Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

The Sales Floor

727 members • $20/month

Real Estate Investing

1.2k members • Free

4 contributions to Real Estate Investing

Looking for some guidance/insight

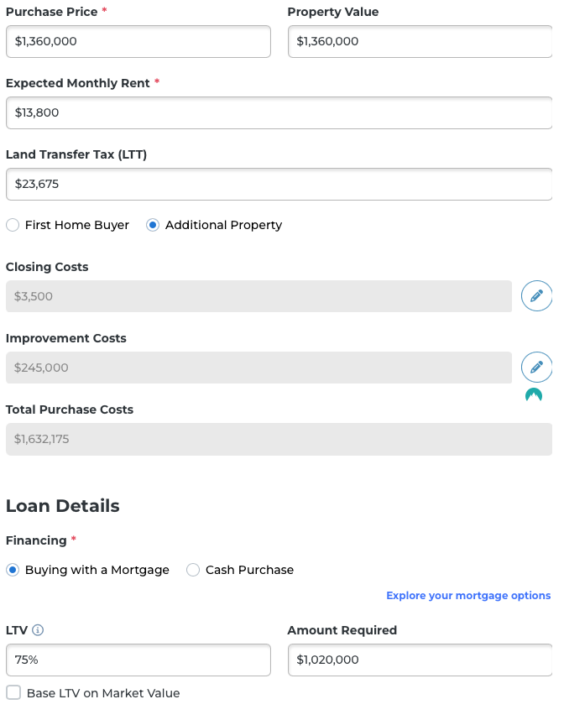

https://x.com/jimchuong/status/1879957178951561354?s=42 I've been studying RE investing for a couple of months now. Found the pod a couple of weeks ago, started bingeing it and never looked back (love the content lads keep it up). I've been analyzing and unwriting deals for 2 weeks now so I'm very new to this. I found this deal about an hour from where I am based. I received the financials from the seller, and the rents are well below market value on unrenovated units (Its 6 units, 2 fully renovated 2 partly and 2 which have not been) I believe that with negotiating the seller down between 10-15% below asking price as I've included below, renovating some of the units and bringing up the rents (have each unit priced slightly below market value trying to be conservative to make sure its a good deal) the numbers look pretty good. I based my operating expenses on the financials the seller sent me, each of the tenants pays their own utilities. I just came across this video from jim choung on my feed, he is how I got into this in the first place. While it isn't far off, this deal does not follow the rule he advises of the purchase price being no more than 8 times gross rent multiple. Jim justifies this by saying "You're an investor, not an operator" I know it is a lot of upfront cost but the building post-renos cash flows very well, and this is somewhat counterintuitive to what Dan and Nick says, "Real estate is not passive you are building a business" Projected Monthly Rental income of this property = $13,679 x 12 =$164,148.00 x 8 =$1,313,184.00 I'm still waiting to hear back from quotes on contractors, but the seller estimated to cost of renovating existing units at $210,000. The all-in-total purchase price would be around 1.63M (612k down between downpayment, reno's, and other closing costs) Thoughts?? (Also I have very little capital and will be looking for JV/partner in the future to share good deals I find with. If you're interested HMU)

Attended my first meetup, what an absolute blast!

I just want to give a shoutout to these amazing monthly meetups, it is actually how I initially found the pod (Via Eventbrite). Went to the Mississauga meetup hosted by Mariana Iordanova. I was super nervous at first as my only experience in real estate comes from the books I've read, YouTube and the pod. It could not have been a more welcoming crowd! many of the realtors, brokers, and other professionals could not have been more courteous in sharing their knowledge and expertise! The next day, I received texts from 3 (!) individuals I shared my contact info with. I even have coffee booked with a Realtor I met for next week, as she plans on taking me through her portfolio. I am on cloud 9, thank you to everyone who was there I cannot wait to do it all again!

Weekly Goal-Setting Accountability Thread

Post your: 1. Annual goals 2. Weekly milestones 3. Progress towards your weekly milestones 4. Intentions for the coming week I'll start:

Welcome, Start Here!

Thanks for joining, were super excited to have you here. The purpose of this group and challenge is to help you break out of the habit of consuming information without taking action. Great deals are just around the corner and some are already happening, so now is a perfect time to switch from a season of information gathering into a season of action. To take part in this challenge, watch this brief video attached, then return to read the following steps! 1) Watch the video below if you haven't yet. 2) Comment on this post with a brief description of who you are, where your coming from, and when your looking to invest! Include a link to your social media as well for networking. 3) Navigate to the calendar and mark the live call times in your calendar. If you can't make the live call times, the recordings will be posted under the classroom tab within 24 hours. Whoever posts their proof of work homework on the follow up posts before the March 9th 5:00PM deadline will be entered into the draw. We'll explain further after the first challenge call on Mar. 4th at 12:00PM Looking forward to chatting with everyone again soon.

1-4 of 4