Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

New Gen Solutions

66 members • Free

26 contributions to New Gen Solutions

🚀 Fresh Faces in the Community

Shoutout to our newest members: @Angel Camarillo @Kalli D Welcome to the group. You’re now part of a community focused on learning the credit system and using it the right way 💪 Take a moment to introduce yourselves and share one thing you’re hoping to improve or understand better about your credit. We’re glad you’re here. Let’s get to work 🔥

0

0

Did you know? 💬 The Congress passed a law to protect you from debt collectors?

Many people feel powerless when collectors start calling, sending letters, or threatening action. But federal law says otherwise. 1️⃣ The FDCPA exists for a reason The Fair Debt Collection Practices Act, 15 U.S. Code 1692, was passed to protect consumers from abusive, deceptive, and unfair collection practices. 2️⃣ Sent a cease and desist letter? If you properly request in writing that a collector stop contacting you, they must comply. Continued contact after that can be a violation of federal law. 3️⃣ Violations can cost them Under the FDCPA, consumers may be entitled to statutory damages of up to $1,000 per lawsuit if a collector violates the law, plus possible attorney fees and costs. 4️⃣ Debt buyers still have rules Collection agencies can legally purchase debt, but they must be able to verify it, prove they have the right to collect, and follow strict federal guidelines. They cannot harass, threaten, or misrepresent the debt. 5️⃣ Here’s what most people don’t know Not every call is legal. Not every letter is compliant. And not every collector follows the rules. Documentation and strategy matter. If collectors are contacting you and you’re unsure whether your rights are being violated, it’s time to get informed and take action.

0

0

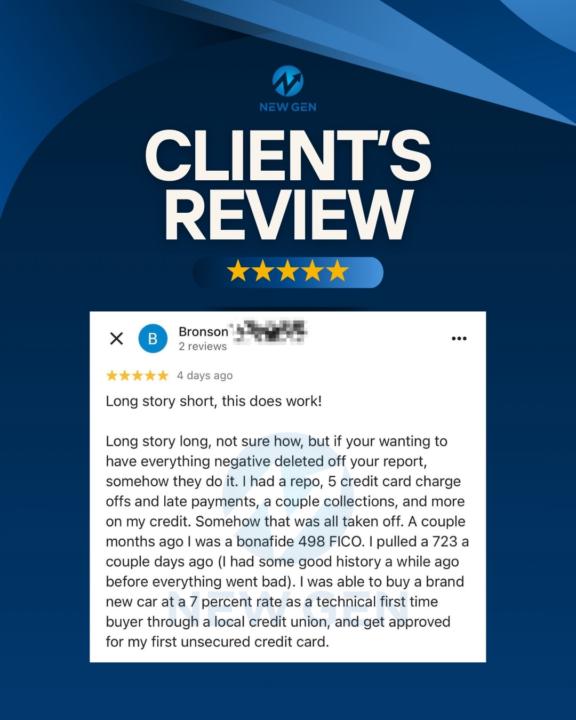

Client Reviews Proving Real Results 💪📈

Our clients speak for themselves 💬 These reviews show that we’re not just making promises, we actually deliver results that make a real difference in people’s lives. From removing collections, charge-offs, late payments, and even bankruptcies, we help our clients rebuild their credit and reach their goals. See more of what our clients have to say and the impact we’ve made at newgensolutions.org 📈💪

0

0

🚨 STOP. Don’t Pay That Collection Yet. Read This First. 🚨

Before you send a single dollar to a debt collector, you need to know this. Most people pay out of fear, not facts. Here’s what debt collection companies MUST prove before they can legally collect from you 👇 1️⃣ Proof you’re the correct debtor They must verify that the debt actually belongs to you. Same name is not enough. If they cannot prove identity, the debt can be challenged. 2️⃣ Legal standing to collect They must show they have the legal right to collect the debt. If they cannot prove ownership or assignment, they have no standing. 3️⃣ A valid contract exists They must provide proof of a valid contract or agreement tied to you. No contract, no obligation. 4️⃣ Proper licensing in your state Debt collectors must be licensed and authorized to collect in your state. Many are not, which makes the collection invalid. 5️⃣ Accurate amount owed They must prove the balance is correct. Fees, interest, or inflated amounts without proof can invalidate the claim. 6️⃣ Within the statute of limitations The debt must be within the legal time limit for collection. This varies by state. If it is expired, they cannot legally sue or enforce it. ⚠️ Paying a collection before verifying these things can restart the clock and hurt you. Smart disputes get results. Random disputes get ignored.

0 likes • 7d

@Simona Makwaia Great question. You start by sending a written debt validation request to the collection agency. By law, you have the right to ask them to prove the debt is yours, that they legally own it, and that the amount is correct. Phone calls are not enough. They must provide proof in writing before they can continue collecting.

🚨 DEBT COLLECTORS HARASSING YOU? THIS IS WHAT YOU NEED TO KNOW

1️⃣ Debt collectors blowing up your phone? You may feel powerless, but the law gives you rights. You don’t have to tolerate constant calls, messages, or threats. 2️⃣ Sent a cease-and-desist letter but they keep contacting you? If you’ve asked them to stop in writing and they continue, they are violating your rights under federal law. 3️⃣ Know your protections under the FDCPA The Fair Debt Collection Practices Act (15 USC 1692) prohibits collectors from harassing, threatening, or ignoring your written requests. They must follow strict rules or face penalties. 4️⃣ Most people don’t know the details - What actions legally count as violations - How to properly document each violation - How to use violations as leverage to remove negative items from your credit 5️⃣ Breaking the rules has real consequences When collectors fail to follow the law, you can: - Gain leverage to have accounts deleted - Hold them accountable - Potentially remove negative items from your credit report 6️⃣ That’s where strategy matters Random disputes often fail. Our team focuses on legal, strategic, and well-documented actions to maximize results and protect your credit. If you want us to help and sign up for our program and have done-for-you disputes 📲 TEXT “Dispute” to 833-976-2966 or DROP “Dispute” in the comments to get started and put your credit back in your control 👇

1

0

1-10 of 26

Active 7h ago

Joined Dec 26, 2025

Powered by