Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Credit to Keys Lab

3.8k members • Free

Ivy Wealth Academy

1.7k members • Free

4 contributions to Ivy Wealth Academy

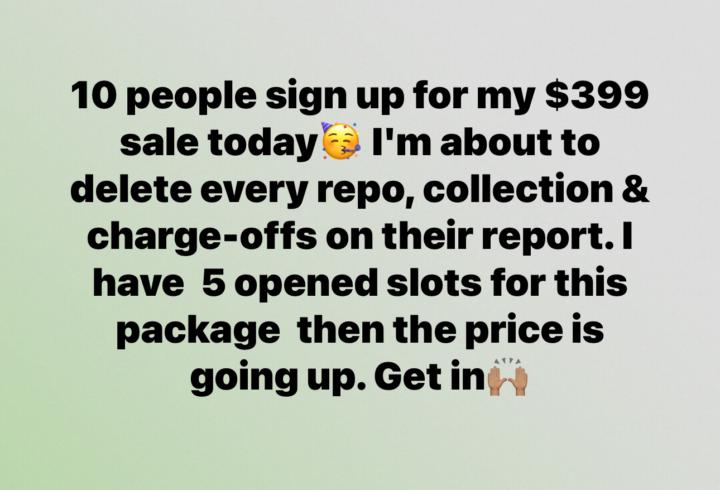

Let me fix your credit for the low😇🙏🏾

Are You Signing Up!? 🚨 Who’s ready to wake up and join the 700 Club? 🙌🏾💳 Who’s ready to get approved for a new Benz straight off the lot? 🚗💨 Or secure 3 major credit cards with a $25,000 limit—all in ONE day? 💰🔥 I can show you how to turn credit into cash and elevate your financial future! But first, you have to invest in yourself—fixing and building your credit is the key! 🏆✨ I can handle everything for you in less than 60 days—just pay and let me work my magic! 🪄💼 I’ve got new letters and exclusive methods that get REAL results! 💥 Let’s start your credit restoration today! Tap in NOW! 📩💳 https://ivywealthsolutions.com/collections/all

💸 💡 Finesse NFCU Like Me 🔌💴

This is a solid strategy for building a strong relationship with Navy Federal Credit Union! Here’s a breakdown of your plan, plus a little insight: 1. Pledge Loan (Short Term + Long Term) • Use a pledge loan (secured loan) to build payment history. The short-term loan pays off quickly, showing responsible repayment, while the long-term loan helps establish ongoing credit history. 2. Secure Credit Card or Pre-Qualified Card • Start with a secured card if you’re new or rebuilding credit. If eligible, go for a pre-qualified unsecured card to accelerate credit-building. 3. Make it Your Primary Bank • Direct deposits and regular banking activity strengthen your relationship with Navy Federal, potentially unlocking better offers. 4. Autopay • Set up autopay for all credit accounts and loans to ensure on-time payments and avoid late fees. On-time payments are essential for a strong credit score. 5. Increase Unsecured Card Limit After First 91 Days • NFCU typically allows for a credit limit increase (CLI) after 91 days. Make consistent on-time payments and keep utilization low to improve your chances. 6. Ask for Increase Every 6 Months • Continue to request credit line increases (every six months) to grow your available credit and keep utilization rates low. This strategy improves both your score and relationship with NFCU. Key Takeaway: Execution is everything! By using these steps, you’re not just leveraging NFCU but building a strong foundation for financial freedom. What’s your personal favorite Navy Federal product or strategy? also make sure that you considered in for auto loans, personal loans, and line of credits!

💫 500's to 700's in 1 month 😃

Elevating Credit Scores in 2025! 💫 I've implemented my most powerful strategies to achieve quick results. My client is kicking off the new year with a fresh start! ✅ Their improved credit score is now a reality. 😊 Our company specializes in comprehensive credit restoration services. ❤️ Who's next?

$497 Aggressive Credit Sweep

I'm looking for 50 people who will let me try to fix their credit fast using my most aggressive new solution package. I'm really trying to get you funding and make my money on the backend. I charge 15% of whatever I get you. Which good! If I get you $50,000. My payout is $7,500!!! That's cool easy money. Imagine help people fix their credit FAST then get $100,000 to invest in a business. That business start making millions. Now I just made an impact. Sign up now cause my team and I about to go crazy. I need your score to be a 720+ please for funding. https://ivyleague.gumroad.com/l/Cyber

1-4 of 4

@shudricka-tyler-8922

A 🧚♀️ from Detroit finding her way through life, hustling, & sprinkling pixie dust along the way! 🪄✨

Active 2d ago

Joined Nov 29, 2024