Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Imperium Academy™

48.4k members • Free

#6FigureDealSourcer (FREE)

1.3k members • Free

True Finance and Property

27 members • Free

Commercial Property Blueprint

45 members • Free

Savoys Growth Network

1.4k members • Free

Wholesale Real Estate

983 members • Free

Wholesaling Real Estate

65.6k members • Free

Property Investing Community

533 members • Free

Real Estate Club

812 members • Free

3 contributions to Smart Property Millionaire

Detached 6 bedroom

🏡 For Sale – Bury (BL8) https://goodliferealestate4.base44.app/ 💷 Price: £1,200,000 (Freehold) 📐 Size: Approx. 4,250 sq ft Approx. ¾-acre private plot 🛏 Configuration: 6 Bedrooms | 4 Bathrooms | 5 Reception Rooms 📈 Yield Range (Optimised) ≈ 4.5% → 10%+ gross (strategy-dependent) 💸 Income Potential: £54,000 → £125,000+ p.a. ⏳ Completion: Flexible 6-Month Completion A substantial detached six-bedroom freehold residence set on an approx. ¾-acre private plot, offering extensive living accommodation, gated off-road parking, and a detached garage block. 📍 Where Is It Located in a prime residential pocket of Bury (BL8) within an established commuter area popular with owner-occupiers and executive tenants. 🚀 Yield Uplift Roadmap (Investor Strategy) This roadmap shows how yield improves over time, without relying on speculation. Step 1 — Baseline (Capital Hold / Executive Let) Single corporate or relocation tenant Estimated rent: £4,500 – £5,500 pcm Income: £54,000 – £66,000 p.a. Yield: ~4.5% – 5.5% Purpose: Capital protection + low management intensity Step 2 — Hybrid SA + Corporate Mid-Let Executive serviced accommodation (weekdays) Corporate / relocation mid-lets (1–6 months) Improved occupancy: ~70–75% Income: £90,000 – £105,000 p.a. Yield: ~7.5% – 8.8% Purpose: Yield uplift without compromising tenant quality Step 3 — Reconfiguration (Low-Risk Optimisation) Convert surplus reception space to: additional ensuite bedrooms, or executive annex-style accommodation (STPP) Income uplift: +£20,000 – £30,000 p.a. Total Income: £110,000 – £125,000+ p.a. Yield: ~9.2% – 10%+ Purpose: Turn space + land into income density Step 4 — Land-Led Upside (Optional, STPP) Garage conversion or detached garden annex Executive 1-bed unit Additional income: £1,800 – £2,200 pcm Yield impact: +1.5% – 2.0% Purpose: Monetise land value intelligently 📊 Before / After Yield Table (Investor View) Strategy Stage Gross Income (p.a.) Gross Yield

0

0

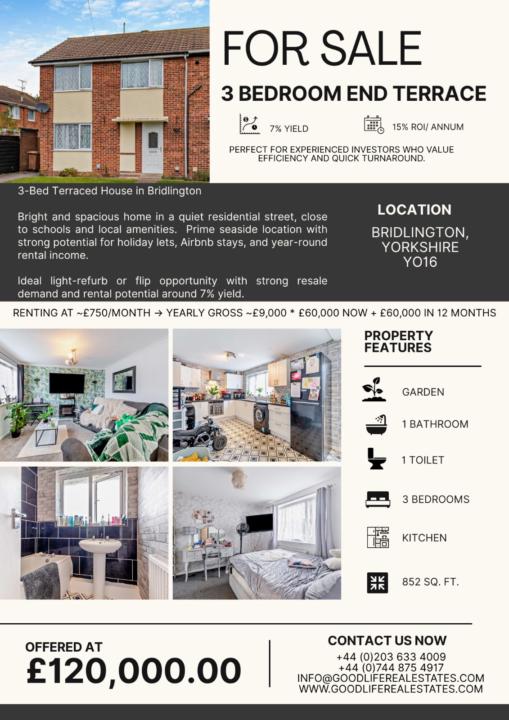

Below-Market-Value 3-Bed Investment Opportunity

🏡 Goodlife Real Estate Opportunity — Bridlington End-Terrace Deal (YO16) 🔥 Below-Market-Value 3-Bed Investment Opportunity Ideal for investors seeking strong yield, capital growth, and low-entry ownership in one of Yorkshire’s most resilient coastal rental markets. View Full Pack → https://goodliferealestate1.base44.app/ 💡 Why This Deal ✅ Freehold 3-bed end-terrace property in a quiet residential area of Bridlington (YO16) ✅ Reduced price — now £120,000, recently down from £125,000+ ✅ Long-term tenants in place generating stable income ✅ Low refurb requirement — only light cosmetic work needed ✅ Strong rental and holiday-let potential with local yield ~7% 🏠 Property Snapshot 🏡 3 Bedrooms 🛁 1 Bathroom 🚽 1 Toilet 🌳 Private Garden 🍽 Spacious Kitchen & Living Area 📏 Approx. 852 sq. ft. 🚗 Shared parking available 🧱 Solid 1970s brick build — ideal light refurb or flip 💰 Financials 💷 Purchase Price: £120,000 💸 Payment Plan: £60,000 now + £60,000 in 12 months 📆 Projected Rent: £700–£750 pcm (£8,400–£9,000 p.a.) 📈 Gross Yield: 7–7.5% p.a. 💼 Estimated Post-Refurb Value: £135,000–£145,000 💰 Sourcing Fee: £3,500 (deductible if reservation paid) 💹 ROI: 7–15% annualised 🚀 Exit Options 🔹 Buy-to-let hold with strong rental income 🔹 Light refurb + refinance to release equity 🔹 Flip opportunity for resale uplift of £10k–£20k+ 🔹 Potential short-let conversion (Airbnb yield up to 12–15%) 🤝 Investor Opportunity Perfect for hands-free investors or co-sourcers looking for ready-packaged deals. Fully documented with AI market analysis, sold comparables, rental comps, EPC data, and local stats in the investor pack. 💼 Sourcing Fee: £3,500 (Non-VAT) 📝 Reservation Agreement: 14-day exclusivity on payment 📞 Interested? Let’s Talk 📧 [email protected] 📲 +44 744 875 4917 🌐 www.goodliferealestates.com

0

0

Below-Market-Value Mixed-Use Freehold Investment

## 🏡 *Goodlife Real Estate Opportunity — Bridlington Deal (City Centre, YO16)* 🔥 *Below-Market-Value Mixed-Use Freehold Investment* Perfect for investors who value *steady income, **strong returns, and **capital growth* in one of Yorkshire’s busiest coastal towns. ---https://goodliferealestate2.base44.app/ ### 💡 *Why This Deal* ✅ Prime *city centre location (YO16)* — close to shops, schools & transport ✅ *Dual income*: commercial + residential tenants in place ✅ *Private gated courtyard* (exclusive to this property) ✅ Year-round rental demand + future short-let potential --- ### 🏠 *Property Snapshot* 🏢 Ground-floor *retail unit* with kitchenette & WC 🚪 Private gated access to *maisonette entrance* 🍽 Large *kitchen–dining room* 🛋 Spacious *lounge/living area* 🛁 *Bathroom with shower + toilet* 🚽 *Separate upstairs toilet* 🛏 *Three double bedrooms (top floor)* 🪟 UPVC double glazing & electric heating 📏 Approx. *852 sq. ft.* total area 🪜 Internal staircase (currently blocked, can be reopened for single-use option) --- ### 💰 *Financials* 💷 *Purchase Price:* £110,000 (Freehold) 💸 *Monthly Rent:* £570 (£220 shop + £350 flat) 📆 *Annual Gross Income:* £6,840 📈 *Gross Yield:* *6.22 % p.a.* 🧾 *Net Yield (after costs):* ~*5.3 % p.a.* 💼 *ROI (Cash Purchase):* *≈ 6.2 % p.a.* 🏦 *ROI (75 % LTV Mortgage):* *≈ 21.1 % p.a.* 💰 *Sourcing Fee:* £3,500 --- ### 🚀 *Exit Options* 🔹 Hold for *steady cash flow & appreciation* 🔹 *Light refurb + refinance* to boost equity 🔹 Convert to *holiday let / Airbnb* for higher yield (subject to consent) 🔹 *Reopen staircase* for flexible owner/tenant use --- ### 🤝 *Investor Opportunity* Ideal for buyers seeking a *hands-free, income-producing asset* with *dual income potential*. *Co-sourcing welcome* — you bring investors, we package the deal. 💼 *Sourcing Fee:* £3,500 --- ### 📞 *Interested? Let’s Talk* 📧 *[email protected]* 📲 *+44 744 875 4917*

0

0

1-3 of 3

@ibi-martins-4339

Ibi Martins, Property sourcing & deal packaging, web developer & Digital Marketer, Focus area London and it's Environ's. Personality type, Protagonist

Active 11d ago

Joined Aug 29, 2025

London

Powered by