Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

Living Life to The Fullest

70 members • Free

GROUNDED PURSUIT

92 members • Free

SALES VIBE INNOVATION$

697 members • Free

The Inner Frontier

12 members • Free

Simplified Sales Society

39 members • Free

RECREATE

569 members • Free

𝙂𝙊𝙊𝙎𝙄𝙁𝙔 🍓🐛🦋🌈⭐️🩷

9.5k members • Free

True SOUL HEALTH Freedom

812 members • Free

The Money Game

116 members • Free

13 contributions to Profit & Presence

Basic Trading Terminology

Bid/Ask: Bid = buying price, Ask = selling price. Spread: Difference between bid and ask (lower = better liquidity). Leverage: Borrowed capital to increase position size (higher risk/reward). Long/Short: Long = buy (expecting price to rise), Short = sell (expecting price to fall). Stop-Loss (SL): Automatic exit to limit losses. Take-Profit (TP): Automatic exit to lock in profits.

0

0

Trading Basics: A Beginner’s Guide

Trading involves buying and selling financial instruments (like stocks, forex, cryptocurrencies, or commodities) to profit from price movements. Types of Trading - Day Trading: Buying and selling within the same day (no overnight positions). - Swing Trading: Holding trades for days or weeks to capture medium-term trends. - Position Trading: Long-term investing (months/years) based on fundamentals. - Scalping: Extremely short-term trades (seconds/minutes) for small profits. Markets - Stocks: Shares of publicly traded companies (like, Apple, Tesla). - Forex (FX): Currency pairs (e.g., EUR/USD, GBP/JPY). - Cyptocurrencies: Digital assets like Bitcoin, Ethereum. - Commodities: Gold, oil, silver, etc. - Indices: S&P 500, NASDAQ, Dow Jones (traded via ETFs or futures).

0

0

💎 Exclusive Weekly Market Analysis!

Bitcoin Remains Range-Bound Despite Increased Volatility Interestingly, Bitcoin showed slightly increased volatility during President Trump's tariff announcement but did not exhibit any significant directional movement. Currently, Bitcoin continues to trade within the same range as before the news, reflecting a level of resilience in the face of broader market uncertainties. However, this does not imply immunity to macroeconomic pressures. While Bitcoin has at times exhibited decoupling from traditional markets, it generally follows the sentiment seen in equities, particularly during risk-off periods. Given the negative outlook in stock markets, we anticipate that selling pressure may extend to cryptocurrencies as well, though we do not expect a dramatic selloff in the short term.

0

0

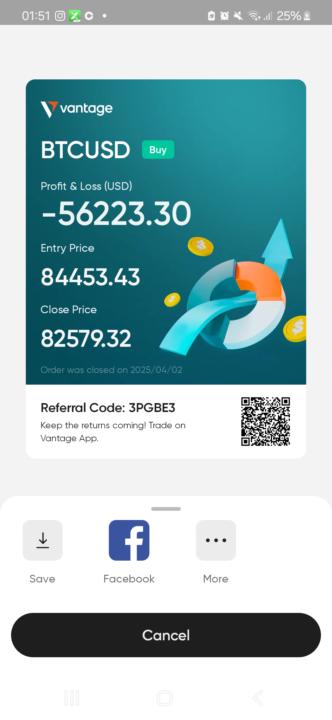

Uhh yeah great...

-56k, pure example that even I can lose trades.... not thinking about what trump did with his crypto war... and doing a swing trade🤡

0

0

Result of Declaration of Trade War

🇺🇸💸📉 — S&P 500 futures accelerate losses, now down -3% in 4 minutes, after Trump's Declaration of Trade War against, basically, all Globe That’s -$1.3 TRILLION of market cap erased in 4 minutes.

0

0

1-10 of 13

@dani-pols-9774

Scaling Coaches to $10k+/Month | Psychology | NLP | Astral Projection | Sales Vibe Innovations Admin💰

Active 14d ago

Joined Mar 28, 2025

Netherlands

Powered by