Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

Wealth Hackers

146 members • $37/m

The Digital Marketing Bar

67.9k members • $5

Wealth University

2.9k members • Free

20 contributions to Wealth University

Recording

Hi Alex, Please share the links to the previous recordings. Thanks

🚨 $1 to Join the Top 1%? Here’s Your Chance. What if your next big breakthrough cost less than a cup of coffee?

Hi, you don't want to miss this! Tuesday next week, we’re kicking off one of the most powerful wealth-building experiences of the year — Wealth Weekend. It's the flagship event of our ecosystem, where we collaborate with our family office and Private Wealth Global, and give you direct access to the strategies, structures, and insights the Top 1% use to grow and protect their wealth. Normally, this is a closed-door event with only 50 hand-picked people in the room. But this year, we made a decision. After attending the Investor Summit with Robert Kiyosaki (where I personally invested over $10,000 for access), I realised how rare it is to find a truly world-class event that transforms how you think, feel, and act around money. That’s exactly what Wealth Weekend is. And it’s too valuable to keep to ourselves. So we’ve professionally filmed it. We’re streaming it. And we’re offering 2 ways for you to join us virtually: ✅ Option 1:Join for just $147 and bring a friend for free (2-for-1 ticket). You get 2.5 days of immersive learning, workbook access, recordings, breakout rooms, and a dedicated support team. ✅ Option 2:Pay just $1 today, get full access, and only pay the rest ($146) after the event if you loved it.If not? Just cancel, no questions asked. No catch. No gimmicks. Just results. If you’re serious about setting up 2026 and beyond for freedom, legacy, and impact…Then join us virtually and experience this life-changing weekend for yourself. 👉 Secure Your Spot for $1 To your freedom, Scott PickenCo-Founder, Wealth Migrate & Wealth University P.S. Spots are limited to 100, and this is the last time we’ll offer it like this. Don’t miss the chance to immerse yourself in proven investor strategies for just $1.

Financial Freedom and Diversification

I was attending a webinar that focused on the concept of financial freedom and where the world is going in the couple of years. The presenter mentioned that crypto is set to reach highs this year - that's the general sentiment. He sees this as an opportunity to amass wealth so as to invest in property next year. According to him, we'll experience another bubble in real estate, much like the 2008 crisis. He even mentioned that it's delayed as it was supposed to happen around 2020,but countries had to bail out financial institutions because of Covid. But it's an opportunity to buy properties as prices will be highly discounted. He also mentioned diversifying into precious metals as well as ensuring that investments aren't all localised in the same country or region. It was at that moment that I was thankful to be part of Scott's group, cause these are the topics he talks about. Has anyone else heard about the property crisis coming next year. Apologies if sharing this kind of content is inappropriate, I will gladly delete the post.

Wealth Going Global - Module 2 | Countries - where do you invest in the world?

If I was to ask you what are the Top 5 countries to invest in? Put in the comments below where you think that is? Do you use your gut feel, or fundamentals, facts and systems? This is how we do it... In a rapidly changing world, where geopolitical uncertainty, monetary shifts, and technological acceleration intersect, choosing where to invest has never been more critical—or more complex. This module brings together the world’s most trusted data, frameworks, and foresight tools to help you make SMART investment decisions across global real estate and alternative assets. We begin with the scenario planning methodology of Clem Sunter, a leading futurist, whose system of flags and probabilities helps us anticipate global economic outcomes with realism and precision. Using his latest insights for both global and South African scenarios, we anchor our risk-adjusted investment strategy in plausible future states, rather than rigid forecasts. From there, we apply our proprietary Global Property System™ (GPS)—a data-driven, comparative model that ranks countries by their Risk Index and Return Index across three asset classes: - Residential Real Estate - Commercial Property - Alternative Assets (e.g. VC, Private Credit, Infrastructure) Each country is evaluated using structured fundamentals: - Yield & Capital Growth Potential - Legal Environment & Rule of Law - Demographics & Demand Drivers - Infrastructure & Market Liquidity - Economic/Political Stability - GIDDS™ – Our Global Investment Due Diligence System to assess long-term sustainability, sector strength, and geopolitical resilience Throughout this module, every ranking and recommendation is backed by primary source data from global authorities such as: - Knight Frank - PwC & ULI - The Economist - CBRE, JLL, and Deloitte - IMF, World Bank, Global Citizen Solutions - Visual Capitalist, Reuters, and McKinsey You’ll also see how we integrate passports and second residency into this strategic framework. In an era where mobility is both a privilege and a hedge, we evaluate the Top 20 countries to acquire a first-world passport through investment, balancing visa-free access, investment thresholds, legal protections, and global positioning.

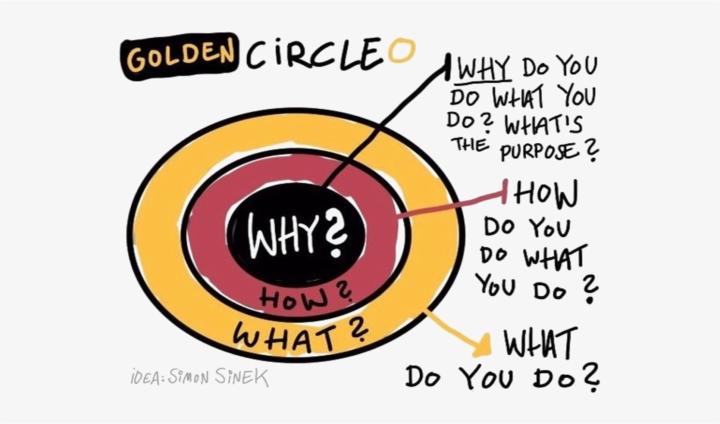

Wealth Going Global - Module 1: The Power of Clarity

This module lays the foundation for your Wealth Going Global journey by helping you uncover your why. Before the strategies, countries, and assets, you must get crystal clear on why wealth matters to you personally. Using Simon Sinek’s Golden Circle and Scott’s proven frameworks, you’ll define your driving purpose, create the fuel for your wealth plan, and set the tone for the entire course. Please leave your key takeaway's below and what you thought about the session today.

2 likes • Aug '25

1. Any goa that is worth pursuing starts with why 2. The WHY becomes the driving force that will keep you going way after motivation has waned 3. Find the purpose of the goal you're pursuing, that's not related to money 4. There are leaders and then those who lead. Leaders hold power while those who lead inspire others

1-10 of 20

Active 18d ago

Joined Jun 6, 2025

Powered by