Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

Venture Insider

165 members • Free

4 contributions to Venture Insider

YC Winter 2026 Startup Rankings #1 - o11 (9/10) 🚀

I'm going through 30+ companies from Y Combinator's Winter 2026 batch and ranking them based on what I'd actually invest in. Here's company #1: o11 What They Do: AI platform for capital markets built directly into Microsoft 365 (Excel, Word, PowerPoint). They're targeting investment banks, hedge funds, and asset managers. Why I'm Bullish (9/10 Rating): 1. They Meet Users Where They Are - Capital markets firms haven't changed workflows in decades - They live in Excel and Word - Most AI companies fail because they ask users to abandon everything and adopt new platforms - o11 just plugs into the tools they already use every day 2. Founder Credibility is Insane - Aryah: Morehead-Cain Scholar, led AI at two major capital markets firms - Ajay: 4x founder, ex-Mayo Clinic AI Lab - Technical depth + domain expertise = rare combo 3. Business Model is a Money Printer - B2B SaaS in fintech = high margins, sticky contracts - Enterprise deals in capital markets = massive contract values - If they land 2-3 major banks, they're set - Switching costs are HIGH once integrated into daily workflows 4. TAM is Massive - Trillions flow through these firms - Efficiency gains = direct bottom-line impact - AI in capital markets is inevitable; question is who captures it What do you think? Would you invest in o11? What am I missing in my analysis? Drop your thoughts below 👇 (29 more companies coming in this series - who should I cover next?) P.S. - Want access to my full ranking spreadsheet with all 30+ companies, my ratings, and investment theses? I'll be dropping that exclusively in here once I finish the series. 📊

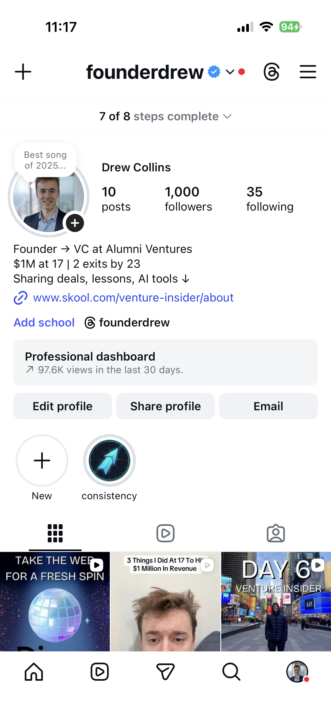

1,000 Instagram followers 🎉

Just hit 1,000 followers on Instagram today. Started posting consistently 7 days ago, sharing deals, VC insights, and AI tools. Here's what worked: 1. Show real deals from my pipeline 2. Share what I'm actually learning as a 23yo in VC 3. Post AI tools people can use immediately 4. Be honest about the journey The goal was never followers - it was to build in public and help founders get access to capital. But hitting 1K proves people want this content. More coming. Let's keep building 🚀

Saying Hi 🙃

Hey everyone, I'm a designer that has worked with and in startups. I've designed high-converting sites, delightful apps, and trustworthy brands. I'm here to connect with founders and learn a bit about the VC game. Don't hesitate to ask me about anything design related I'll be glad to answer your questions as best as I can and hangout. 🧐

1-4 of 4

@kaleab-eshetu-7017

Designing websites, apps and brands for startups... fast

Active 17h ago

Joined Dec 29, 2025

Powered by