Activity

Mon

Wed

Fri

Sun

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

What is this?

Less

More

Memberships

Legacy Wealth Academy

129 members • $5/m

7 contributions to Legacy Wealth Academy

The Bright Future of Quantum Computing: Why It’s Exciting for All of Us

Quantum computing is more than just a futuristic concept—it’s a revolutionary technology that’s already starting to shape the way we solve problems and innovate. Here’s why this breakthrough could have a massive positive impact on all our lives: 1. Breakthroughs in Medicine Quantum computers can simulate molecules and biological processes at an incredible level of detail. This could lead to: • Faster drug discoveries for diseases like cancer and Alzheimer’s. • Personalized medicine tailored to your unique genetic makeup. Imagine a future where cures and treatments are discovered in months instead of decades! 2. Safer Online Security While quantum computers could disrupt current encryption, they’ll also create stronger, quantum-proof security systems. This will protect our data, financial transactions, and online privacy better than ever. 3. Cheaper and Smarter Technology Quantum computing could optimize manufacturing and improve technology design, leading to: • Lower costs for consumer electronics. • More efficient energy systems like better batteries and renewable energy solutions. This means more affordable, eco-friendly products for everyone. 4. Smarter Everyday Services From logistics to AI, quantum technology will make everyday services faster and more reliable: • Quicker deliveries and smarter supply chains. • Improved AI assistants and personalized apps that actually understand your needs. 5. Solving Global Challenges Quantum computing has the power to address massive global issues, such as: • Climate change, by optimizing renewable energy and carbon capture technologies. • Traffic congestion, by solving city-wide optimization problems in seconds. The Big Picture Quantum computing is opening doors to possibilities we’ve never had before. From improving healthcare and technology to solving some of the world’s most complex challenges, this innovation is set to make life smarter, safer, and more efficient for everyone. What excites you most about the future of quantum computing? Let’s share our thoughts and explore the opportunities together!

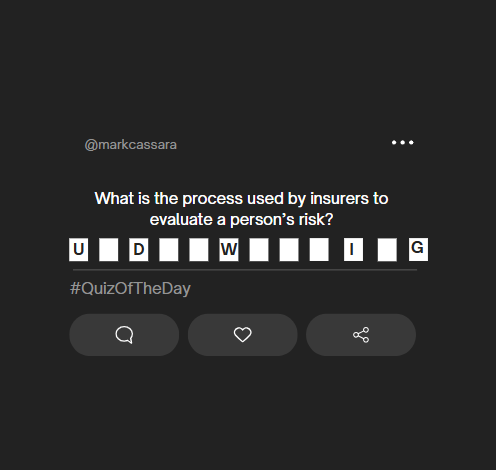

#QuizoftheDay 🗒️🗨️

What is the process used by insurers to evaluate a person's risk? Let's test your knowledge! 🧠 Drop your answers in the comments! and I’ll announce the answer tomorrow 🤩 LEZGOOOO!!! #QuizOfTheDay

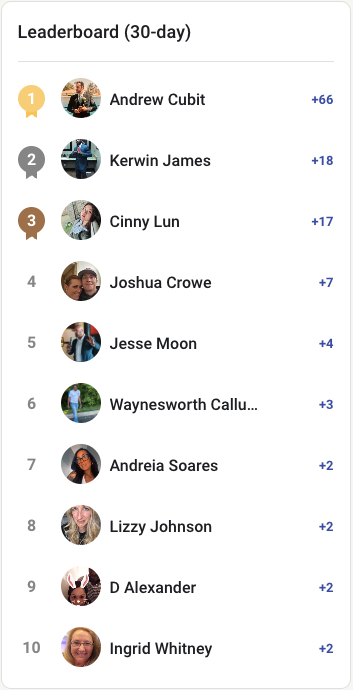

🏆 Leaderboard Update: Halfway Mark! 🏆

Hey Legacy Wealth Academy! We’re halfway through the month, and it looks like Andrew Cubit is still holding strong in 1st place with a massive +66! 🎉👏 But it's not over yet—there’s plenty of time for someone to claim that top spot and win our exclusive LWA merch on December 1st! 🥇 Here’s where the current leaders stand: 1️⃣ Andrew Cubit - +66 2️⃣ Kerwin James - +18 3️⃣ Cinny Lun - +17 4️⃣ Joshua Crowe - +7 5️⃣ Jesse Moon - +4 6️⃣ Waynesworth Callu... - +3 7️⃣ Andreia Soares - +2 8️⃣ Lizzy Johnson - +2 9️⃣ D Alexander - +2 🔟 Ingrid Whitney - +2 🔥 Will someone rise to challenge Andrew, or is he going to keep his throne? Let’s keep the momentum going and stay active! 🚀 If you’re looking to climb the leaderboard and take the top spot, here are some surefire ways to boost your ranking in our Skool group and get closer to that exclusive LWA merch prize! 1️⃣ Engage with Others' Posts: Leave thoughtful comments, answer questions, and share insights. Engagement boosts visibility and is a great way to earn points. 2️⃣ Post Valuable Content: Share useful resources, tips, or ask meaningful questions. Posts that add value and spark conversation are rewarded with points and build credibility in the community. 3️⃣ Invite Members to Join: Bringing in new, active members benefits everyone—and it’s a fast way to gain recognition on the leaderboard! 4️⃣ React to Comments & Posts: Liking and reacting to others’ posts and comments keeps you active and noticed. Consistent activity helps increase your ranking over time. 5️⃣ Be Consistent: Daily or regular activity—whether posting, commenting, or reacting—keeps your points growing. The more active you are, the faster you’ll climb! 6️⃣ Join Discussions & Ask Questions: Starting a discussion or asking a question that sparks a lot of interaction shows engagement and gives you a boost. So, if you’re ready to take your place on the leaderboard, put these tips to use and keep building momentum! 🚨 LIKE THIS POST AND COMMENT... "PUT ME IN COACH!" and lets get to work!!!

Imagine Building Your Own Family Bank 🏦

There’s a powerful yet little-known strategy called privatized banking that only a few communities have fully embraced. Most of us are taught to keep our money in traditional banks or credit unions, where our deposits are used for fractional lending, allowing banks to lend out our money multiple times to generate higher returns. Banks understand the principle of Financial Velocity (more on that another time)—they know how to keep money moving to make even more. To “become your own bank,” you need a financial account that remains both liquid and growth-focused. This is where a permanent life insurance policy comes in. These policies have been around for over a century, serving wealthy families like the Rockefellers, Vanderbilts, and Carnegies as tools for everything from tax mitigation to protecting against market volatility. Thanks to the rise of social media, these strategies are finally reaching a broader audience, allowing middle-class Americans to explore a method once reserved for the elite. Here is a simple yet powerful strategy on how to use a permanent whole life policy to create your own family bank. Step 1: Set Up the Policy To get started, establish a high-cash-value Whole Life insurance policy with a reputable insurer. This type of policy builds cash value alongside the death benefit. By front-loading with a $100k “dump-in,” you boost the cash value from day one, creating leverage that lets you tap into those funds quickly. Make sure it’s set up with features that allow early access to cash. Step 2: 30-Day Waiting Period After making the initial $100k deposit, there’s a 30-day waiting period before the loan can be accessed. During this time, the cash value starts to grow due to interest and dividends (if applicable). Think of it as a short “activation” period to let the funds settle, setting the stage for a loan. After 30 days, you’re ready to borrow! Step 3: Borrow Against Your Cash Value Here’s where the concept of “being your own bank” shines. You can borrow up to 90% of your cash value—so in this case, up to $90k. This policy loan is tax-free and secured by your cash value. It’s generally available at a low interest rate, which is repaid on flexible terms, so you’re in control of the loan’s structure and timeline.

Quick way to LEVEL UP in here 👇

Introduce Yourself With GIFs😍...How Would Describe Yourself? 👇 Let's get to know each other in GIFs Happy Saturday!!

1-7 of 7

@joshua-crowe-1623

I am a Son in the Kingdom a husband to a beautiful Women and a father to 4 great humans. I also own and operate an events and security company.

Active 159d ago

Joined Oct 9, 2024

Powered by