Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Eric

EBE helps entrepreneurs build a business that makes real money — with step-by-step guidance, weekly support, and a community that actually shows up.

Memberships

Conversation Domination

2k members • Free

CREATE

1.6k members • Free

Selling Online / Prime Mover

36.2k members • Free

Affiliate Manager Mastermind

221 members • Free

Skool Speedrun

12k members • Free

Skoolers

191k members • Free

88 contributions to Elite Business Entrepreneurs

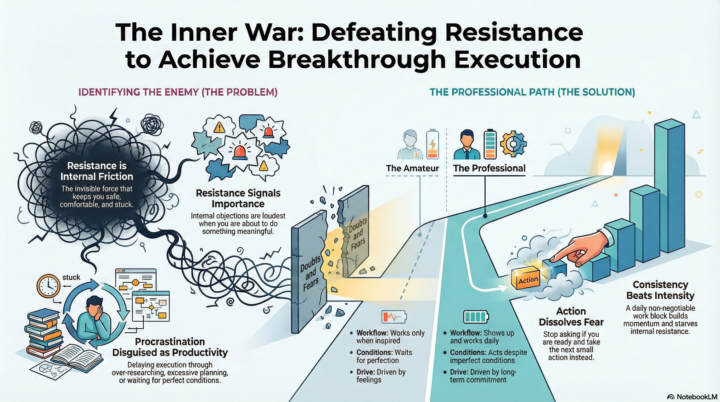

🚨 Entrepreneurs — Let’s Talk Real Growth for a Minute

Every level of success comes with a new internal battle. Doubt. Fear. Procrastination. Distraction. We all face it — but the difference between those who win and those who stay stuck is simple: 👉 Winners show up anyway. 👉 Winners take action even when it’s uncomfortable. 👉 Winners stay consistent when motivation fades. You don’t need perfect conditions. You need daily commitment. Small actions done consistently create big breakthroughs: • One connection a day • One improvement a day • One piece of value shared daily That’s how businesses grow. That’s how legacies are built. 🔥 Question for the EBE Family: What’s ONE action you’re committing to this week to move your business forward? Drop it below — let’s hold each other accountable and win together.

0

0

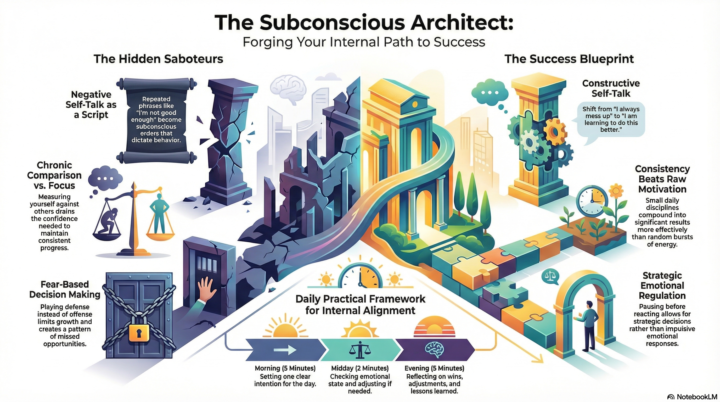

EBE Family — quick mindset check today.

We make or unmake ourselves. The attitudes we repeat daily eventually shape our business results, finances, confidence, and opportunities. That means growth isn’t just strategy… it’s mindset, consistency, and intentional action. No market, economy, or obstacle fully defines your outcome. Your response does. Let’s keep building: ✅ Strong habits ✅ Financial awareness ✅ Consistent execution ✅ Positive but realistic thinking Question for the community: What mindset shift has helped your business or financial growth the most lately?

1

0

EBE Family — Let’s Talk About AI & Money Decisions

Here’s something every entrepreneur in this community needs to understand: More financial decisions today are being influenced by systems and algorithms — not opinions. That means: • Funding decisions • Credit reviews • Account monitoring • Risk assessments …are often evaluated by patterns of behavior, not explanations or intent. AI doesn’t ask: “Do I like this business?” It asks: “Does this behavior look stable, predictable, and sustainable?” That’s why some entrepreneurs feel frustrated when: • Revenue is strong, but approvals stall l• Decisions feel impersonal • Feedback is unclear Nothing is “wrong. ”The rules have simply changed. The good news? You don’t need to fear AI — you need to build with it in mind: • Clean financial structure • Consistent cash flow habits • Disciplined decision-making over time The entrepreneurs who win in this next phase won’t be the loudest or fastest. They’ll be the most intentional. Community Question: What part of business finance feels the most confusing or frustrating right now — funding, credit, cash flow, or compliance? Drop it below 👇 Let’s talk through it together.

1

0

Don’t Let This Tax Season Cost You Thousands: File Smart, Not Fast

Tax season is officially here. The IRS is open, returns are being processed, and millions of people are rushing to file as quickly as possible. But here’s the hard truth: Filing fast isn’t the same as filing smart. Every year, hardworking individuals and families leave money on the table—not because they don’t qualify for refunds or credits, but because they don’t have the right guidance. They guess. They rush. Or they trust tax software or preparers who simply check boxes instead of building a real strategy. This year can be different. Why Most People Overpay on Their Taxes The tax system isn’t designed to reward speed—it rewards accuracy, strategy, and awareness. Yet many people approach tax filing like a chore they just want to get over with. Here’s what usually goes wrong: - Credits and deductions are missed because no one asks the right questions - Income is reported without proper planning - Life changes (marriage, children, side income, business expenses) aren’t fully accounted for - People rely on “one-size-fits-all” solutions instead of personalized advice The result? Smaller refunds, unexpected tax bills, or worse—issues that surface months later. Filing Early Is Powerful—If You Do It Right T here’s nothing wrong with filing early. In fact, filing early gives you advantages: - Faster access to your refund - More time to fix mistakes or address surprises - Less stress as deadlines approach - Better planning for the rest of the year But filing early without a strategy is just rushing toward the same mistakes. The goal isn’t just to submit a return. The goal is to maximize what you keep. Why Professional Guidance Makes the Difference Taxes aren’t just paperwork—they’re part of your overall financial picture. A real tax professional looks beyond the numbers and asks questions like: - Are you eligible for credits you didn’t know existed? - Are you leaving deductions unclaimed? - Could income or expenses be structured more efficiently? - Are there opportunities to improve next year’s outcome starting now?

0

0

Hey Business Owner Need a Funnel?

I'm going through this crazy intensive training right now on building sales funnels and I'm actually getting pretty good at this But I need to practice on real businesses — not just fake ones. So I'm looking for 2-3 people who'd let me build the first page of their funnel for FREE. Want more leads? I'll build you a lead funnel. You want to sell something? I'll build you a sales funnel. You want people to book calls with you? I’ll create an application funnel. No catch. I just want the experience (and a testimonial if you love it). Anyone have a business and want a free funnel? DM me I want a FREE funnel!

1

0

1-10 of 88