Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

AI Masters Community with Ed

11.1k members • Free

Crypto Renegades Academy

153 members • $497

CryptOptics

31 members • Free

RoseTree Investing Academy

991 members • Free

InvestCEO with Kyle Henris

40.9k members • Free

7 contributions to CryptOptics

5 Industries Set To Generate Trillions In 2026 👇🏽

Most wealth isn’t made by chasing trends, it’s made by positioning early in structural shifts. These sectors are where capital is concentrating: 1️⃣ Robotics Automation is moving beyond factories into logistics, healthcare, and real-world systems. - NVIDIA — Powering AI brains behind robotics - Tesla —Humanoid robotics (Optimus), AI-driven automation 2️⃣ Energy AI, data centers, EVs, and electrification are pushing grids to their limits. - NextEra Energy — Renewable + grid scale - Constellation Energy — Largest operator of nuclear power plants in the U.S 3️⃣ AI / Cloud The digital foundation of the modern economy. - Microsoft — Azure + AI integration - Amazon — AWS dominates global cloud 4️⃣ Space Satellites, communications, defense, and data collection are scaling fast. - Lockheed Martin — Space + defense systems - Rocket Lab — Commercial launches + satellites 5️⃣ Defense Geopolitical tension + AI warfare + cybersecurity = sustained spending. - Palantir — AI + government contracts - Northrop Grumman — Advanced weapons + space defense 💡 The takeaway: These aren’t short-term hype plays, they’re systems being built. The edge comes from understanding why capital is moving, not just reacting when prices already ran. Which sector should we break down deeper next and do you want this from an investing or trading angle?

Epstein Created Bitcoin... ALLEDEGLY

Every cycle, the same playbook shows up. New “shocking” narratives. Sensational headlines. Sudden stories meant to shake conviction. Right now, that looks like: “What if Satoshi was X?” “What if Bitcoin was secretly funded?” “What if the whole thing is compromised?” Let’s be clear: Even if every rumor were true, it wouldn’t change the fundamentals. Bitcoin doesn’t run on personalities. It runs on code, consensus, and math. No kings. No backdoors. No central control. If you don’t trust developers, the answer isn’t panic BUT it’s running your own node. Bitcoin was designed for that exact reason. Here’s the part most people miss: If Bitcoin were truly going to zero, institutions wouldn’t be stacking it quietly. They wouldn’t be building custody, ETFs, and infrastructure behind the scenes. Wealth has always been built on one side’s ignorance and the other side’s intel. The media cycle exists to distract, confuse, and weaken conviction especially when something threatens the existing monetary system. Bitcoin remains the last uncensorable money in a world moving toward surveillance finance and CBDCs. Don’t let noise shake your understanding. Study the system. Understand the incentives. Ignore the propaganda.

1 like • 3d

I wish there was a LOVE button but I guess the LIkE button will do . I LOVED your take on BTC and I couldn't AGREE more with you and WE are certainly in the Minority right now with the overall World population still Asleep and just eating whatever the media is serving that day. I was once there myself and sometimes I have to check myself so it's always a great thing to be reminded at times what is REALLY taking place and not to fall in the mainstream narrative to where we're all screwed. Thanks My Friend. Hope all has been going well with you and I always enjoy your commentaries. Thanks Again for all you do!!!

New Here? Here’s What AI Actually Is (And How To Start Using It)

If you’ve never used AI before or aren’t even sure what it really is. this post is for you. AI (Artificial Intelligence) is simply software that can think, analyze, explain, and assist by learning from massive amounts of information. You don’t need to code. You don’t need a tech background. If you can type, you can use AI. So… how do you actually use AI? You use AI through websites or apps, just like Google but instead of searching, you talk to it. You type a question or task, and AI responds: - Explaining things in plain English - Helping you plan or decide - Writing, summarizing, or negotiating - Saving you time and money That’s it. That’s using AI. Is there a free AI? Yes and they’re very powerful. Beginner-friendly, free options: - ChatGPT (My favorite) (Free Version): Best place to start. Versatile, simple, and easy to talk to. - Microsoft Copilot: Built into Edge/Windows, good for everyday help. - Google Gemini: Useful for research and explanations. You can start with these today, no payment required. Are there paid versions? Yes but you don’t need them yet. Paid versions usually offer: - Faster responses - More advanced reasoning - File uploads and deeper analysis Most people should start free, learn how AI works, and upgrade only if it actually helps their life or income. Why this matters AI isn’t “the future”, it’s already here. People are using it right now to: - Save money - Learn faster - Increase productivity - Create new income streams Those who learn it early gain leverage. Those who ignore it fall behind. This community will teach AI from the ground up. No hype, no games, just practical ways to understand it and use it in everyday life.

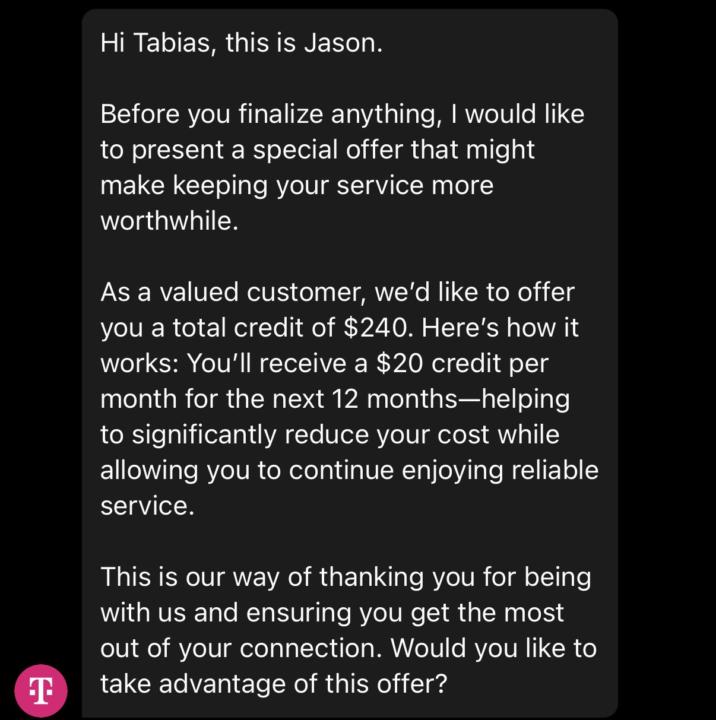

How I Lowered My Monthly Bill Using AI (With Proof)

I recently used AI to analyze, negotiate, and optimize my phone bill, and it worked. Here’s the bigger lesson 👇🏾 Most people overpay because they: - Don’t know what to ask for - Don’t understand how companies structure pricing - Don’t push back consistently AI changes that. By using AI to: - Script conversations - Identify leverage points - Compare plans and pricing - Stay calm and objective You turn a frustrating process into a repeatable system. This isn’t about phone bills specifically. It’s about learning how to use AI as a personal leverage tool for saving money, negotiating, researching, and optimizing everyday decisions. I’ll break down the exact process and prompts if you like, but for now: 👉🏾 Let this be proof that small AI wins compound, just like investing. Review through the screenshot. Then ask yourself: where else could AI be saving you money right now? 👇🏾 Comment “AI” if you want the step-by-step breakdown and I’ll direct message you.

1 like • 30d

AI Also, this may be a silly question and maybe I should already know but I don't. So, when your using AI, how do I use AI? Is there a AI site that I go to? Is there a Free one? Is there a Paid for one (which I'm sure there are PLENTY of those) and which do you use and possibly recommend? The more user friendly would be up my alley preferably and if there are any good Free ones would also be right up my alley as well. Thank You in advance for any input that you may have.

AI Infrastructure In 2026: The Stack Powering The Future

AI doesn’t run on magic. It runs on infrastructure and in 2026, understanding this stack matters as much as understanding the internet did in the early 2000s. AI is layered. Every layer plays a role. Miss one, and the system fails. Here’s the breakdown 👇🏽 The AI Stack: - Layer 1⚡ Energy & Power → Electricity, grids, nuclear, renewables. No power, no AI. - Layer 2 🧠 Chips & Compute → GPUs and accelerators that process intelligence. - Layer 3 🏢 Data Centers → Physical homes of AI systems. - Layer 4 🌐 Cloud & Networking → Fiber, cloud platforms, and data flow. - Layer 5 🤖 Models & Software → Where intelligence is built and refined. - Layer 6 📈 Applications → Where real-world value is created. Why It Matters : AI isn’t one product, it’s an ecosystem. Understanding the layers helps you see where opportunity, bottlenecks, and long-term value will form. Searching for investments tied to these layers would present great long-term opportunities. We’re still early. The stack is being built now.

0 likes • 30d

I've got a question on Investing/ possibly Trading with the above information at hand. I would assume with the 6 stacks/layers mentioned that any and all of them would be a pretty safe bet that investing into them would more than likely produce good to even great returns over time. Now, if I wanted to Trade on any of the Stacks/Layers which (if any) might you recommend to get into 1st? In other words which of the 6 do you anticipate to boom or skyrocket before or quicker than the others? I could be wrong but I'm scencing that out of those 6 something will boom really quick and I'm thinking really soon. Any thoughts

1-7 of 7

Active 3d ago

Joined Oct 4, 2025

Lafayette, Georgia