Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

AI Investor Secrets

325 members • Free

Tradeline Secrets

1.2k members • Free

MM

Morby Method Labs

234 members • Free

Chase AI Community

36.7k members • Free

Results Driven® Community

5.1k members • Free

Self Storage Success

155 members • Free

7 contributions to Tradeline Secrets

Where to pull most accurate credit report?

Every report I seem to pull from has different info on it. Where is the best place to pull from? I just spent $100 to pay for a year with Experian, so when I do the first round of credit stacking I can see which inquires are there and which ones I've had removed.

Why I Refuse To Gatekeep Information

Someone just reached out. They're executing everything I taught them to get funded. That made my day. I've always believed that business funding information Shouldn't be locked behind expensive courses or consultations. The knowledge gap in this space is massive. And too many people are profiting off it. Keeping business owners and investors confused. I'd rather teach people the real playbook up front . Let them decide if they need help executing it. If your business model relies on gatekeeping basic information. So you can charge people to "decode" it later. You're doing it wrong. I'm not built like that. The goal isn't to keep people dependent. The goal is to give them the tools to move forward Whether that's with me or on their own. That's how you build something real.

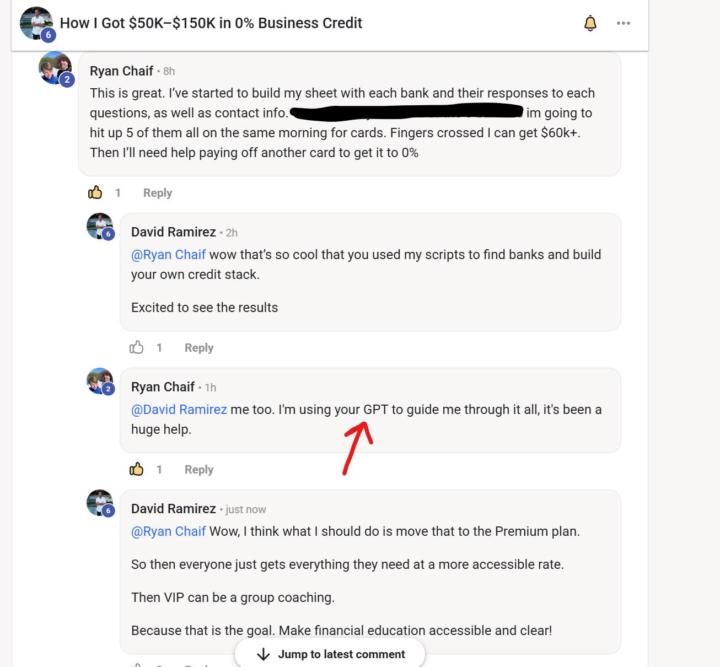

How I Got $50K–$150K in 0% Business Credit

Just uploaded a full breakdown on how to access $50K–$150K in 0% business credit cards using your personal credit profile. This is the same system "funding gurus" charge thousands for—now it's in the classroom. Here's what's covered: The setup: - What your credit profile needs to look like before you apply - Why most people get denied (shared underwriters) - How to build a funding sequence that rotates bureaus and underwriters The execution: - Which banks to target (regional banks and credit unions) - How to gather intel before applying (call script included) - How to stack 9+ approvals in 30 days without overlapping denials The tools: - Bank call script for gathering lender data - Lender tracking sheet - Bureau rotation chart Bottom line: This isn't random applications hoping something sticks. It's a step-by-step sequence based on which credit bureau each bank pulls, which underwriter they use, and their stated-income approval limits. When you rotate correctly, you stack approvals. When you don't, you stack denials. The training walks through the entire process—what you need, where to apply, and how to execute without burning your credit profile. Check it out in the classroom and drop any questions below.

2 likes • 25d

This is great. I’ve started to build my sheet with each bank and their responses to each questions, as well as contact info. Once I get my CO off 2 of the 3 bureaus im going to hit up 5 of them all on the same morning for cards. Fingers crossed I can get $60k+. Then I’ll need help paying off another card to get it to 0%

Your LLC is "Public," but your funding is non-existent.

Most of y'all are out here filing generic LLCs and wondering why the banks treat you like a liability. In Black’s Law, there’s a massive difference between a "General" entity and one with the Legal Capacity to handle six-figure debt. The banks use automated filters to scan your industry code, your address type, and your entity structure before a human even looks at your score. If you look "high-risk" on paper, you’ve lost the game in the first 72 hours. We don't just "apply" for cards. We architect the entity first so the bank has no choice but to say yes.

Does it work?

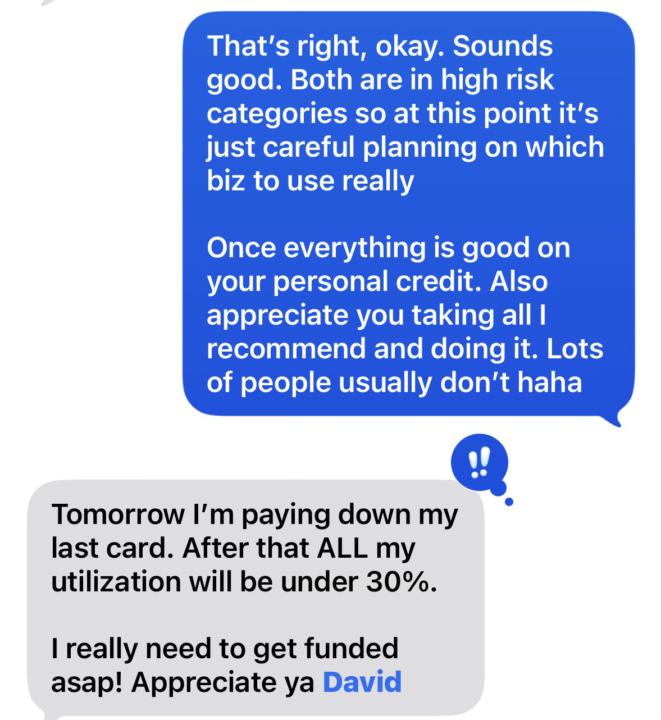

I helped a client prep their file over about two months. Most places bill for that, but it takes me very little time and saves people a lot of trouble later. That’s why I do the prep and guidance for free. No reason to complicate simple work. In this case, they didn’t need credit repair. When someone does need it, that part is paid and we’re upfront about it. The main reason this worked is simple. They followed the guidance all the way through. No one has to listen to me. But when people don’t, or don’t even answer basic questions, that’s usually where things break.

1-7 of 7

@ryan-nonya-3912

@RuffledFeatherzz: Navigating entrepreneurship, fatherhood, and financial recovery with wit, wisdom, and a touch of sarcasm.

Active 12h ago

Joined Oct 16, 2025

Powered by