Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Owned by Shuana

Memberships

Skoolers

180.5k members • Free

Assets For Life Hub

8k members • Free

Private Wealth Global

129 members • Free

Wealth University

2.8k members • Free

Wealth Hackers

148 members • $37/m

41 contributions to Wealth University

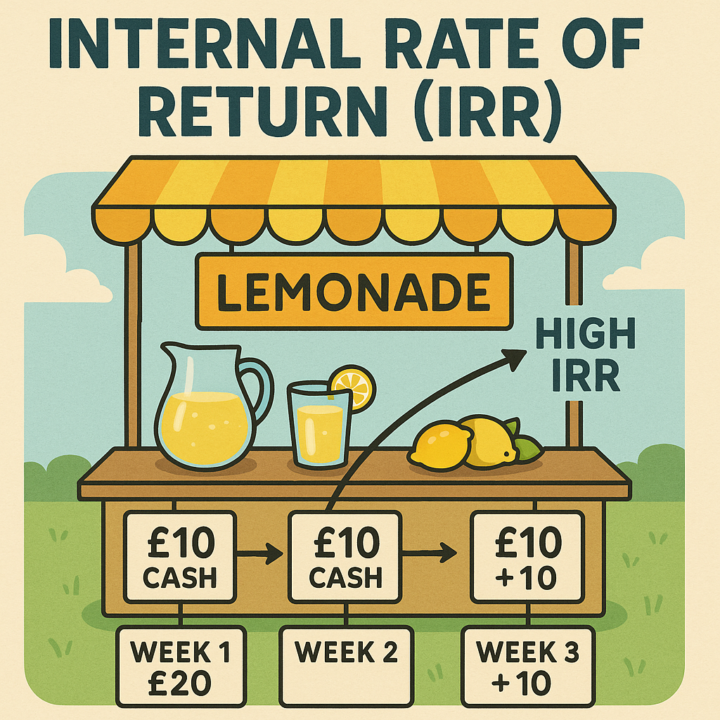

'IRR explained simply with basic analogies for kids, grandkids & newbies'

Hi friends...after the weekend I realised that if sophisticated investors are also wrangling with fully grasping IRR then I needed to simplify it right down...then Scott said, 'Simplicity is the ultimate sophistication' so that gave me the courage to share this VERY SIMPLE example which really helped me. Most of us were taught IRR backwards — through jargon, formulas, and technical explanations, instead of everyday intuition. We hear words like *discount rate*, *net present value*, *capital efficiency*, *time-weighted returns*… and it feels like trying to grab smoke. But here’s the truth: 💡 **IRR isn’t actually a complex concept — it’s a simple idea that’s been explained in a complicated way.** So I started breaking it down using simple everyday analogies — not to patronise anyone, but to finally make it click. And I want to share that with you here. 🍋 The Lemonade Stand Analogy (surprisingly powerful) Imagine you spend £20 today to set up a lemonade stand. Then over the next three weeks you receive: Week 1 **£10** Week 2 **£10** Week 3 **£10** Forget “profit” for a moment. IRR doesn’t look at profit. It looks at **cash coming back**. That’s it. IRR asks: “How fast did my £20 *return to me*, and how quickly did it start growing beyond that?” It’s simply a speedometer for money. * You get half your money back in the first week * All your money back in the second week * And profit begins in the third That makes the IRR surprisingly high — not because this is an amazing business, but because the cash comes back quickly. And that’s exactly what IRR measures. 🍦Now swap lemonade for an ice cream truck… * Initial cost: **Money out** * Weekly sales: **Money in** * Timing: **Early money counts more than late money** Suddenly the same IRR logic applies. 🏢 And now swap lemonade for a property syndication deal… * Acquisition cost = **initial cash out** * Rental income = **cash inflow** * Operating expenses = **cash out** * Refinancing / sale / distributions = **cash in**

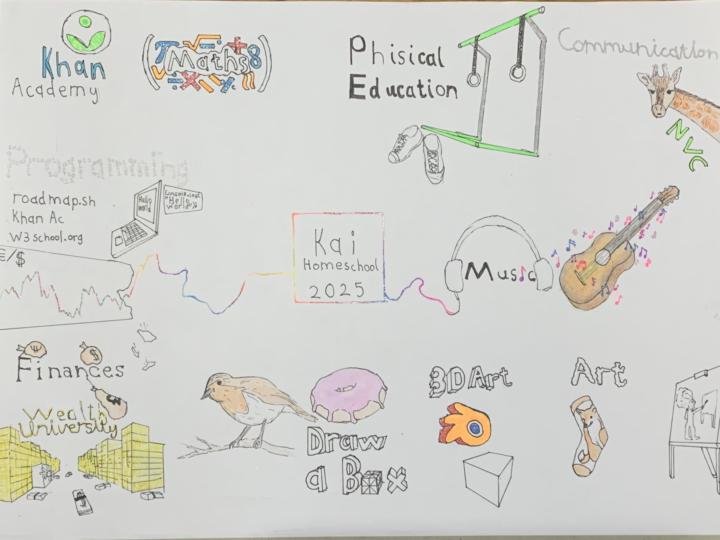

My son’s financial future is my WHY - what’s yours?

I’m here to break crappy money cycles and learn from the experts with my son, so that he doesn’t have to go through what I did - which wasn’t fun! Today I was so proud of him as he educated his homeschool assessor on DIVERSIFICATION and Wealth University. Thank you Scott, Alex and the incredible people of WU and all of you here cheering us on. We’ve been here 2 years and it’s been life changing for us. What’s your why?

The 3 Questions Every Investor Must Ask Before Investing

Most people start with “What should I invest in?” Wrong question! Smart investors start with these 👇 1️⃣ Why am I investing? — Income or Growth? 2️⃣ What’s the IRR? — The true rate of return. 3️⃣ What’s the Risk? — Big returns mean nothing if you lose capital. These 3 questions form the foundation of every great investment plan. 💬 Comment “Top 3 Questions” and I’ll send you a free Investor Framework Cheat Sheet to help you compare any investment like the top 1%.

Scott’s new Instagram page

We’re excited to let you know that Scott has a new official Instagram page where You can follow his latest updates and insights. You can find it here: https://www.instagram.com/scottpickenwealth?utm_source=ig_web_button_share_sheet&igsh=YWxzb21oMmE1ZzYy We’d love for you to follow along and stay connected.

1-10 of 41

@shuana-mansfield-3987

Horse are a big part of my life. I collect records, like gemology, finding things, learning, searching for solutions, objects & curios. BSc.(Hons).

Active 3h ago

Joined Jan 2, 2025

Wisbech, West Norfolk, UK

Powered by