Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Philly

The best moves to make in home buying, so you can build wealth. A first home is a Cucoon®, it sets you up for life.

Memberships

Becoming Her

87 members • Free

Moving to London

11 members • Free

London Academy for Business &

75 members • Free

AI Freedom Finders

708 members • Free

GMR Club - Get Mortgage Ready

72 members • Free

easyPet® Academy

38 members • Free

ProLink

113 members • Free

Digital Products Academy

4.1k members • Free

Digital Breakthrough Lab

113 members • Free

31 contributions to How to buy a house

Which ONE would you choose for your home? 🏡

You can get more, but knowing your priorities definitely helps with the home viewing process

Poll

3 members have voted

Before & After share!

Preview into the before and after (the navy is after 😂) of my first home. Remember you can change anything within 4 walls, it's the location you can't change. Happy Friday!

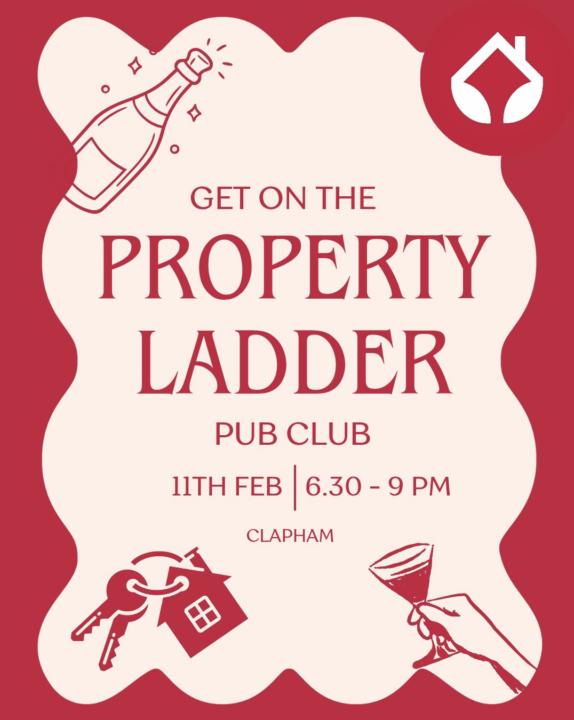

London Event - You're Invited!

Get on the Property Ladder Pub Club is coming to London for the first time one month today on the 11th February, and you're invited! Get first class home buying advice directly from experts. Limited Early Bird tickets available here 😁: https://www.eventbrite.co.uk/e/get-on-the-property-ladder-pub-club-tickets-1976575973946

2

0

I've been getting this question a lot

I hear this question a lot lately. Who would ever give up a 2.75% interest rate? The honest answer is people whose lives have changed. People still move and refinance because of job relocations, moving closer to family, divorce, growing families, college expenses, and debt consolidation. It is also not always about the rate. It is about loan balance, cash flow, and equity strategy. In some cases, refinancing a much lower balance even at a higher rate can still improve monthly cash flow. As income goes up, the tax benefits of mortgage interest become more valuable, which helps offset higher rates more than most people realize. Rates matter, but life, cash flow, taxes, and strategy matter more. Every situation deserves a real conversation, not a headline answer.

Thank for letting me be part of your group!

I'm Mark Maiocca. I help Real Estate, Mortgage Tax & Financial Pros create Networking Groups to generate referrals! How can i add value to this community?

1-10 of 31

@philly-garrett-6045

Sharing the best moves to make in home buying. Bringing fun, optimism and clarity to first time buyers.

Active 2h ago

Joined Aug 15, 2025