Activity

Mon

Wed

Fri

Sun

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

What is this?

Less

More

Memberships

UP Credit

975 members • Free

HolaSlashie 數位斜槓人生修練區

440 members • Free

微笑私酷群

2.5k members • Free

億趴俱樂部 1% Club

6.5k members • Free

6 contributions to Global Business Growth Club

Forget to send 1120/5472 form before April

Hi, How can I amend it if I forget to send 1120/5472 of 2024 before April 2025?

Is it legal to hire someone on Fiverr to help applying for EIN?

Hi, I saw there are some people on fiverr say they can help people get EIN within 2 days, which makes me wondering if it's legal or not.

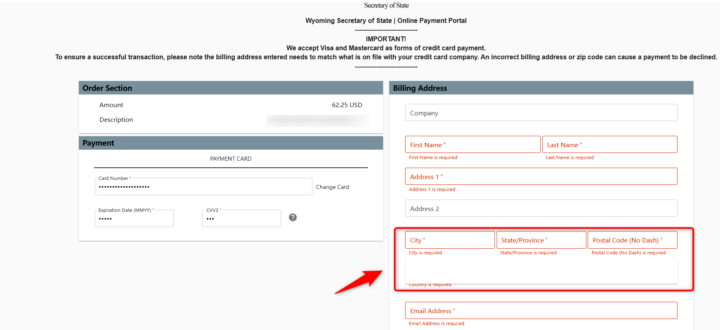

Wyoming Annual Report System country issue

Hi, I am trying to report Wyoming annual report for my LLC through their website. While checkout it needs me to fill the address, so I fill in all the sections, however, the country section is a dropdown without anything to be chosen, which cause me not able to checkout. How to solve this?

How to check if IRS receive my tax form?

Hi, I just filed 1120/5472 form to IRS. I am wondering how to check if IRS receive my tax form? Also, how do we know if there is anything wrong, will they inform us? I don't want to get any penalty for it.

Do Affiliate marketing and Stripe payment belong to trading business?

Hi, I follow James' video to form my single-member LLC and LLC US mercury bank and Stripe account. I use it only to receive affiliate income from affiliate network like Shareasale and CJ affiliate, and sometimes I use Stripe to receive donation and payment while selling digital products to clients all over the world. Does that mean I have trade activities in US since some affiliate partners are from US, since it will effect how to file tax report. Also I want to know what tax form I should report in my circumstance.

1-6 of 6

@kevin-fang-4970

I am an online biz coach and provide affiliate marketing consultant service.

Active 7d ago

Joined Mar 1, 2024

Powered by