Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

LEARNin Local Academy

51 members • $5/month

Real Estate Cheat Codes

28 members • $6,000/y

6 contributions to LEARNin Local Academy

February 10, 2026 - LEARNin Local Challenge Week 3 LIVE Q&A "How to Find the Best Deal in Real Estate"

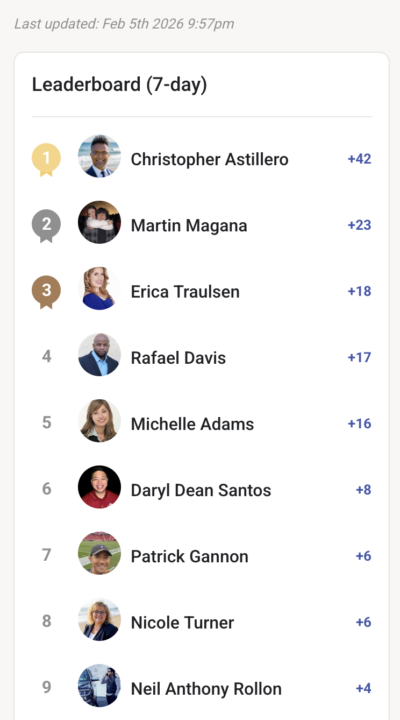

Happy THRIVE Thursday! Another AMAZING week thus far only continues! For Week 3 of the LEARNin Local Challenge on Tuesday the INFLUENCERs below have the opportunity to be LIVE with us from 1:23pm to 2pm PST. 1) @Christopher Astillero - 1031 Exchange, EXCHANGE RESOURCES INC 2) @Martin Magana - Wholesaler, OAKROCK REALTY 3) @Erica Traulsen DST, LEGACY INVESTMENTS & REAL ESTATE 4) @Rafael Davis - Private Mortgage Lending, BLACKBELT MORTGAGE PRO 5) @Michelle Adams - Title, TICOR TITLE SERVICES 6) @Daryl Dean Santos Life Insurance, DARYL SANTOS INSURANCE 7) @Patrick Gannon Real Estate Agent, REAL Military 8) @Nicole Turner - East Region Leader for San Diego County , SELL STATE NEXTGEN REALTY 9) @Neil Anthony Rollon - Founder, PRIME ACCESS Week 3 is "How to Find the Best Deal in Real Estate" RUN OF SHOW: 01:00pm - PREP, Networking 01:11pm - ROS Review 01:23pm - LEARNin Local 101, SMEs Introductions 01:30pm - LIVE Q&A 02:00pm - END All you INFLUENCERs above will undoubtably can help anyone who wants to get a great deal by sharing your INSIGHTs! I will be Hosting the show, NO NEED TO PREPARE ANYTHING, just show up and BE AWESOME! That's what I do, I'm COACH RU! 🤓 Please respond to this thread if you are interested and available to participate 😁. @Emerson Pacete @Ruel Reyes will be our LIVE producers. Please let us know if you would like to share your expertise Tuesday!

Website Assists Property Owners in Complex ADU Sale Process

@Erica Traulsen This is going to be the NEWs article for tomorrow I will share :) AD who? Get it? 🤓. Basically, the article points to the website as the ADU Solution to homeowners and investors to solve all their ADU questions. We all know good people will never be replace by just a website!!! Our Co-Hosts and INFLUENCERs @Martin Magana @Alley Perkins @Tracie Hasse The reason we have the NEWs segment to help uncover FAKE NEWS. So glad we have INFLUENCERs here to EDUCATE, EMPOWER and INSPIRE our audience! @Nicole Turner @Aris Anagnos @Noemi Flores @Patrick Gannon @Christopher Astillero @Rafael Davis @Casey Clayton @Adib Mahdi do you know any good ADU contacts we can invite to the show to promote? https://www.sdbj.com/real-estate/website-assists-property-owners-in-complex-adu-sale-process/

February 6, 2026 LEARNin San Diego LIVE featuring Patrick Gannon of the North Central Region

Happy Tuesday Everyone! We are 30 days out from a LIVE production which will be Week 5 of the LEARNin Local Challenge! At the currently moment, we are still looking an Subject Matter Expert in either the North Inland or North Central region of San Diego County. I'm certain that @Emerson Pacete and I will the help of you all will be able to fill in those last 2 region leaders positions. For the February 6th, 2026 LIVE production the following SMEs (aka 9 LIVEs) will have production control over that LIVE show according to the attached screenshot of the 30 day Leaderboard: - @Christopher Astillero - @Jean Anagnos - @Martin Magana - @Erica Traulsen - @Nicole Turner - @Tracie Hasse - @Ryan King - @Roger Lee - @Maria Ingle More details to come in the next 30 days about this LIVE production! The "LIFEline" thread on LinkedIN for the LIVE will be at https://www.linkedin.com/messaging/thread/2-OWMyYmE5Y2YtYmEzNC00ODA0LWEwNjEtNjJlZGFlOTRlZGQ5XzEwMA==/ THANK YOU all for your contributions and participation! Let's make it happen! Coach RU @Ruben Austria

Real Estate Unplugged next Thursday Feb 5th 5-8pm

Next Thursday! Has anyone ever gone to one of these? I have not and curious to check it out l.. 🤔 Who’s down to attend this event? Let’s make it happen! Coach RU @Tristan Bushkov @Samuel Shayegi @Emerson Pacete @Ruel Reyes @Reina Espejo @Rafael Davis https://www.eventbrite.com/e/real-estate-unplugged-tickets-1980668047448?utm_experiment=test_share_listing&aff=ebdsshios

What does like kind mean in a 1031 Exchange?

In a 1031 Exchange, "like-kind" is a legal term that is much broader than it sounds. Most people think it means you have to swap a rental house for another rental house, but that is a myth. The Golden Rule: For a 1031 exchange to work, you must be swapping real estate held for business or investment purposes for other real estate that will also be used for business or investment. The IRS cares about the nature of the property (it’s real estate), not its grade or quality. What Counts as "Like-Kind"? You can mix and match almost any type of investment real estate. For example, you can exchange: - A rental house for an apartment complex. - Raw land for a shopping center or office building. - A warehouse for a retail storefront. - Farmland for a medical facility. - A 30-year leasehold for outright ownership (fee simple). What does NOT count? There are strict boundaries you cannot cross: The Bottom Line: If it’s an investment property located in the U.S., it is likely "like-kind" to any other investment property in the U.S. - No Personal Use: You cannot exchange your primary residence or a vacation home you use personally. - No Crossing Borders: U.S. property is not "like-kind" to foreign property (e.g., you can't swap a Miami condo for a London flat). - No "Flipping": Properties held primarily for sale (like a quick fix-and-flip) are considered inventory, not investments, and do not qualify. - No Paper Assets: You cannot exchange real estate for stocks, bonds, or partnership interests.

1-6 of 6

@patrick-gannon-1325

19 year service member utilizing Skillbridge to learn the Real Estate process in California.

Active 20h ago

Joined Feb 5, 2026

Powered by