Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

ELEVATE YOUR LIFESTYLE

32 members • $49/m

TOPTIERBETZ UNIVERSITY

42 members • $300/m

5 contributions to ELEVATE YOUR LIFESTYLE

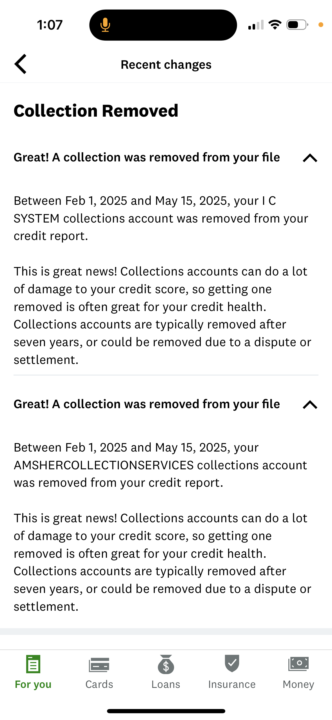

6 DAY TRANSUNION SWEEP

Real results REAL FAST! Contact me if you’d like me to repair your financial situation.

💰Get Your $2500 Credit Card Now (NO CREDIT CHECK) 🚨

This is homework 📚 for the entire community increase your score immediately With the link below you can be approved for anything from $500-$3,500 credit card limit This will be your first credit card or a good Primary account💳 No matter where you are in your credit journey you can be approved 🔥 Be sure to link your highest balance debit card to the app for highest chances of approvals ‼️ Hit the link below ⬇️ Lets get it💰💳🔥 CLICK HERE TO GET $2500

light stream loan approval qualifications

1. Strong Credit Profile: - Good to Excellent Credit: LightStream primarily lends to borrowers with good to excellent credit scores. While they don't specify a minimum credit score, according to NerdWallet, borrowers generally need scores above 690 to qualify. - Credit History: Several years of credit history with various account types (credit cards, installment loans, mortgages, etc.). - Payment History: A good track record of on-time payments with few, if any, delinquencies. 2. Healthy Financial Situation: - Sufficient Income and Assets: You'll need stable income and assets to comfortably repay your existing debts and the new loan. - Low Debt-to-Income Ratio (DTI):LightStream considers your DTI ratio, which is the percentage of your monthly income that goes towards debt payments. According to NerdWallet, a maximum DTI of 50% is generally required. - Ability to Save: Evidence of your ability to save, often demonstrated through retirement/investment accounts and liquid assets (checking and savings accounts). 3. Other Requirements: - U.S. Citizen or Permanent Resident: You must be a U.S. citizen or permanent resident. - Age: You must be at least 18 years old. - U.S. Bank Account: You need a U.S. bank account for loan disbursement and repayments. Important Notes: - No Pre-Qualification: LightStream doesn't offer pre-qualification, so you can't check your potential rates without a hard credit pull. - Minimum Loan Amount: LightStream's minimum loan amount is $5,000.

4

0

Everything you need to know about light stream loan

https://youtu.be/6uRWqNz0Adk?si=Xz5pRkCDKRUcwrod

2

0

1-5 of 5

Active 30d ago

Joined May 6, 2025

Miami, Florida

Powered by