Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Trading Skool

1.7k members • Free

Retire On Margin

157 members • Free

44 contributions to Retire On Margin

📉 Healthcare is 2024’s most hated sector. That’s why I’m buying.

Everyone’s chasing AI and semis. Meanwhile, healthcare quietly underperformed the S&P by 30 %+ this year. But here’s the twist: Over 25 years, $XLV (healthcare ETF) has outperformed the market, alongside $QQQ and $XLY. Why? Aging population. Chronic disease. Non-cyclical demand. Do you know what changed? → Sector rotation (Mr. Market’s mood swing) → Post-COVID claim spikes hurting insurers → High interest rates choking biotech funding → Regulatory noise scaring off capital Short-term chaos. But structurally? Demand is compounding. And when capital returns to this sector (it always does), the upside will be violent. I’m not betting on miracles. I’m accumulating high-cash-flow, dominant companies trading at a 30–40% discount. Call me crazy, but I’d rather buy misunderstood resilience than overpriced hype. Healthcare won’t stay cheap for long. Follow me to see what I’m loading up on 👇 #stocks #investing #healthcare #valueinvesting #SP500 #biotech #XLV #UNH #stockmarket #trading #inflation #longterminvesting #financialfreedom

0

0

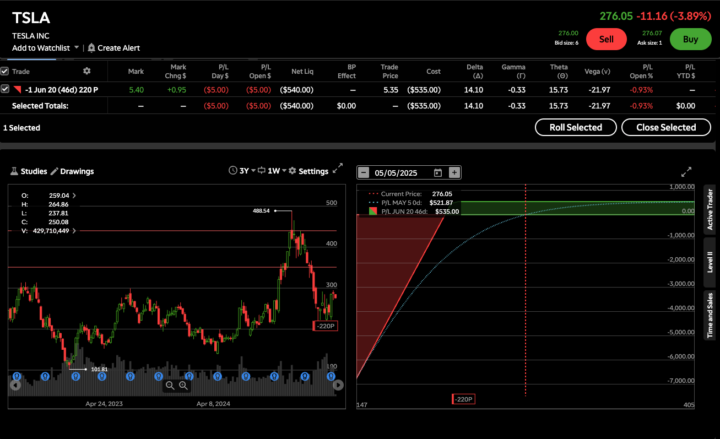

TSLA Trade Idea

Just sold a Cash-Secured Put on $TSLA: Strike: $220 DTE: 46 days Premium: $5.35 ($535 total) Collateral: $22,000 Yield: 2.43% for 46 days (~19.29% annualized) This trade, plus the $142 from $GOOGL, gets me 22.57% closer to my $3000 premium goal for June. June Target ($677/$3000) Happy to own $TSLA at $220 if assigned. If not? I keep the premium! Stay consistent, stay disciplined. #OptionsTrading #CashSecuredPut #TSLA #PassiveIncome #OptionsFlow

1

0

Late Night Trade | $MES Futures Long Position

Description: Woke up in the middle of the night... and decided to trust the setup. Took a long position on the Micro E-mini S&P 500 futures $MES — this is how it played out. 🔍 Trade Context: • Instrument: $MES Micro E-mini S&P 500 Futures • Direction: Long • Time: Middle of the night / overnight session • Strategy: Heikin-Ashi Diff crossover + Hull-Smoothed Stochastic filter • Entry: Bullish signal + oscillator confirmation • Exit: Momentum fade detected via Stochastic %K is 80 and drop 🎧 Background music: Royalty-free Music by Ribhav Agrawal 📈 Just a quick share of how trading can happen anytime, even when you’re half asleep. Sometimes the setups just call you.

2

0

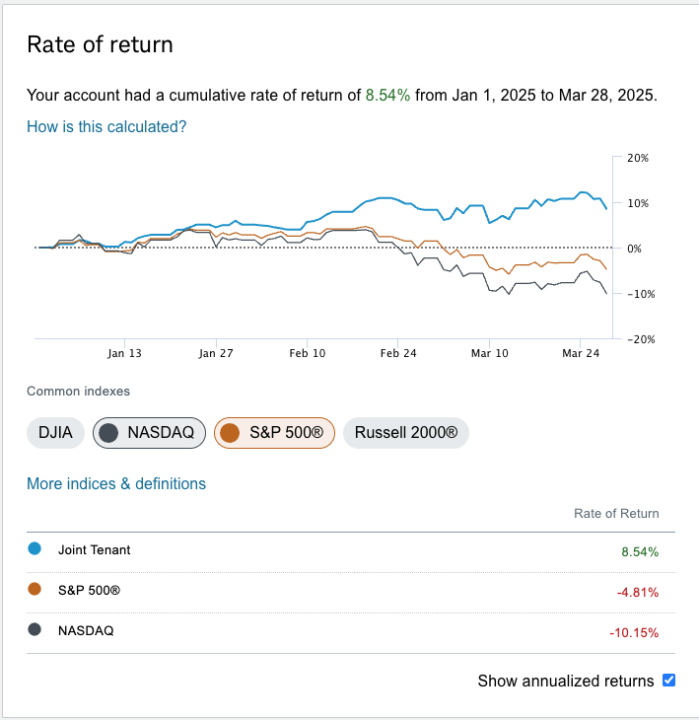

"Crushing the Market: How I Outperformed the S&P 500® with an 8.54% YTD Gain"

As of March 28, 2025, I’m excited to share that my account is up 8.54% year-to-date. It’s been a solid start to the year, especially when you compare it to the S&P 500®, which is down -4.81%, and NASDAQ, which is down -10.15%. It feels good to see that my approach is outperforming the broader market! For the month of March alone, I’ve had a net gain of $11,334.32, which works out to a 28.00% return on my initial investment of $36,163.40. Breaking it down further, my long-term positions gained $6,046.90 (29.89%), while my short-term positions brought in $5,287.42 (26.12%). Honestly, I’m proud of these numbers, especially since I’ve had a 100% gain/loss ratio—no losses this month, just growth. Looking at the broader picture, the 8.54% YTD return is a reflection of sticking to my strategy, staying disciplined, and managing risks. I’ve learned a lot along the way, and it feels great to see the hard work pay off—especially when I’m doing better than the market averages. If you’re on a similar journey, know that consistency and smart decisions can lead to some great results. I’m looking forward to what the rest of the year brings. Keep pushing and stay focused! 👏📈

3/27/25 Thursday

I entered an SPX 0DTE call butterfly for 2.00, 20 wide, mid strike 5755, and exited for 3.45. It continued to 4.35, but I had a few fly losses in the past few days, so I wanted to take the win early. I also sold a few put credit spreads on SPX for .75 and bought back for .35. That is my opening range breakout trade. Where is @Options Jive and @Tomer Har Yoffi in the past week? They are usually the most active.

1 like • Mar '25

@Winston Sam As an option seller, it's crucial to know when to let the magic happen—I'm talking about theta decay doing its work. I aim to hit my monthly goal by the 20th of each month, and this month, I was able to collect around $3200. So nothing new ... here are my last 2 trades: - Just sold a cash-secured put on $NVDA with a DTE of 21 days. Premium received: $125, strike price: $100. Let's see how it plays out! - Just sold a cash-secured put on $TSLA with a DTE of 22 days. Premium received: $250, strike price: $220. Let's see how it plays out!

1-10 of 44

@tomer-har-yoffi-4248

As an option trader, adept at navigating markets with strategic precision, optimizing returns, and effectively managing risks for consistent success.

Active 9d ago

Joined Dec 7, 2024

Powered by