Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

millionaireME

58 members • Free

4 contributions to millionaireME

MME Wealth and Wellness Way #12: Overcoming Resistance

Greeting millionaireME Family, Welcome to Monday, Fund-Day, the most powerful money move of your week. Here’s how it works: You look back at last week’s spending—all of it. Every oat milk latte, dog groom, DoorDash, or dance recital. Then you take 10% of that total—and fund your future with it. That’s it. Spent $300 on life’s little pleasures? Great. Set aside $30—not as punishment, but as payment to your future self. Here’s the magic: If that $30 grows 10x over time (as it could with patient, consistent investing), you’ll have $300 later and the joy of what you bought last week. That’s not deprivation. That’s having your cake and compounding it too. Let’s do the math again, just to let it sink in: If it takes $10 to buy something today… …and you tip your future self just $1 when you do… …and that $1 becomes $10 over time… …you’ll have the thing and the money. Which means you have what it takes. Now ask yourself: Why do we tip strangers out of obligation—but resist doing the same for ourselves out of opportunity? You tip 18–25% for decent service. But 10% for your dreams? Suddenly we hesitate. That’s resistance. Steven Pressfield, in The War of Art, tells us that resistance always shows up when something matters. That pushback you feel? It’s a signal, not a stop sign. It’s not proof you shouldn’t act. It’s proof that you’re standing at the threshold of growth. Which means Monday Fund-Day isn’t just a habit. It’s a declaration. A line drawn between who you’ve been—and who you’re becoming. Because anyone can coast. But you? You’re becoming an after-tax millionaire in retirement. And you’re doing it one Fund-Day at a time. #millionaireME #FundDayMonday #PersonalFinanceMadeEasy #UnleashYourInnerTBA #TipYourFutureSelf #ResistanceMeansGo

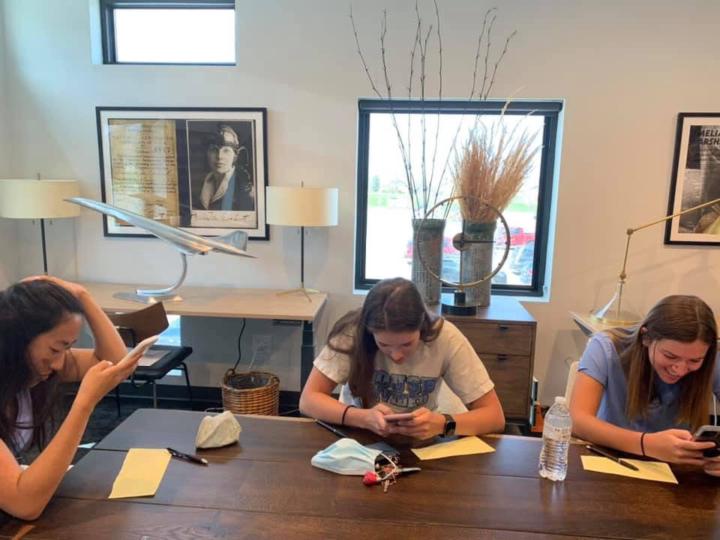

Blast from the past…Girls Doing Work at Mission Control HQ

“Start ‘em young.” —Fellow Ninety-Nine High Flyer, @Mike Taylor

Wealth and Wellness Way #2: Weekend Reading—Top 10 Takeaways from The Millionaire Mind by Thomas J. Stanley 📕

What if your next great financial breakthrough came not from working more hours… but from reading the right book? 🤓 This weekend, pick up The Millionaire Mind by Thomas J. Stanley—a revealing deep-dive into how America’s quiet millionaires think, behave, and build wealth. Spoiler alert: it’s not about luck, brilliance, or a Lamborghini in the driveway. Stanley’s research uncovered a profile that might surprise you: most millionaires are unassuming, self-made, value-oriented learners. In fact… The average millionaire reads at least one nonfiction book per month—and not just for entertainment. They’re investing in wisdom, insight, and personal growth. Here are 10 of the most powerful lessons from The Millionaire Mind—perfect for a weekend of reflection and recalibration: 1. Frugality Beats Flash. Most millionaires drive used cars and live in average neighborhoods. They value freedom over flexing. 2. Discipline Is King. Millionaires credit self-control—not IQ or even education—as the #1 driver of their success. 3. They Avoid Consumer Debt. They may leverage debt for growth, but they loathe high-interest liabilities. 4. They Instill Independence in Their Kids. They teach their children to fish—rarely handing them the fish. 5. They Marry Wisely. Stanley found that a supportive, like-minded spouse is a massive wealth multiplier. 6. They Choose Purposeful Careers. Think small business owners, self-employed professionals, and entrepreneurs—not just C-suite execs. 7. They Read. Constantly. Stanley’s millionaires average one nonfiction book per month, often on personal finance, investing, or leadership. Lifelong learning is a lifestyle, not a luxury. 8. They Seek Counsel. They’re not “know-it-alls.” They hire advisors, ask questions, and listen deeply. 9. They Learn from Failure. Many experienced major setbacks—but used them as stepping stones, not stop signs. 10. They Redefine Success. They measure success by freedom, control of their time, and impact—not applause or appearances.

For now anyway…our youngest millionaireMIGO! 🙌

Say hello to @Connor Lyons, 14 going on 15, and his awesome parents, Shaun and @Carrie Lyons! 👋

1-4 of 4

Active 147d ago

Joined Apr 9, 2025

Powered by