Activity

Mon

Wed

Fri

Sun

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

What is this?

Less

More

Memberships

IAM T&A University (Pro)

9 members • $47/m

IAM T&A University (Free)

218 members • Free

Tax Strategy Accelerator

1.2k members • Free

21 contributions to IAM T&A University (Free)

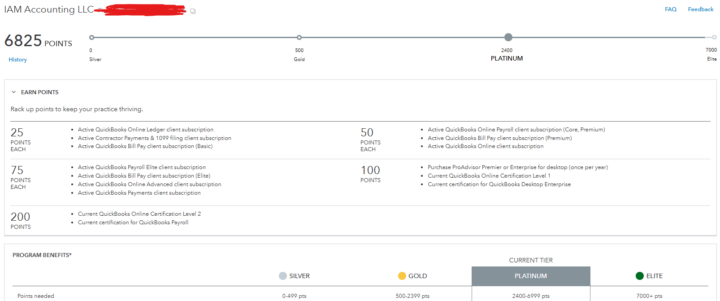

Elite ProAdvisor???

I'm so close to being an Elite ProAdvisor! How are y'all stacking up???

Free Gift for the Community!

I wanted to bless y’all with something that can truly change the way you think about growing your business. I’ve got 150 free copies of a book called $100M Money Models. Even if you’ve never heard of it before, here’s why it matters: It breaks down how to package your services so clients clearly see the value. It shows how to design offers that people want to say yes to. It gives practical frameworks for scaling — whether you’re trying to land your first few premium clients or add six figures to your firm. I know a lot of us struggle with undercharging or explaining our value. This book is a game-changer in fixing that. Here’s how to claim your copy: Click this link → Claim Your Book Here The code will automatically make it FREE (you just cover shipping). Your Code: 162818-SD3MV-199 Don’t wait — once the copies are gone, that’s it. Let’s level up together, —Ibrahim

Steal this email & send to your leads/clients!

Subject: Upcoming Tax Changes Could Impact You – Here’s How to Prepare Hi [Client’s First Name], We wanted to give you a quick update on something that could affect your tax situation in a big way. Back in 2017, the Tax Cuts and Jobs Act (TCJA) was passed under President Trump, cutting taxes for individuals, families, and small businesses. But here’s the catch: Many of those tax breaks are set to expire on December 31, 2025. To keep those savings in place, a new proposal called “The One Big, Beautiful Bill” is being pushed to extend the current tax law. If it doesn’t pass, here’s what we could see: - Higher tax rates across income brackets - Standard deductions cut in half - Child Tax Credit reduced by 50% - Loss of key small business deductions - Higher estate taxes and AMT exposure This affects millions of households and business owners — and it’s critical to start planning now. Want to know how these changes could impact your situation? Let’s map out a strategy before these changes take effect. [Click here to schedule a call with us] (or paste your custom link here) We’re here to help you stay ahead and protect what you’ve built. Warmly, [Your Name / Firm Name]

Who wants to learn about CFO Advisory?

Thinking about dropping some resources in the community... Lets see how much traction this post gets and I may just give it all away for free....

Weekly Q&A Cancelled This Week.

Hey Everyone, weekly Q&A call canceled this week. Celebrating my daughters birthday. Shoot me a DM with any questions and I will send a Loom video response. Have a great week! Tax Deadline Approaching! File, File, File!

1-10 of 21

@melvin-williams-1845

I am a retired Army Veteran. I am just getting started in the bookkeeping and tax world. I am looking forward to learning and contributing where I can

Active 2d ago

Joined Dec 3, 2024

Clarksville,TN

Powered by