Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

35 contributions to gwt

UPDATE: GWT is migrating to Trading Boss!

New Free Group: Trading Boss Free New Paid Group: Trading Boss VIP I've put 500+ hours into building a portfolio of 75 live trading bots that are ready to plug & play. This new update is truly my best work. And it will all be available in a new group that co-own called Trading Boss VIP! As of 12/6/24 this current group will be retired, and all future updates and support will be provided inside Trading Boss. The Update New Workspaces: - Data: Faster chart load times by ensuring no duplicate datasets are downloaded (open first). Defaults to 3 years per chart - Micros: 30 micro bots - Alpha: 12 mini bots (indexes) - Olympus: 33 mini bots (indexes, oils, metals, commodities, currencies) - TM: Improved Trademanager for faster position matching. Can now sort by strategy labels (open last), and quick trade. More Workspaces: - "Full" workspaces: Default to 30 years of data for back testing. Data_Full can take 1+ hours to load - Analysis: Review trades taken. - Backup folder contains copies of all workspaces for restoration. New Bots: - Added: BTC, RTY, YM, MBT, M2K, MYM - Reoptimized bots for better risk: ES, NQ, EMD, MES, MNQ - Removed SI Long Bot Coming soon: - Preloaded VPS's with Tradestation bots already installed - Spreadsheet including strategy risk stats - Simplified install files and walkthroughs If you are a current client of mine, check your email for an invite. P.S. GWT members, if you'd like to trial the new algos for free DM me!

GWT Coding Bounties

1. GUI of Python Portfolio Analysis Code (running project) 2. Live Slippage Delta 3. Spearman's Correlation I've ranked these by order of difficulty. Rewards will be credited towards mentorship or licensing 1. 3 months 2. 2 months 3. 1 months Please select the bounty you want. For options with multiple vote, best one wins (not necessarily the fastest coder but the best one)

Poll

4 members have voted

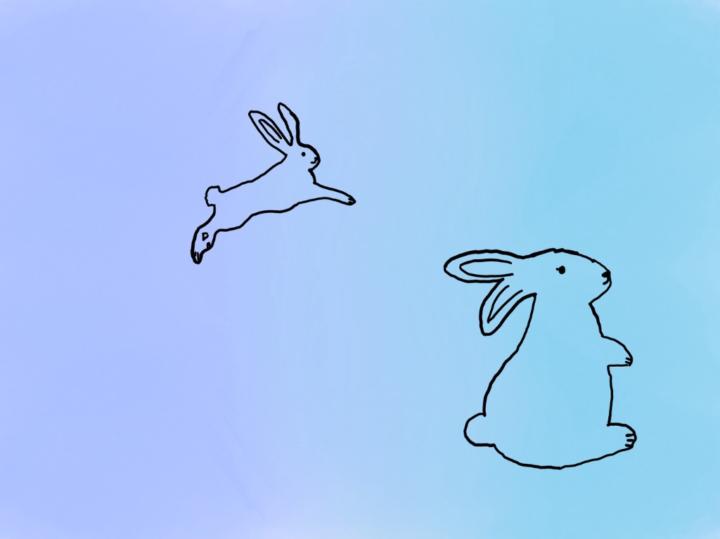

Live Traders: If you are getting market rejected orders

DANGER! Heads up if your purchasing power (amount of money in your live account) drops too low And an algo entry triggers and gets rejected, then you need to IMMEDIATELY: - Find that chart and toggle status and click "Do Not Exit This Position" If you dont, the algo is still on full auto with account confirmation off. It will STILL TRY TO EXIT. Even if it didn't get filled on the entry Which means you'll be trading random positions without edge. This is very dangerous. Here's 4 solutions: 1) Add more capital to the account (best option!) 2) Go to micros (deleveraging is 2nd best option. But more slippage) 3) Turn on account confirmation by unchecking the bottom check box in F2 (you manually approved all orders) 4) Turn off some algos (still might result in order rejections if you don't have sufficient purchasing power)

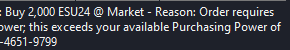

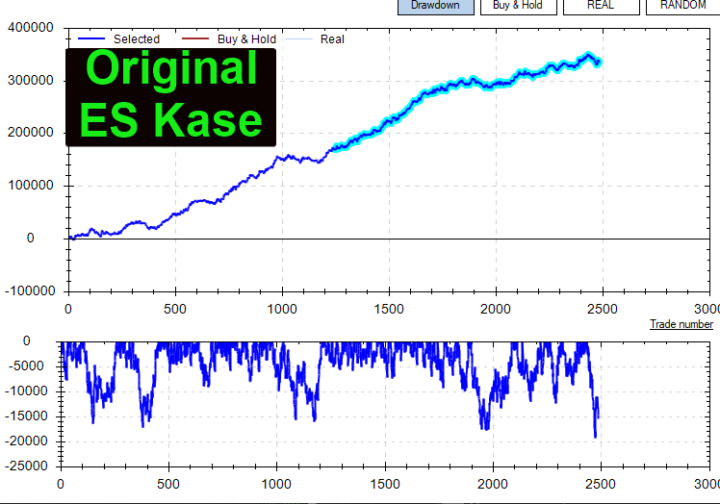

ES Long Kase Algo: Adding SMA Filter

Simulated parameters - Close[O] < SMA(N)[P] Results sorted by Total Net Profit Where O = starting value, P = ending value, N = step - O: 0,0,0 - P: 1,10,1 - N: 5, 200, 5 Screenshots 1) Original Algo 2) SMA rule added 3) Comparison metrics Notes (approx) - Total net profit: -$68k - PNLDD: +5 - WR: +7% - Avg Trade: +$60 - Trades: -1150 $70k net profit is a big trade off. Will test out some other filters

ES1! Algo

Here is an idea! Esu24 algo has taken a couple of trades yesterday and overnight. The price is sitting under the 50 moving average, 100ma, and 200ma. This could mean the algo is EARLY to the party before a massive rally or it’s spinning its wheels until an eventual stop loss is hit. Let’s back test this theory!! Should the algo NOT take any trades while sitting below these moving averages?

1-10 of 35

Active 233d ago

Joined Jun 25, 2024

Powered by