Activity

Mon

Wed

Fri

Sun

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

What is this?

Less

More

Memberships

Agent-N

5.5k members • Free

Global Business Growth Club

1.9k members • Free

Start Writing Online

17.9k members • Free

19 contributions to Global Business Growth Club

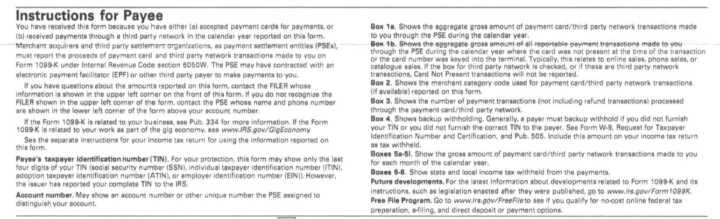

1099-K - Do I care about it?

Apparently I got a physical mail to my company's PO Box from Worldpay, with a 1099K, elaborating the credit card charges I've billed customers with This is the first time I get this. Do I care about it? I mean I have 1065 to file (Multi Member LLC), and I will declare my income there, is it any different than any other income source? This is the "Instructions for Payee" on the letter (screenshot below) Thank you

Ohio Benniel Reports - Do I need to file?

I've heard about these benniel reports that need to be filed once every 2 years (on the odd year). I have a multi-member LLC established in Ohio - Does anyone know anything about it and can reference me on how to fill it? Here's my resource https://www.ohiosos.gov/globalassets/business/forms/520_instructions.pdf

0 likes • Jan 13

Hey everyone, just an update in case anyone stumbles upon this thread. This is the registered agent answer: The state of Ohio requires all Professional Associations and Limited Liability Partnerships to file a biennial report every two years. Nonprofits must file a Statement of Continued Existence every five years. Ohio corporations and LLCs are not required to file biennial reports or statements of continued existence. Multi Member LLC's would fall in the same category as any regular LLC when it comes to Biennial Reports with the State. Only Professional Associations, Limited Liability Partnerships (LLPs) and Nonprofits, Cooperatives, and Religious Corporations are required to file a report with the state. @James Baker

LLC Business Account

Hello great people, please I need someone to help me with guidance on how to register a us business account with EIN (without SSN/ITIN) as a non resident

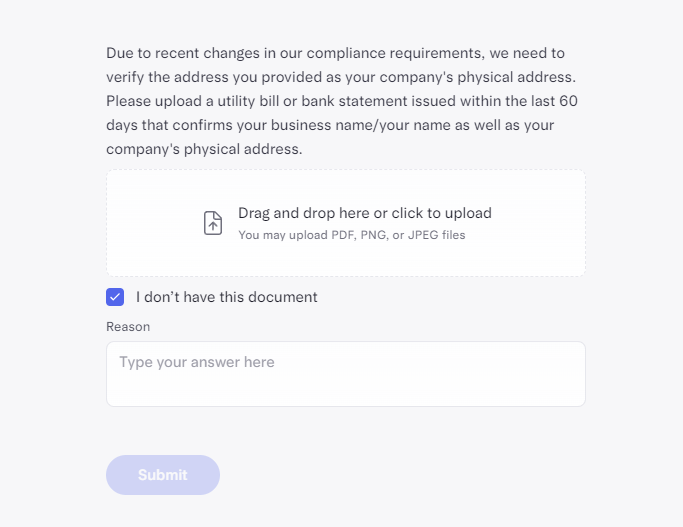

Mercury asking to verify LLC physical address.

Hi everyone, I'm opening a Mercury account for my LLC and after submitting all the documentation I just received an email asking for a utility bill or bank statement for my LLC (which I don't have at the moment). Does anyone have any tips on how to proceed in this case? UPDATE: I was approved after submitting a Wise bank statement with my LLC address.

0 likes • Jul '24

@Lucas Oliveira What was in the statement? Your address in your foreign country? And which account is in Wise - USD account or your home country currency? If I'm not mistaken, the company name is on the Wise business account, not your personal, and the business address is on the statement... That is what you used to prove your personal address with? Thanks!

Bank account

Hey team, I am just wondering if anyone has the experience to use your foreign card for any kind of business? Like to pay all the cost for your US company and also earn revenue out of it? My plan for now is to start first anyways, considering I still have until April to deal with tax? and at some point hire professionals, like James to open a business account and take care of my tax entirely. Any advise?

2 likes • Jul '24

There's no problem with it, you'll just have to record it properly, that's it... Make sure you log it somewhere and hand it to the CPA once you deal with your taxes filling Don't make a habbit of it, it's better to separate personal and business expenses, so once you have a bank account and credit/debit card, use those

1-10 of 19

@danny-gelfenbaum-4821

Salesforce Consultant, traveling the world and living as a digital nomad

Active 64d ago

Joined Feb 10, 2024

Powered by