Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

BatchDialer & BatchLeads

1.1k members • Free

Flip Flop Flipper Real-Estate

3.9k members • Free

Preforeclosure Real Estate

3k members • Free

6 contributions to BatchDialer & BatchLeads

How To Use Resimpli CRM as a Complete & Total Newbie Walkthrough

(I’m not an affiliate) Resimpli offers a compelling value proposition by starting with a 30-day free trial, allowing you to fully explore its capabilities before committing. Following the trial, you can choose from three main monthly subscription tiers. The Basic plan is available at $149/month, the Pro planat $299/month, and the Enterprise plan at $599/month. Each plan is designed to scale with your business, with the higher-priced tiers providing additional users, dedicated phone numbers, and increased allotments for calls and SMS messages, on top of core features like list stacking, marketing automation, and an integrated dialer. Discounts are also available if you opt for annual billing. Resimpli 101 For Dummies/20 minutes & 36 seconds https://youtu.be/tt5awBUVyy4?si=tDJ7OhP9DlW-_9vK three file attachments..

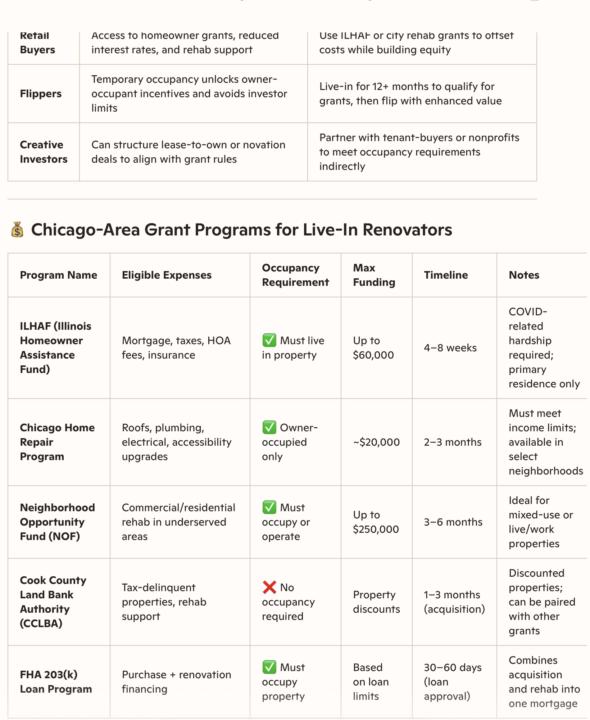

Live-In-Renovation Grants—Think Like An Investor

In Chicago Illinois, living in the property during renovation can unlock access to grants and incentives that are typically off-limits to non-occupant investors. This strategy—often called “live-in renovation” can be a powerful tool for flippers, retail buyers, and creative investors who want to reduce acquisition costs, cover delinquent debts, and boost ROI while aligning with grant eligibility. Here’s a breakdown of how each group can benefit, followed by a comparison chart of relevant programs: 🏠 How Each Buyer Type Benefits from Live-In Renovation Grants file attachment…. 🧠 Strategic Tips for You • Temporary Occupancy: Flippers can live in the property for 12+ months to meet grant requirements, then sell post-renovation with higher margins. • Lease-to-Own Structuring: Investors can partner with tenant-buyers who qualify for grants, using novation or mirror wrap strategies to stay compliant. • PadSplit Conversions: If you’re converting to shared housing, some grants may apply if the operator resides on-site or partners with nonprofits.

The Time Trap: Why Overconfident Sellers in Boarded Distress Areas Miss Hidden Costs, Unlike Middle-Class Convenience

DO NOT CALL LIST FOR DISTRESS SELLERS, suggest can I follow up every month or two text, mail or phone call? General rule give easy opt out, STOP for texting “This title captures the emotional resistance some owners feel while highlighting the financial consequences of ignoring outdated infrastructure and potential demolition costs, such as 1970’s replacement steel pipes with PVC pipes.” Picture file stubborn seller vs. strategic.. "Sellers want to hang on to their properties for dear life, and maybe want to take it to their grave." This is a vivid and impactful phrase! It clearly communicates a strong, almost irrational attachment to property. It's often used to describe owners who have a deep emotional or historical connection to their home, or those who are extremely resistant to selling for any reason, even when it might be in their best financial interest. You could use this phrase to comment below: 1)Highlight a challenge in real estate negotiations: Especially in situations like the distressed neighborhood you mentioned, where sellers' emotional attachment overrides logical market decisions. 2)Explain market stagnation: When owners refuse to sell, it can prevent properties from changing hands and neighborhoods from revitalizing. 3)Describe a particular seller's mindset: It gives a strong visual of their unwillingness to part with the property. It's a great way to express extreme seller reluctance! Text script attachment below..

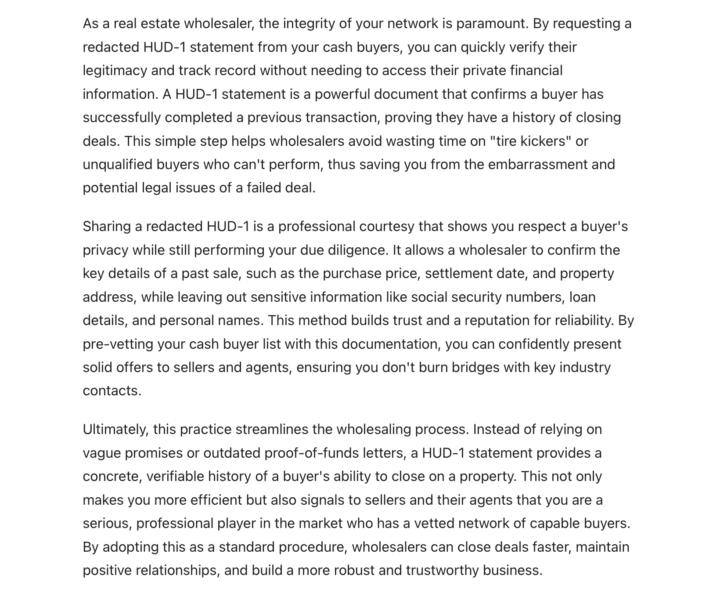

Got A Deal-Requesting a HUD-1 Statement with Privacy, Limiting Daisy Chains, and Preventing Real Estate Fraud

The Wholesaler's Advantage: Vetting Cash Buyers/(Just In Case You Don’t Have A Software App To Find Buyers) …picture attached Verifying A Deal's Legitimacy While Protecting It With A Shared HUD-1 Settlement Statement …picture attached A real estate "daisy chain" occurs when a wholesaler secures a contract to purchase a property at a discounted price from a seller and then assigns that contract to another wholesaler, who in turn assigns it to another, and so on. Each link in the chain adds their own fee, increasing the final price of the property for the eventual buyer. While this practice in itself isn't inherently is not legitimate, it can create a situation ripe for "stealing a deal" or deal poaching.

1-6 of 6

@mr-bland-7891

Dedicated individual undertake wholesaling, & creative seller finance brings enthusiasm & commitment to excellence, known for organizational skills

Active 2d ago

Joined Aug 4, 2025

INTP

Chicago Illinois

Powered by