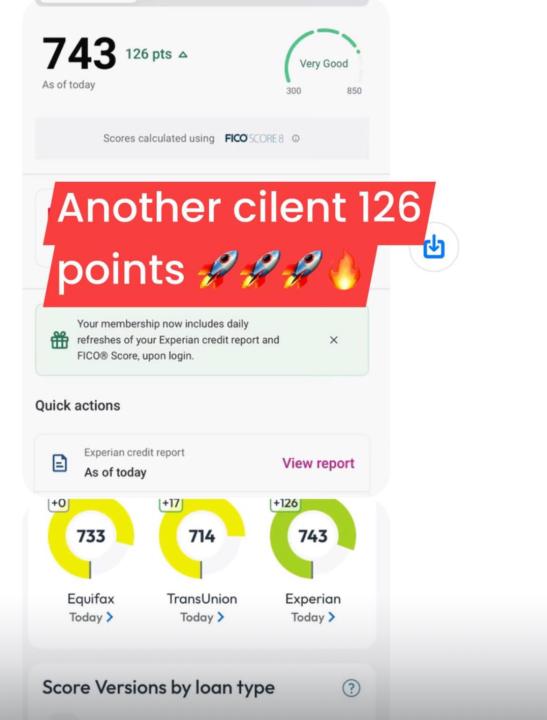

Tradeline 📈📈📊‼️Boost +112 points

A tradeline from M&A Financial Academy can be a powerful tool for boosting your credit score. Tradelines are essentially credit accounts listed on your credit report, such as credit cards, loans, or lines of credit. Here’s how they can enhance your credit profile: 1. Improves Credit Utilization Ratio When M&A Financial Academy adds a high-limit tradeline to your credit report, it can lower your credit utilization ratio. This is the percentage of your total credit used compared to your credit limit. A lower utilization ratio is a key factor in improving your credit score. 2. Adds Positive Payment History Tradelines with a history of on-time payments demonstrate financial responsibility to creditors. By adding such a tradeline to your report, M&A Financial Academy can help show lenders that you have a history of managing credit well. 3. Lengthens Credit History The age of your credit accounts contributes significantly to your score. By leveraging an older tradeline, you can increase the average age of your credit accounts, making your profile look more seasoned. 4. Increases Creditworthiness With higher credit limits and a positive credit record, tradelines can improve your overall credit profile. This can make it easier to qualify for loans, secure lower interest rates, and access better financial opportunities. How M&A Financial Academy Helps M&A Financial Academy specializes in adding authorized user tradelines to clients’ credit reports. These tradelines are from well-established accounts with excellent payment histories. By temporarily being added as an authorized user to these accounts, you benefit from their positive credit history without being responsible for the debt. This strategy is especially useful for individuals trying to: • Secure approvals for mortgages, auto loans, or business credit. • Recover from financial setbacks, such as late payments or collections. • Build or rebuild credit quickly and effectively. If you’re looking to significantly enhance your credit profile, M&A Financial Academy’s expertise with tradelines and credit repair services makes them a valuable partner.

4

0

CREDIT BOOSTER 🚀🚀🚀📊📈📊🚀

AU TRADELINES LIST AVAILABLE!!! Amex $50k limit 12 years 2 spots available! Capital one &40k limit 18 years 1 spots available! Capital One $65k limit 17 years 7 spots available! NFCU $90k limit 6 years 5 spots Available TD Bank $45k limit 10 years 5 Spots Available NFCU $40k limit 12 years 5 spots Available Chase 50k limit 9 years 5 spot available! Barclays 35k limit 11 years 5 spot available! Work on getting your credit score raised and increasing your overall purchase power ⚡️

The Power of a Tradeline 🔥🔥🔥

A tradeline is a record of activity on a borrower’s credit account, and its impact on credit can be powerful for several reasons: 1. Credit History Boost: A seasoned tradeline, which has been open for a long period, can add positive credit history to your report. A longer credit history tends to boost credit scores, especially for those with a shorter or limited credit history. 2. Improving Credit Utilization: If the tradeline has a high credit limit and low balance, it can improve your overall credit utilization ratio (the amount of credit used versus available credit). A lower utilization ratio typically increases credit scores. 3. Enhancing Payment History: A tradeline with a strong record of on-time payments can positively impact your payment history, which is the most significant factor in determining a credit score. 4. Credit Mix Diversification: Adding different types of credit, such as a revolving credit line (credit cards) or installment credit (loans), through a tradeline can improve your credit mix, which also influences your score. However, the effectiveness of a tradeline can vary depending on individual credit profiles.

🚀Boost Your Credit, Unlock Your Future – Secure Your Success with Powerful Tradelines‼️📊🚀🚀

Are you ready to unlock the doors to better financial opportunities? Boosting your credit score can be the key to achieving lower interest rates, higher credit limits, and approvals for major purchases like homes or cars. With our premium tradelines, you can add positive credit history to your report less than 30 days. Imagine having a strong credit profile that lenders trust! Whether you’re working on rebuilding your credit or looking for that extra edge to secure your next big financial move, our tradelines provide the proven results you need. Don’t let a low score hold you back—start investing in your credit today and watch your financial future grow! Contact me @205-521-4441 to learn how you can boost your score fast with our trusted tradeline services. Your future is just a credit score away!

1-10 of 21