Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

Wealthy Investor

1.4k members • Free

Apartment Investing Secrets

374 members • Free

3 contributions to Apartment Investing Secrets

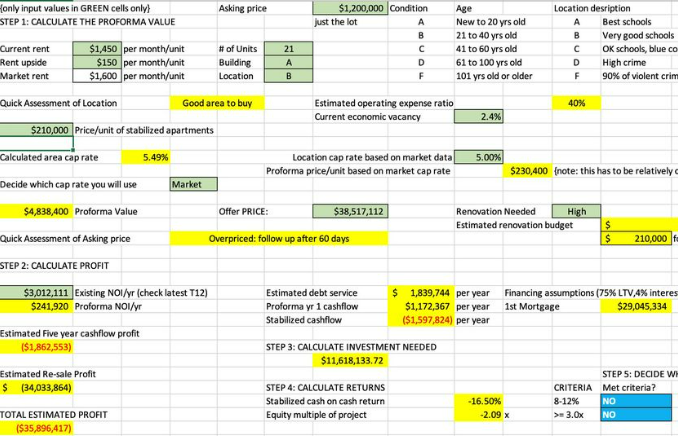

What Do You Think - Is This a Deal or NO Deal?

One of the things we do for our Mastermind members is analyze their apartment or hotel deal WITH them. Last night, Wen (one of the coaches in my Mastermind) analyzed this deal from one of our Mastermind members: 168 units; Currently rented for $1,020/month on average It's in an area of the country where the cap rate is around 7%. The rents are under-market by $145/mo on average. We estimate the apartments need $10,000/unit in updates to command a higher rent. They're asking $15.5M and they have an assumable mortgage of $12M with a 4.38% interest-only payment. This is what made the deal interesting. It's a "C" property right now in a "B" area. Is this a DEAL or NO DEAL? Step 1: Calculate the proforma value of the property . We use a simple formula for our initial "back of the envelope" calculation. {Proforma rent x 12 x 168 units x (1- expense ratio)}/ cap rate {$1165 x 12 x 168 x (1- 50%)/7% = $16,776,000 Step 2: Calculate the over-all profit The mortgage payment is $12M x 4.38% interest only or $525,600/yr The proforma NOI is $1165 x 12 x 168 x (1- 50%) = $1,174,320/yr This gives us a cashflow of $648,720/yr To be conservative, we factor 4 years' worth of cashflow or $2,594,880 cashflow profit. The assumption here is we get minimal cashflow year 1 as we renovate the units and get them stabilized. The profit from the re-sale is $16,776,000 less $15,500,000 (purchase) less $1,680,000 (rehab) or - $404,000. So the profit will come only from the cashflow, for an overall profit of $2,190,880. Step 3: Calculate the Returns The investment needed is $3,500,000 ($15.5M less the $12M assumable mortgage) plus the $1,680,000 in renovation cost for a total of $5,180,000. Our favorite metric is Equity Multiple which is calculated as: (Profit + Investment)/ Investment = ($2,190,880 + $5,180,000)/$5,180,000 = 1.42x The goal in every deal is at least a 2.5x equity multiple so this is a NO DEAL at the current asking price. But what do you guys think? Is this a deal for you?

0 likes • Mar '24

I really appreciate the walk throughs like this. What resources are you using when pulling cap rate for your calculous, what are you pulling your proforma NOI data from (broker, independent, yourselves)? And I am gonna sound ignorant, but how are you getting/calculating expense ratio?

You Should NOT Buy a Median House to "Median-Rent It".

Before residential real estate investors crucify me, know that I own 40 houses (in addition to 1500 apartment units and 4 hotels). So I know the difference among 3 asset classes and the TL/DR is you should not buy houses to rent right now (the "median-kind" that is). Here's the MATH: 1. The median home price in the US right now (2024) is $395,000 2. The median home rent however is $1,981 per month 3. The median home property tax is around $300/month 4. The median home property insurance is around $200/month 5. Assuming you put 20% down ($79,000) and at today's interest rate of 7.5%, your monthly mortgage payment on $316,000 mortgage is $2,208 6. By the time you add the taxes & insurance to that amount, your total house payment is $2,708/month 7. You are already negative $727 a month on a median house with a median rent! 8. By the time you factor in property management, maintenance and repairs, and having a budget for replacement reserves, you're looking at possibly a negative $1,227 a month or negative $14,724 a year cashflow. That's a NEGATIVE 18.6% cash-on-cash return. I don't know why you would like to LOSE over 14 grand per year and you have to deal with tenants, toilets, and trash..So how do real estate investors like me make money with houses? First, I invest in areas where the rents are higher vs the price (not median rent on median house price). Second, I don't buy houses at market value. I buy them at 30-50% discount. How do I find those houses? They're not in the MLS most of the time. And they need substantial renovation (mold issues, structural problems, gut rehab) so the sellers are desperate to sell them. If you're a high earner like doctors & business owners, you don't have the time to do 1 & 2. But there's a better way. I will reveal that in my next post. Write "MEDIAN" or comment below and I will tag you when that post comes out. #realestateinvesting

How Apartment Deals Are Analyzed (part 2 of 2)

Step 3: Calculate The 3 Most Important Numbers To Determine If an Apartment Building is a GOOD Deal or NOT The 3 numbers are: 1. Cash on cash return; 2. Equity Multiple; and 3. Internal Rate of Return Cash-on-cash return - What It is & Why It's Important CoC is the annual cashflow you get divided by the investment you made to get that cashflow. It's basically the YIELD on the capital you've invested. In Part 1, the investment you made is $2M (20% of the "All in" costs), and the cashflow (difference between NOI and debt service) is $140,000/yr. CoC = $140,000/ $2M = 0.07 or 7% The YIELD is only one of the 2 profit centers from investing in real estate. The other one is the profit from the sale. And the 2nd metric incorporates that as well. Equity Multiple - What It Is & Why It's Important The EM or Equity Multiple is a measure of how much your equity or the investment you've made has grown over time. The usual time frame we look at is 5 years. An EM of 2x means your equity or investment or capital has DOUBLED. Let's say you invest $1M and then after 5 years, you get $2M. That means your investment made a $1M profit ($2M - $1M). For our example, the profit from selling the building after 5 years is $1M. Assuming the cashflow is $140K per year over 5 years, the total profit from the cashflow is $700K. Equity Multiple = ($1M profit from sale + $700K profit from cashflow + $2M investment) divided by the $2M investment EM = 1.85x. We aim for deals that give us an EM of 2.5x - minimum for apartments, and an EM of 3x as our minimum for hotels. This means that this apartment (with an asking price of $9M and it needs a rehab amount of $1M) does not pass our EM metric. Hence, we need to buy it for well below $9M. The reason why we aim for a 2.5x EM is because we want to give our passive investors an EM of 2x on their capital. If you do the math, a 70/30 LP/GP split (limited partners - the passive investors; general partners - the active investors or the people who do all the work) necessitates a 2.5x project EM so the LPs get 2x on their capital.

1-3 of 3

@nathan-ham-2003

Dad and husband

Entrepreneur

Emergency Room Physician

Perpetual learner

Active 13h ago

Joined Nov 8, 2023

Powered by