Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Dr Thomas

Builders who want to optimize Energy and performance with weekly challenges ✅ Energy Audit Call 👇 https://cal.com/thomas-webb-personal/30min

Memberships

Hybrid Athlete Club

184 members • $7/month

Skoolaroos

139 members • Free

Evergreen Foundations

530 members • Free

The Content Revenue Lab

514 members • Free

The Better Brain Project 🧠

110 members • Free

UNDETERRED

659 members • Free

Elaborate Runners

130 members • Free

Ontos Run Club

10 members • Free

Cinematic Film Skool

936 members • Free

78 contributions to Bitcoin

🥈 Silver vs ₿ Bitcoin: Don't Fall Into The Switching Trap

The Silver Opportunity ⚡ Silver can absolutely do well in the coming year. When fear rises and money gets debased, precious metals get a bid. I'm not here to trash silver – it has real utility and has protected wealth for thousands of years. But here's what you need to understand: Silver is not the end game. Bitcoin is. ⚠️ The Deadly Trap Most Investors Fall Into --------------------------------------------------------------------- Here's where people get wrecked. Jumping from one horse to another to chase short-term gains feels smart. You see silver pumping and think you're being tactical. You see Bitcoin dipping and think you're being disciplined. Until you fall off and get trampled. 🐎💥 Most people lose money not because they pick the wrong asset, but because they switch too often at exactly the worst time. They sell the bottom, chase the top, and end up with less than if they'd just stayed put. The wealth isn't made by those who jump around. It's made by those who ride the right horse all the way to the finish line. 💡 My Practical Take for 2025 ------------------------------------------------ If you want to put a small percentage of your emergency fund into silver? Fine. Do it smart: ✅ Physical bars only – no paper, no futures, no ETFs ✅ No leverage – own it outright ✅ No paper promises – if you can't hold it, you don't own it But make a rule right now: 📅 At the end of 2026, rotate back into Bitcoin. Promise yourself you will buy Bitcoin in November 2026 when it usually starts that slow grind higher and everyone is still asleep. Set a calendar reminder. Make it non-negotiable. Silver can be your trade. But don't let it become your prison. 🏆 Why Bitcoin Wins Long Term --------------------------------------------------- Let's get real about the fundamental difference: Silver's Limitations 🥈 - Requires third-party trust again - Storage costs and security risks - Verification requires expertise - Transport is expensive and risky - Settlement requires middlemen - You're back to trusting the same people who have lied time and time again

2 likes • 9d

good post jeremie but I wouldnt be a fan of a "rotation" november is a prediction based on historical timelines but who knows i think it comes back to fundamentals and long term mindset so that brings me DCA into BTC at this stage if you believe in fundamentals of silver then fine DCA into that but rotations to me just feels like trying to time the market, and also trying to beat the longterm trends. not a fan of that and goes against your previous very good points

The Tale of Two Savers: A 10-Year Journey

Meet two friends, both 30 years old, both sitting on $100,000 in savings. They're standing at a crossroads that will define the next decade of their financial lives. Sarah buys the dream home. ---------------------------------------------- She finds a $500,000 house. Perfect neighborhood, good schools nearby, everything she imagined. She puts down her $100,000, takes a $400,000 mortgage at 7%, and settles into homeownership. Her monthly reality becomes: - $2,661 mortgage payment - $417 property taxes - $150 insurance - $417 maintenance fund Every month, $3,645 leaves her account. She's building equity, she tells herself. This is the American Dream. Marcus takes a different path. ------------------------------------------------- He takes that same $100,000 and buys Bitcoin. He rents an apartment for $2,500 a month, but here's the key—he still has that $1,145 difference between what Sarah pays and what he pays. Every single month, that $1,145 goes into more Bitcoin. He's betting on 25% annual growth. Aggressive? Yes. Impossible? History says no. Fast forward 10 years. ------------------------------------ Sarah decides to sell. Her home appreciated 3% annually—solid, respectable growth. It's now worth $671,958. But there's still $343,250 left on that mortgage. After paying 6% in selling costs and settling the loan, she walks away with $288,391. Not bad, right? She more than doubled her initial investment. Marcus opens his Bitcoin wallet. ----------------------------------------------------- $1,785,077. He stares at the number. Six times what Sarah made. And unlike Sarah, he could have accessed that money at any point over the decade. No selling costs. No mortgage to settle. Pure liquidity. The brutal math nobody talks about: ----------------------------------------------------------- In Sarah's first five years, nearly all her mortgage payments went to interest. The bank got rich while her equity barely moved. She was trapped—not just in the house, but in the payment. One bad month at work? She's not just behind on rent, she's risking foreclosure.

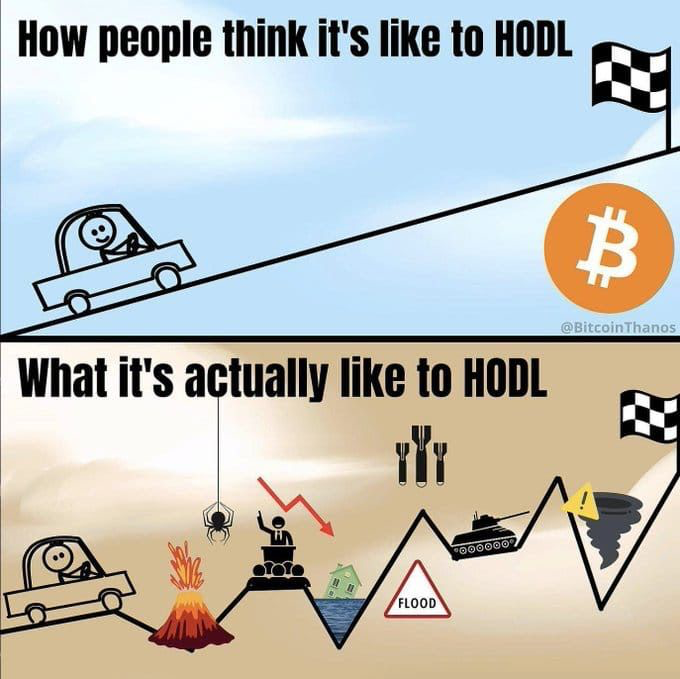

This Is Why Most People Quit Bitcoin Too Early

Bitcoin rewards patience + consistency, not emotion. What’s been harder for you? Staying disciplined Ignoring noise Waiting without results Explaining Bitcoin to others - One answer only 👇

3 likes • Dec '25

Yea @Nate Perry said it well. Bitcoin doesn’t care about your timeline. It has its own. And that’s longterm. It has reached me to be longterm minded. Bitcoin simply won’t tolerate short term mindsets. It will shake you out. I realise to be on the Bitcoin train peacefully I need to increase my time horizon. Let go of where I want price to go in short term. Best thing I have done in my 2.5 years of Bitcoin is - set up a DCA I can afford - Not check the price - Have a certain amount of money in my bank account to use if I need to and not worry about extracting from BTc

3 likes • Dec '25

Very true. I have fully accepted the effect it can have on the lizard brain. So I have been very disciplined at not making it a habit to look at price. I have a constant DCA daily of what I can afford. Otherwise I live my life with my mind on longterm. Definitely got a bit too excited this bull run and obsessed with price. But have been humbled, so am fixed now on longterm. If you want to play short term game it’s volatile and not fulfilling.

1-10 of 78

@thomas-webb-7574

Medical Doctor, Energy and health Optimizer

Online now

Joined Jul 4, 2024

INTJ

Perth

Powered by