Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

$100K Funding Challenge (FREE)

9.9k members • Free

Cowork & Credit

1.7k members • Free

(Free)The Creditprenuer Group

9.9k members • Free

Credit2Capital University

1.6k members • Free

Main Way to Wealth

16.2k members • Free

Credit Hacker Society (Free)

828 members • Free

13 contributions to (Free)The Creditprenuer Group

Next step ??

Has anyone worked with an eviction ? I left my unsafe apartments in march and last month got a letter that they sent me to a collection agency for $8k 🤯 I left only owing 2k . Now it is on my credit as a collection for $7900. I put the following in my statement Box when I did my CFPB complaint This debt collector has done unjustifiable practices of the FDCPA which it prohibits. They furnished this account that we didn't agree upon and I didn't sign an agreement on. A legal contract is signed by two parties and I did not participate in any of it. they didn't follow the proper 5-step validation procedure. According to the FDCPA, I’m entitled to compensation for these violations and clearly, they violated my rights and abused my privileges. I demand this account be taken off immediately.

Not sure how to challenge this one

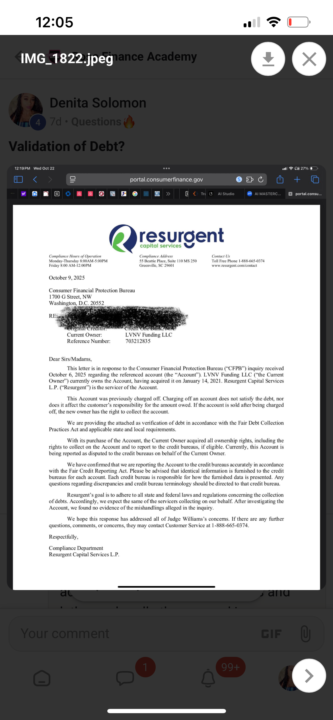

I Did a 7 day deletion for this collection account with Harris and Harris , original creditor is cox ! They responded with all this PROOF and multiple bill statements . Do I still do a round one inaccuracy letter next for this type of response ?

1 like • Oct 29

@Banetta F McDaniels honestly, I was just trying to to follow some steps. Someone gave me for a seven day deletion and it was just straight to a CFPB complaint. This is what she had is put in the statement box. This debt collector has done unjustifiable practices of the FDCPA which it prohibits. They furnished this account that we didn't agree upon and I didn't sign an agreement on. A legal contract is signed by two parties and I did not participate in any of it. they didn't follow the proper 5-step validation procedure. According to the FDCPA, I’m entitled to compensation for these violations and clearly, they violated my rights and abused my privileges. I demand this account be taken off immediately. And then the pictures I posted here are the response. Does that make sense now now I’m just stuck in lost on the next step. Does this give some clarity

1 like • Oct 29

@Banetta F McDaniels can identity theft reports be submitted for collection disputes? That’s how I was taught in the course they said technically they bought our identity which we never gave permission or rights to do so and that is identity that is that a method I can still continue to use as well or do you think I should leave that the hell alone because yes it was able to remove all of my collections last year

Consumer law disputes ???

I was originally taught to do Credit using identity theft reports, and submitting them to CFPB complaints over the past several months. I have learned that that is not the best way to do credit repair. I’m very interested in learning more about consumer laws and how to get deletions using the law if anyone is willing to help me or show me some things I would greatly appreciate it. I am really trying to master this credit game.🙏

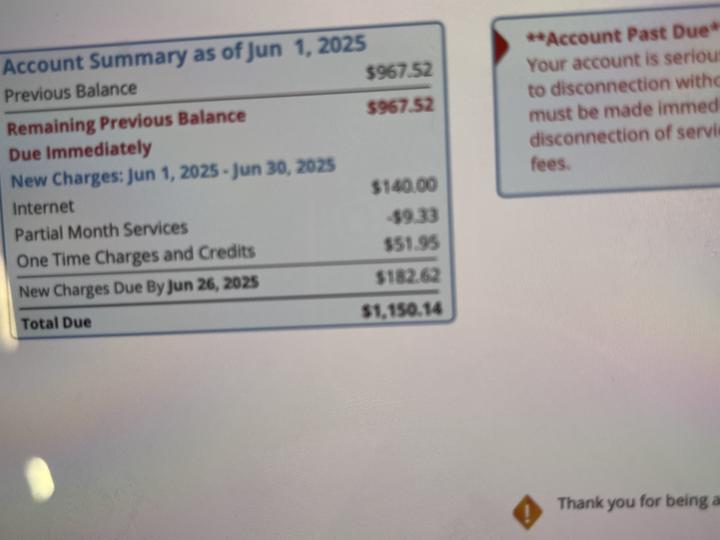

Response 🤔

so I did a seven day deletion method for this collections for my daughter’s father and this is what CFPB responded with and closed the case please help me with what my next step should be at this point???? 🤔

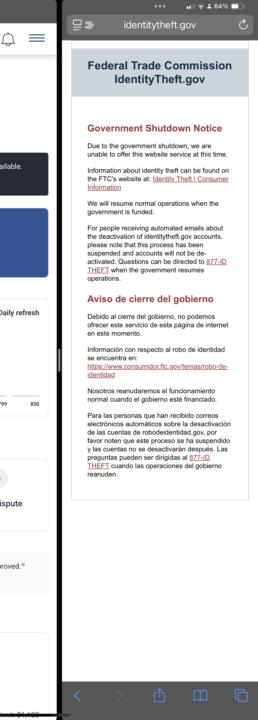

FTC closed 🤔

I just wanted to ask has anyone else been getting this response? I’ve been trying to complete FTC reports and this is the message.

1-10 of 13