Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

Millionaire Trading

5.5k members • Free

The PIKA Academy

72 members • $15/month

Pokemon Card Investing

465 members • Free

7 contributions to Pokemon Card Investing

Swsh starting to rise

Lot of swsh sets are starting to make some good moves. Starting in us, but looks like eu is following the price trend. Intrested to see where prices will get by end of the year. What set do you guys have the best expectations for?

Has anyone purchased Shiny Treasure ex yet?

Shiny Treasure ex Booster Boxes released about 2 weeks ago and ever since then the price is plummeting. 👉 Cardmarket: Shiny Treasure ex Booster Box 🇯🇵 Japanese Booster boxes are going for as low as €79,50 I wouldn't be surprised to see if it falls to €60 per box like Vstar Climax did back in the day. Have you purchased Shiny Treasure ex yet? If not, what price should a box go for, for you to get tempted to invest in a couple of boxes? Or do you think this set isn't investible? Maybe there will be too much supply for the level of interest down the line and your money is better spent elsewhere?

If anyone is looking for some more CZ

Then I might have found a great deal for you 😄. https://ceescards.eu/products/pokemon-sword-shield-crown-zenith-elite-trainer-box/ Got 2 myself.

Pls help?

Are there people here who conduct their investments in Pokémon as a business, for example, to offset VAT? If, as a Pokémon trader, you hold boxes for, say, 5 years because they "don't sell" at purchase, you can write off the VAT against the received VAT. It seems that at the time of sale, you would then have to pay VAT. And on the made "profit," income tax depends on your other income. Now I'm wondering if this is interesting; as a private investor, you usually don't pay income tax (although it may not be entirely allowed). I'm hesitant about whether to make these investments as a business. Anyone familiar with this or has knowledge that can provide advice? This relates to the tax system in the Netherlands.

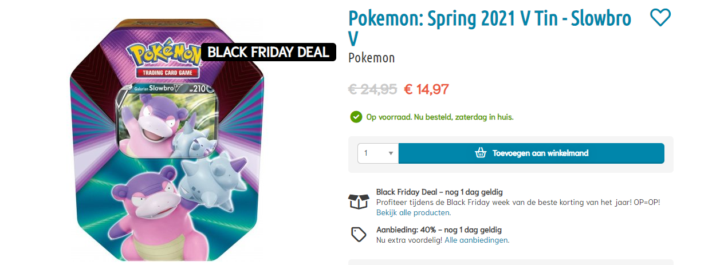

Slowbro Tin 2021

Do these tins guarantee one breakpoint booster? If so, this is quite a decent pick up

1-7 of 7

Active 27d ago

Joined Oct 15, 2023

Powered by