Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Imperium Academy™

49.9k members • Free

AI Automation Agency Hub

293.6k members • Free

AI Automation Made Easy

12.4k members • Free

Trading Accelerator

237 members • Free

17 contributions to Trading Accelerator

Homework - Module 3

After re-watching the videos several times, I have finally completed the exercises in Module 3. WHOA just WHOA! Very cool to have a sort of conviction on where the price is likely to go based on liquidity. My result was 50:50 right versus wrong. But trading liquidity allows me to look for higher R:R trades. I was able to take 1:5 RR trade that played perfectly. So cool! Hehhehe still a long way to go.. but so excited about what the future holds. Thank you AOC!!! Some of my lessons learned/observation: - Price will almost always reverse/pullback after taking liquidity (especially on major S/R). - It's better to take trade following the HTF trend bias. - Check few key timeframes to make sure I don't miss out on details of where liquidity is. Here is my result (from 6-15): https://docs.google.com/spreadsheets/d/1bgXpsLuHU4IXe0YzvlMpbWRDPQacTzWsTbdK0Fraqx0/edit?usp=sharing

🙏The balance between give and take.🙏

Hello dear community, today is another one of those days in my life where I want to give something back from the heart. Not that I got an opportunity to improve here my Trading but also to have found new friends with the same goals. I think the people in this community have what it takes to step out of their old patterns and do something better than their generation before. That's why I thought to share with you for free the books that AOC mentioned in his videos and Q&A back then. Have fun reading and learning more. I am happy to be a part of something big. Enjoy your day. ; )

Risk management Module 2 complete

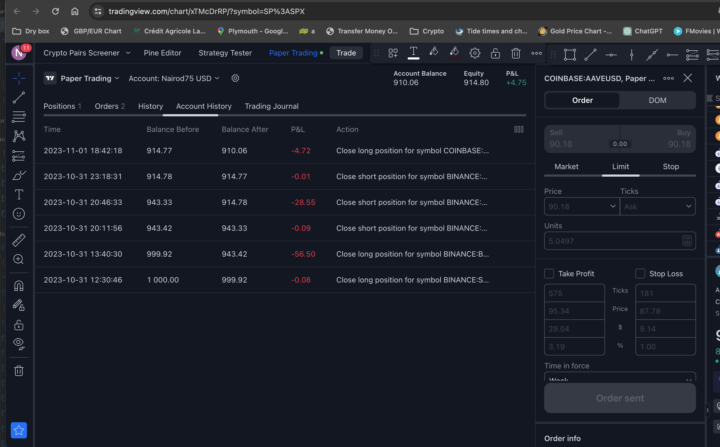

Just completed module 2 of risk management. This was my first time trading in that way - I have been more of a buy the dip kind of guy (who has mostly fomoed at the top 🤨 and hoddle). Well, not the best outcome on this occasion. My 5 trades got stopped out 🥲. I have a lot to learn by the looks of it. Here is the link to my set ups and results. https://docs.google.com/spreadsheets/d/1SZTPvMfKP-Qmuawyos2aYrq6xuc9TvTI5o59WNB3GBM/edit?usp=sharing There is something I don't understand in regards to risking 1%. My ending balance on my journal is as it should be for 1000$ account I'm now at $950.99. However on trading view I'm at 910$. I've attached 2 screen shots that might help with my query if anyone can spot where I'm going wrong (I started modifying my account ballance as it shrank for the last couple of trades but I can't see that it made any difference). Thanks in advance.

Homework Module 3

I watched the video a couple of times and it took a while to start the homeweork. I became a bit more confident in identifying levels of liquidity. However targeting the most probable one is still a lot of work. https://docs.google.com/spreadsheets/d/1BXGYH531u8Y_IRhqVdUnxLxWzI5pGmfY/edit?usp=drive_link&ouid=114766830262157684800&rtpof=true&sd=true

Module 2 - Homework.

This is the best Risk Management content I have ever consumed! Very clear and logical. Thank you so much!! I was able to stick to the 1% risk and take only 1:3 R trades. Made 3 losses out of 5, but the fact that I stick to the rules, overall im in profit :). https://docs.google.com/spreadsheets/d/1bgXpsLuHU4IXe0YzvlMpbWRDPQacTzWsTbdK0Fraqx0/edit?usp=sharing

1-10 of 17

Active 38d ago

Joined Aug 24, 2023

Powered by