Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Owned by Lonnie

We show people how to generate custom Metro 2 letters using our software to permanently delete credit items that are out of compliance by law.

Memberships

OPM Mastery Consulting

2.8k members • Free

Peakvest Society

12.8k members • Free

KR-8 Program

1.4k members • Free

100k The Easy Way

1.2k members • $49/m

fundusi

3.3k members • $1/month

Affiliate Inner Circle

2.4k members • $12/month

Digital Sales Accelerator

1.4k members • Free

Anonymous Affiliate Society

527 members • Free

Affiliate Quick Start Setup

2.7k members • Free

13 contributions to Credit Freedom Skool

✅ How Late Payments Almost Cost Me Everything

If you have late payments on your credit report, you know how heavy they feel. I was there too. I remember applying for a mortgage and being told my late payments made me too much of a risk. It was embarrassing, and I felt hopeless. I thought those late payments were locked in for seven years and there was nothing I could do. Then I discovered the truth. Late payments are only permanent if they are reported in full compliance with the law. Most of the time, they are not. That means they can be permanently deleted, even if the payments were actually late. Once my out-of-compliance late payments were removed, my score jumped, my mortgage application was approved, and I was finally able to move into the home I had been working toward. I have seen the same thing happen for others too — people stuck with late payments for years who suddenly qualified for credit cards, car loans, or business funding once those marks were gone. You are not stuck. Late payments do not have to define your financial future.

0

0

📘 How I Learned Late Payments Are Not Permanent

If you have late payments on your credit report and feel stuck, I know exactly what you are going through. For the longest time, I believed late payments were permanent scars. I thought, “I was late, so it is my fault, and I will have to live with it for seven years.” That belief kept me from even trying to improve my credit, because what was the point if those marks were going to be there forever? The truth is, a late payment only stays if it is reported in full compliance with the FCRA standard. And most of the time, it is not. That means late payments can be permanently deleted if they are out of compliance, regardless of whether you actually missed the payment. I have seen parents denied for a car loan because of late payments suddenly drive off the lot once those accounts were deleted. I have seen people finally qualify for credit cards with better limits after being told “no” for years. The difference was not luck — it was understanding compliance. Late payments do not define you. They are not a life sentence. Once you know the law is on your side, you start to realize you have more power than you ever thought.

0

0

⏰ The Truth About Late Payments On Your Credit

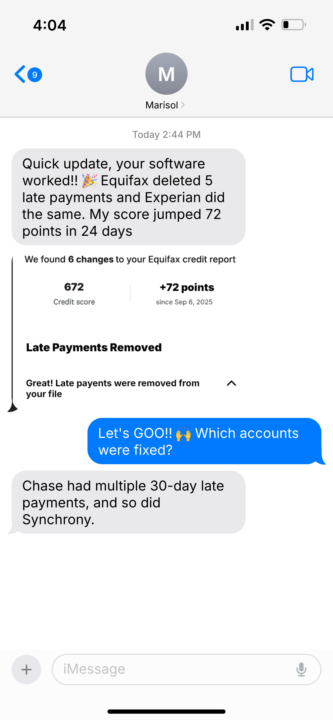

Shout out to Marisol for using our software to get late payments removed from her credit report. If you have late payments dragging down your credit score, I know how stressful it feels. I remember the weight of opening my credit report and seeing late payments staring back at me. It felt like a permanent stain I could never get rid of. I thought, “Well, I was late, so I guess I’m stuck with this forever.” That belief kept me discouraged for years. But here is what I eventually learned. A late payment does not have to stay on your report just because it happened. If it is reported out of compliance with the FCRA standard, it must be permanently deleted. It does not matter if you really missed the payment — what matters is whether it was reported correctly and in compliance. Credit repair companies will never tell you this. They want you to believe you are powerless so you keep paying them month after month. The reality is, compliance is the law, and the law says you have the right to challenge inaccurate or noncompliant reporting. I have seen people with multiple late payments go from being denied for basic credit cards to being approved for prime accounts with rewards. I have seen homeowners lower their mortgage rates after late payments were permanently removed from their reports. The shift is real — you do not have to carry late payments forever.

0

0

📉 How I Wasted Money On Credit Repair

I remember paying month after month, hoping this time my score would finally move. The company told me to be patient, that results take time. But the truth was, nothing really changed. Even when an item got deleted, it showed right back up. I felt like I was throwing money into a black hole. What I did not realize then was this simple fact: credit repair cannot actually repair your credit. The law does not allow people to sell it the way they do, and the final decision about your report always belongs to the three bureaus. That means no matter how much you pay, you are not in control. The breakthrough came when I learned about compliance. If an account is out of compliance with the FCRA standard, the bureaus must delete it permanently. It does not matter if the debt is valid or not. That is when I finally saw progress. I have seen people go from 520 to over 650 once their out-of-compliance items were removed. I have seen families who kept getting turned down for homes finally close on the house they thought they would never get. That is the difference between chasing repair and using compliance.

0

0

📘 The Moment I Realized Credit Repair Was A Lie

If you have ever wondered why credit repair never really works, let me share the moment it clicked for me. I used to believe the same pitch everyone else did. Pay a company month after month, and eventually my credit would be “repaired.” But here is what I learned the hard way. Credit repair companies do not actually control your credit. The law does not even allow them to advertise the way they do. And the final decision about what stays or goes is always made by the three credit bureaus. That is why even when something gets deleted, it can show right back up. I remember paying hundreds of dollars, waiting for results, only to get the same rejection letters. Car loans turned down. Credit cards denied. Mortgage dreams crushed. I felt like my future was locked up by three companies I could not fight. The shift came when I discovered compliance. If an item is out of compliance, it must be permanently deleted. It does not matter if the debt is valid or not. That was the first time I realized I actually had power. Since then I have seen people go from 500s to 600s, from being denied everywhere to finally being approved for the things they need most. That is when credit stops being a wall and starts being a bridge. Comment the word letter and we will help guide you toward real credit freedom.

0

0

1-10 of 13

@lonnie-oxendine-6046

8 out of 10 credit reports have out of compliance items. I teach people how to remove those items legally with Metro 2 AI letters, not credit repair.

Active 10d ago

Joined Sep 1, 2025

Tampa, FL