Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Eila

Learn, experiment & grow with AI. We are a no-jargon community for non-tech founders, agency owners & professionals.

Memberships

AI Automation Mastery

26.1k members • Free

Sales X AI

36 members • Free

AI Automation Society

253.5k members • Free

AI Automation Agency Hub

291.9k members • Free

Skoolers

189.9k members • Free

7 contributions to Untech AI

Problem Decomposition Assignment (Week 3): Blog to Instagram Content Workflow

Hi everyone, This is my Week 3 assignment on Problem Decomposition.For this task, I have chosen the topic “Social Media Workflow – Blog to Instagram Post”, where I broke down the complete process into clear, structured steps following the decomposition framework taught in Week 3. I’ve defined the final output, listed all messy steps, distilled them into minimal viable steps, assigned node types, added acceptance checks, and designed the complete task graph. Here is the document link: 👉 https://bit.ly/3MxotxG @Eila Qureshi , I’d really appreciate your feedback on this assignment. Thank you!

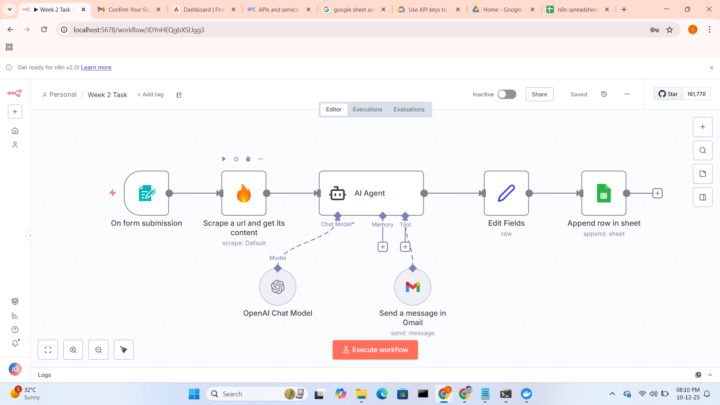

Week 2 Build Assignment

In Week 2 assignment i rebuild AI Automation for Digital Marketing B2B, included my website https://digitalimran.xyz

Want your feedback Eila on this.

I was practicing to write prompt for an AI agent. can you give me feedback on it? What mistakes have I made, and what things can I improve in it? doc link: https://docs.google.com/document/d/1XOnz0n-6YBNxyUucnRQst7MyAbNviSbqNEZHVqZGbTo/edit?usp=sharing @Eila Qureshi

Banking Professional Exploring AI With You All

👋 Hey everyone, I am Pankaj Vashist! I am based in Gurugram, India and currently work full-time in the banking industry (15+ years of experience). I have recently started my AI journey because I want to leverage AI to build real systems and solve practical problems. 🎯 Why I joined Uniteck AI ✨ I have known Eila through DD’s Digital Mentor program and really appreciate her clarity and teaching style ✨ I want clarity of thinking, not tool-hopping ✨ I learn best in a structured environment ✨ I’m here to learn how to build AI projects that make a real business impact 🚀 My goals over the next 90 days ⚡ Complete the full 10-week Agentic AI program and apply each concept with a real build ⚡ Strengthen fundamentals in prompt engineering, problem decomposition, and multi-agent orchestration ⚡ Build 5–7 functional AI workflows end-to-end using real world use cases ⚡ Stay consistent, participate actively, and connect with other builders in the community ⚡ Connect with like-minded people and learn from the community Excited to be here and looking forward to learning, sharing ideas, and growing together! 🙌

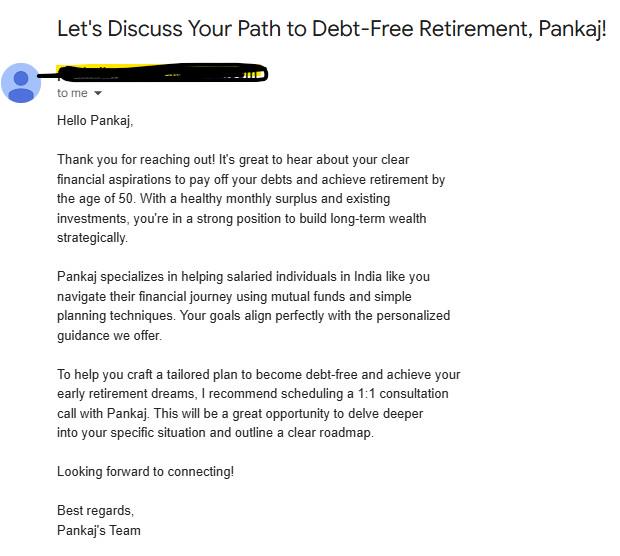

Week 2 Assignment – AI Lead Qualification Agent (Personal Finance Use Case)

🔥 Overview For Week-2, I rebuilt the AI lead qualification workflow for personal finance education & coaching niche. This automation: - Takes form submissions from leads - Scores lead quality based on their financial readiness - Assigns a qualification tier - Automatically sends different emails depending on score - Logs the complete lead + score + next steps into Google Sheets All built in n8n without any coding. 🧠 AI Agent – System Prompt 1. ROLE You are Pankaj’s inbound lead qualification agent for his personal finance education & coaching business. 2. TASK You will receive one JSON object with these keys: - lead_name - lead_email - monthly_income - monthly_expenditure - financial_goal - help_required - current_investments - lead_source Your job is to: - Score the lead from 0–100 (lead_score). - Decide a tier: - A_1to1 (score ≥ 80) - B_Webinar (score 50–79) - C_NoEmail (score < 50) - Say if they are qualified (true/false). - Write a short summary, reason, and recommended_next_step. - For qualified leads (score ≥ 50) write email_subject and email_body. - For non-qualified leads (score < 50), email_subject and email_body must be empty strings "". 3. CONTEXT Pankaj helps salaried individuals in India build long-term wealth using mutual funds and simple planning. Good leads usually: - Have regular income. - Have positive surplus: monthly_income > monthly_expenditure. - Have clear or semi-clear goals (retire early, pay debts, child education, wealth building). - Are asking for guidance, planning, or education. Weaker leads: - Very low or negative surplus. - Only want “quick money” tips. - Say they cannot pay for anything soon. - Spam or random requests. 4. SCORING GUIDE First, estimate monthly surplus = income - expenditure (roughly from the text numbers). Use this as a guide: - Surplus > 30,000 → strong readiness (+40 points). - Surplus 10,000–30,000 → medium readiness (+25 points). - Surplus < 10,000 → low readiness (+10 points).

1 like • Dec '25

Hey Pankaj, loved how deeply you went in scoring criteria, that is a very well defined field. As we spoke, it worked properly for you and I am extremely happy that you went a step ahead with the build and the customisation. Just one suggestion, the email is HTML but the lines are getting cut-off in between. Look into this issue. You will have to som addition in the email body in the gmail node to render the email properly. Apart from that, a great start man!!! Next step - Consize your prompt with chatgpt without loosing the context, try with shorter version of prompts to see how the results are coming.

1-7 of 7

@eila-qureshi-3453

Welcome to AI for non-techs community. Here, we simplify complex AI concepts that you can leverage without a technical background.

Active 1d ago

Joined Nov 5, 2025