Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

GovTech Community (Free)

17k members • Free

Lets Geaux Hustle

7.8k members • $17/month

44 contributions to Lets Geaux Hustle

$50k on us! 😈🔥💰 FUTURE BIZ OWNERS!

Did you know? 💡 If you're a student in our Done For You Mentorship, we’ve got you covered! Our team not only builds your Turo business but our lending team can secure your first $50K in funding at 0% interest to get you started on your journey to success. Need more funding? No problem. 💼 We can take it even further—helping you secure up to $250K in business funding after we optimize and repair your credit to ensure you’re ready to maximize opportunities. If you're not a student yet, let me ask you this: What are you waiting for? The path to building the life you deserve is one Comment away. Comment “ME” to get started now. Let’s make it happen! 💪

3 Banks 🏦✅💵 That Will Fund Your New LLC Up to $50K

Starting your business and need funding? Don’t stress—I’ve got you. Here are 3 banks (plus a bonus) that can help you secure up to $50K to get your LLC off the ground. 1️⃣ Ameris Bank Ameris Bank is clutch for startups: • Lines of Credit: Great for covering things like inventory or payroll, with limits up to $50K. • Term Loans: Perfect for buying equipment or expanding your business, with flexible repayment options. Kayne’s Pro Tip: A solid business plan and good personal credit will help you lock in approval. 2️⃣ Langley Federal Credit Union Langley FCU is a hidden gem: • Business Credit Cards: Earn cash-back rewards with no annual fees. • Business Loans: Whether it’s equipment or a vehicle, they’ve got you covered with competitive rates. Kayne’s Pro Tip: Credit unions like Langley are more flexible and usually offer better rates than big banks. 3️⃣ KeyBank KeyBank makes funding simple: • Small Business Loans: Fixed payments make it easy to budget for growth. • Lines of Credit: Starting at $10K, these are perfect for managing cash flow. Kayne’s Pro Tip: KeyBank offers free financial consultations to help you figure out your best move. 💡 Bonus: M&T Bank Don’t forget about M&T Bank! • Overdraft Line of Credit: Avoid fees and get quick access to extra cash when you need it. • SBA Loans: They’re an SBA Preferred Lender, meaning faster approvals for government-backed loans. Kayne’s Pro Tip: SBA loans are ideal if you don’t have a ton of business credit built up yet. There you have it—straightforward funding options to set your LLC up for success. Take your time to review these options, and get the capital you need to make moves!

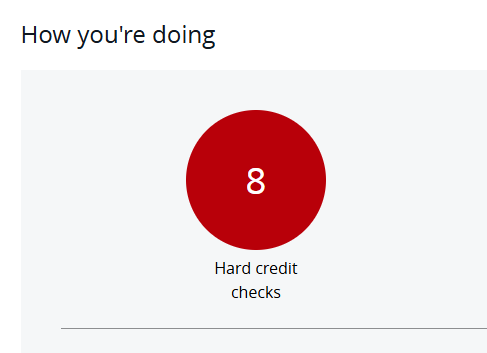

Inquiry Wipe!

Started with 2 inquiries on my report, once it hit 8 I called Experian and followed the play to have them wiped... they removed an extra one without me even asking, so as a bonus my score when up 9 points. Thanks! ;)

Halloween Contest 💰

Hey LGH fam how was everyone’s Halloween?!? 🎃 Comment on this post with a pic of you and your family’s costumes and the winner will get a cash 💰 prize! Ready.. GO 👇

First Business Funding Card Approved ✅

Got approved for my first business credit card in preparation for the Turo play! $24k limit off rip! Eager for more now 👀

1-10 of 44

@isaiah-mitchell-1184

USAF Vet tryna kick the door down to IT!

Active 93d ago

Joined Aug 2, 2024

ISTJ

AZ

Powered by