Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

millionaireME

58 members • Free

9 contributions to millionaireME

Wealth and Wellness Foundations Day 6: What Would You Do If You Weren’t Afraid?

Good morning, millionaireME family— Let’s rise up to 30,000 feet for a moment. We’ve been talking about budgeting, saving, and financial strategy. But today, we zoom out to ask a deeper question: What if the key to your next level of income isn’t more hustle… but more alignment with your gifts? David Brooks once challenged his audience with a few questions that hit hard and deep. Here are some of them—answer honestly: - What are you afraid of? - What would you do if you weren’t afraid? - What talent do you hold that you’re not using? - What commitments have you made that you no longer believe in? - If this five-year stretch of your life was a chapter—what would it be about? - In a year, what will we be celebrating together? Let’s linger there. What gift are you sitting on that could solve a real-world problem, ease someone’s burden, or brighten someone’s path? What message, skill, or solution have you been postponing, minimizing, or rationalizing away? All that is not shared is lost. It’s not just poetic. It’s practical. If you possess a solution to a problem in this world, you have a moral obligation to share it. And sharing it—whether through teaching, creating, consulting, building, coaching, writing, leading—is often the very path to higher income, deeper impact, and a legacy that echoes. Your generosity and your profitability aren’t in conflict. They’re intertwined. Here’s a bold idea: This week, revisit your Aikigai—your reason for being. The place where: 1. What you love 2. What you’re good at 3. What the world needs 4. What you can be paid forAll intersect. Then, ask: - Where am I playing small? - What am I afraid to launch, say, or sell? - Where could I step out in faith—and in doing so, unlock both impact and income? This isn’t just self-improvement. It’s stewardship. You’ve been gifted. And the world’s waiting. Now it’s your move.

2 likes • Apr '25

This is such a strong message, as I think many people hold themselves back for one reason or another. For instance, right now I'm in the last semester of college and find myself saying for a lot of stuff: "I'll get to it after I graduate." I have used this reasoning for putting off reorganization of my personal home server, setting up better home network security, as well as growing an accidentally started electronics/computer-science youtube channel... Cheers! M. Aiden Phillips

2 likes • Apr '25

@Jon Goodman Good question! I have no idea... they just sorta found the video demos I was doing for my classes that I forgot to set as unlisted 😅. Unless you were asking for a link; if you meant that: https://www.youtube.com/@dr.kraven4648 Though please be warned that all it is, is a bunch of breadboard demos and FPGA demos for classes I've taken/am taking (so there's nothing really there) 🫠

Day 12 Challenge: It’s 💰🏋️♂️ WINSDAY WEDNESDAY! So you Know What That Means, Right? 🚀🔥

You know what day it is, millionaireME fam… WINSDAY WEDNESDAY! 🎉 That means it’s time to drop your biggest wins of the week—whether they’re financial victories or fitness breakthroughs! 💡 Need a little inspiration? Here are the 10 most searched questions around saving money and getting fit. Maybe you’ve tackled one of these this week: 1️⃣ How can I save money fast? 2️⃣ What’s the best budget plan? 3️⃣ How do I stop overspending? 4️⃣ What’s the secret to building wealth? 5️⃣ How much should I save each month? 6️⃣ How do I lose weight without dieting? 7️⃣ What’s the best workout for fat loss? 8️⃣ How do I stay consistent with fitness? 9️⃣ How do I build muscle while saving money? 🔟 What’s the fastest way to get in shape? 💭 Now, here’s the deal: If you’ve made ANY progress this week—even if it’s small—SHARE IT! 💥 📢 Why? 1️⃣ Because your story will encourage someone else. 2️⃣ Because when you celebrate your wins, you’re more likely to keep winning. 3️⃣ Because it’s selfish to keep your progress to yourself (Seriously, don’t hoard the inspiration! Sharing is CARING!). 🚨 Remember the Parable of the Spoons 🚨 There was a group of people at a feast, but they had super long spoons that made it impossible to feed themselves. The greedy ones starved trying to feed only themselves. But the wise ones? They fed each other—and everyone thrived. 👉 So don’t starve the community. Feed it! Post your win—big or small—and let’s build each other up! 💪💰 🔥 Drop your WIN in the comments NOW! Who’s got the biggest fitness or financial flex this week? Let’s hear it! 👇🎤

3 likes • Mar '25

I'm not sure I'd really like to call it a flex; I've still got a long way to go, but I have had great success in ensuring I get a more consistent fresh air and exercise through evening walks 😅. It even shows on the scale, as in total since starting this challenge, I've lost 2% of my starting weight!

Day 9: Do Your Sunday Best – Reflect & Refocus 🧘♀️

🚨 Quick Action First! 🚨 Good morning, MillionaireMIGOs! 🌞 If you haven’t already, download the Skool app and turn on notifications so you don’t miss out on important updates, reminders, and motivation from the group. Staying engaged is key to making the most of this challenge! 🎉 Shoutout to McCall Goodman and Aiden Phillips for taking the Top Two finishes in Week One! Your dedication and engagement set the standard—who’s stepping up next? 📊 Big Update: We’ve introduced an Easier to Follow Scoring System based entirely on your activity on Skool and interaction with others. The simple goal? Compare this week’s YOU with last week’s YOU, and may the best Male or Female claim victory in the Battle of the Sexes! ⸻ Sunday is for resetting, refocusing, and refining. You’ve put in the work for eight days—tracking your spending, identifying your leaks, setting intentions, and making small but mighty adjustments. Today, we slow down to reflect and reaffirm our commitment to financial discipline. Your Challenge: 1️⃣ Review Days 1-8. Scroll through your notes, revisit the daily prompts, and reflect on the steps you’ve taken so far. 2️⃣ Identify ONE takeaway that impacted you the most. Maybe it was a surprising spending habit, a mindset shift, or a new approach to saving. Whatever it is, pinpoint that one “aha” moment. 3️⃣ Share it with the group! Drop a comment in the community with: • Your biggest takeaway • How you’re applying it to your life • Any adjustments you plan to make moving forward 🎯 Why This Matters: Success isn’t just about action—it’s about awareness. When you reflect, you reinforce the lessons that matter most, making them a permanent part of your financial foundation. So, do your Sunday best today. Look back, lock in your learnings, and step forward into the next week with even more clarity and confidence. 🔥 Comment below with your biggest insight so far! Let’s learn from each other.

Day 8 Challenge: The Elephant and Personal Finance—Seeing the Whole Picture

There’s an old parable about six blind men who were asked to describe an elephant. Each one touched a different part of the animal: • One felt the trunk and said, “An elephant is like a snake.” 🐍 • Another touched the leg and declared, “No, it’s like a tree.” 🌳 • The third grabbed the ear and argued, “It’s like a fan.” 🪭 • One placed his hand on the side and said, “It’s like a wall.” 🧱 • Another held the tail and claimed, “It’s like a rope.” 📿 • The last man touched the tusk and believed, “It’s like a spear.” 😣 Each was partially right—but none saw the full picture. Now, what does this have to do with wealth-building and personal finance? The Financial Elephant: How the Pieces Add Up People often view money the same way these blind men viewed the elephant. Depending on where you stand in life, your perspective might be entirely different: • The young professional thinks wealth is about earning a high salary (the trunk—flexible but not stable). • The entrepreneur sees it as taking big risks for big rewards (the tusk—sharp and aggressive). • The frugal saver believes it’s about cutting expenses and avoiding debt (the tail—thin but essential). • The investor swears it’s all about compounding and long-term growth (the legs—strong and slow-moving). • The retiree focuses on security and passive income (the side—stable and protective). • The legacy builder looks at wealth as a tool for generational impact (the ears—spreading far and wide). I’m glad you love it! Here’s a revised ending that keeps the powerful message but removes the idea of owning the elephant: You Need to See the Whole Elephant 🐘 If you only focus on one piece, you miss the big picture. True financial success isn’t just about income, savings, investing, or security—it’s about how they all work together. So, ask yourself: 1️⃣ Which part of the financial elephant am I focusing on right now? 2️⃣ Am I missing key areas that could strengthen my financial future? When you step back and see the whole elephant, you gain clarity, confidence, and control over your financial future.

Poll

8 members have voted

1 like • Mar '25

Right now I would say I am focused on the legs, as time can be one's greatest adversary or it may be leveraged as a tool of patience. Technically speaking, considering the state of being a college student I can't focus too much on growth so much as cutting expences and staying 'debt free,' but I still try to look forward and make plans for when that is no longer the case, and usually it seems fun to me in doing so!

Day 5 Challenge: For today, WINSDAY, Adopt the Sweet 16 Mindset!

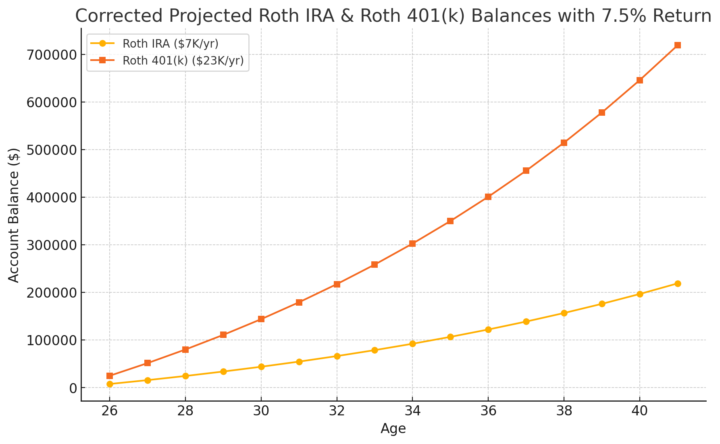

🚀 Day 5 Challenge: The 16-Year WIN Mindset 🚀 We’re five days into the March Forward Savings Challenge—and today, we’re thinking LONG-TERM. 💡 What if I told you that just 16 years of maxing out your Roth IRA or Roth 401(k) could set you up for a six-figure or even seven-figure future? Have a look at the attached chart that shows the results of maxing out your Roth IRA @ $7,500/year or Roth 401(k) at $23K/year with a moderate but historically accurate, annualized rate of return of 7.5%…That could be YOU* in 16 years!! It’s not magic—it’s MATH. Let’s break it down: ✅ Max a Roth IRA ($7K/year) for 16 years at 7.5% ROR = ~$218,800 from a total contribution of $112K(!) ✅ Max a Roth 401(k) ($23K/year) for 16 years at 7.5% ROR = ~$718,900 from a total contribution of $368K(!) 💥 And that’s without adding another penny after Year 16! Let compound growth do the heavy lifting from there. 🔥 Your Challenge Today: 1️⃣ Imagine yourself 16 years from now. Would Future You be thanking you for starting or increasing contributions today? 2️⃣ Drop a Week 1 WIN in the comments! (A small victory from this challenge—less spending, more saving, a mindset shift, progress on the bathroom scale.) Let’s stack small wins into BIG results. Your financial future starts NOW! #MarchForwardSavings #RothIRA #Roth401k #FutureYou #WealthBuilding *Bonus exercise…How do become YOU X 2 and DOUBLE the size of your portfolio? Put a ring on it and get MARRIED already, will you!?! And try really hard to STAY THAT WAY! **For kicks and giggles I provided an animation of what happens if you kept contributing to your Roth IRA (blue) as well as if you stopped altogether (dotted orange). Either way, no spouse required. You a MILLIONAIRE, baby! 💰💰💰

1 like • Mar '25

@McCall Goodman Nice! Ever since getting my first credit card last year I've noticed that it can be easy to spend and forget with it, but I'm lucky in the fact I can't use it at the two main grocery stores I buy from: Winco and Costco. Right now I primarily use it for gas and eating out once or twice a month with my sister.

1-9 of 9

Active 1d ago

Joined Mar 1, 2025

INFJ

Powered by