Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

12 contributions to (Free)The Creditprenuer Group

🚨Empower Yourself: Keys to Success in the Community!!!🚨

Smitty has established a strong community foundation, but it's our responsibility to engage actively and seek improvement. Start by exploring the "Welcome to the Community" post and "Classroom" tab if you haven't already—these are essential first steps for success. To confidently handle calls and inquiries, you'll need to invest time in understanding the information firsthand. Challenge yourself to master credit repair, business funding, or any area of interest by utilizing community resources, conducting internet research, visiting libraries, and more. Below are important agencies to understand and research their operations: familiarize yourself with eligibility requirements, FAQs, and use online search tools to find answers to your questions. Experian: https://www.experian.com/ TransUnion: https://www.transunion.com/ Equifax: https://www.equifax.com/ FTC (Federal Trade Commission): https://www.ftc.gov/ CFPB (Consumer Financial Protection Bureau): https://www.consumerfinance.gov/ Additionally, below is important detail for the M2 GoatRepairs System: Smitty's AI Credit Repair Software: M2Goatrepairs.com M2Goatrepairs Get Support: https://ppower.typeform.com/metro2support?typeform-source=www.m2goatrepairs.com Metro2 Monetization Support Group via Facebook: https://www.facebook.com/groups/417042633674334/ MFSN In-depth Credit Reports: https://member.myfreescorenow.com/join/?PID=20048&fbclid=IwZXh0bgNhZW0CMTAAAR3-XdtD3HsV-h_J2bX3O-zWFKeoaSdcGq2eaGXic4AD9ll2U_h1o7CbGhU_aem_AYF3B1uAIgmDFVToxFCogo2dvrg23l-2KKkplHVIZak0TVP40ns7A0EwNSibhnyFCr2j1WPoNfEdEcs9wqzbYwiQ

🚀 Boost Your Credit Score with Tradelines & Credit Repair! 🚀

What's the two most common ways to both your credit score that's by using tradelines and credit repair. Tradelines: Add positive accounts to your credit report by becoming an authorized user. Showcase responsible credit use for a score boost! Credit Repair: Remove negative items like late payments or collections to present a cleaner credit history. Watch your score climb! Synergies for Success: - Combine tradelines and credit repair for a balanced approach. - Assess your unique situation and tailor your strategy. - Be patient, persistence pays off in the credit game! Unlock the power of a strategic credit boost. Your financial wellness journey starts now!

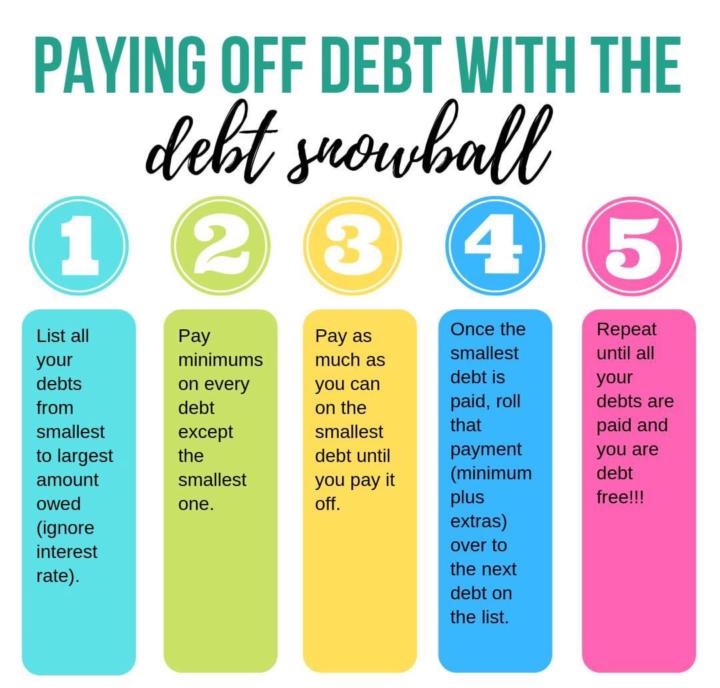

💥Payoff Debt Using Snowball Method 💥

It’s hard to achieve financial freedom with debt hanging on like an anchor, dragging you down. The debt snowball method is your starting point for tackling your debt effectively. It's a tried-and-true strategy for debt reduction, and here's how it works: 1. Arrange your debts in ascending order from the smallest to the largest. 2. Pay the minimum required on all debts, except for the smallest one. 3. Allocate the largest possible payment to the smallest debt. 4. After clearing the smallest debt, direct all that money toward the next in line. 5. Repeat until all your debts are completely paid off. While it might seem more logical to begin with larger debts, the beauty of the debt snowball lies in its ability to create momentum. You'll experience tangible progress much sooner, helping you stay motivated. Starting with bigger debts can make it feel like you're stuck forever. Trust me, this approach works. You'll celebrate each small victory, leading to significant debt reduction.

🔍 Cracking the Credit Code: Credit Score vs. Paydex Score! 💡💳

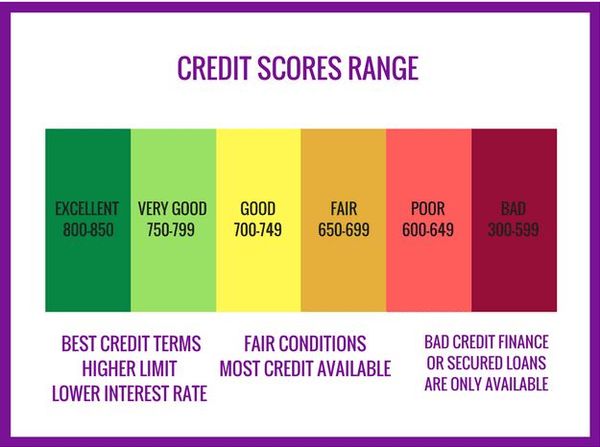

Ever wondered about the numbers behind your business's financial health? Let's break it down: Credit Score: Your personal credit score ranges from 300 to 850. It reflects your creditworthiness, considering personal financial habits like credit card payments and loans. Higher scores open doors to better rates and opportunities. Aim for that 800+ sweet spot! Paydex Score: Now, for your business, there's the Paydex Score, ranging from 0 to 100. It focuses on your business's payment history. The higher, the better! A Paydex of 80 or above showcases reliable payment habits, boosting your credibility with suppliers and lenders. Remember, both scores matter in different ways! Ready to master the art of credit? Drop a comment or message us for personalized tips! #CreditSmarts #FinancialWellness #KnowYourScores

I missed my community!

Hey guys! I miss you guys! Unfortunately I was involved in a horrible car accident but by the grace of GOD I made it. It was definitely a long recovery but I'm back stronger than ever🙏🏾

1-10 of 12