Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

BuildUp Bootcamp

6.1k members • Free

TD

The DJPS Academy

2k members • Free

Property Sourcing Secrets UK

1.1k members • Free

Bri's Investors Circle

670 members • $5,000/y

Assets For Life Hub

8k members • Free

The Elite Sales Community

476 members • $10/m

14 contributions to The Elite Sales Community

Property Help

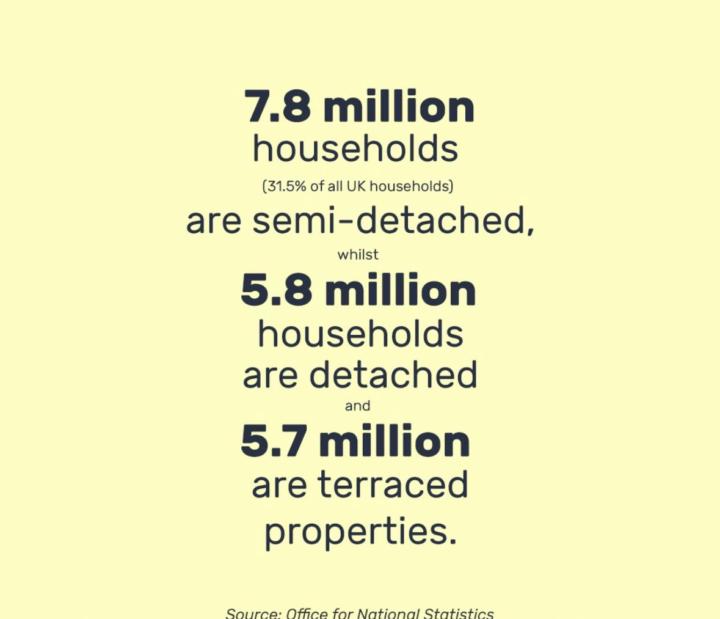

The best properties to target for the majority of investors will be semi detached and terraced houses, typically 2-3 bedrooms. The reason why I prefer targeting these types of properties that are freehold is because there is a larger pool of investors looking for these types of deals. When you are sourcing and flipping the deal, you always have to out yourself in the mind of the buyer. Example: what can I buy this for? How much work does it need roughly (if it does need work) What will it be worth done up? What is it worth now (if it needs no or little Work). What do I need to offer to generate a 20% profit margin? If I hold the property, what is the rental amount? When I look on Rightmove is there similar properties up for sale within 1/4 of a mile? Or close by? When I got to sold prices, is there properties like mine (the one your looking at) selling? This is known as a comp. A like for like comparable. Basically, you always want to be making sure there is demand, either for renting, especially if the goal of the investor is to buy, refurbish, and rent. Or if they are looking to Buy, refurbish, and flip (sell), then the key is to look for any selling/buying activity. I always like to avoid rural areas, you want to Be sourcing deals 2-3 bedrooms, where there is good population, and demand.

🏠 UK House Prices Set to Rise in 2025: What It Means for Everyone in Property 📈

The UK housing market is gearing up for another surge in 2025, with house prices predicted to keep climbing. A combination of falling interest rates, rising wages, and limited housing supply are driving this upward trend. Here’s how this affects you—whether you’re an investor, first-time buyer (FTB), landlord, or any other stakeholder in the property game. Key Factors Behind the Rise: 📉 Falling Interest Rates: Mortgage rates are declining, making borrowing more affordable. 💷 Rising Incomes: Wages are outpacing inflation, boosting buying power. 🏠 Limited Supply: High demand and low availability of properties continue to push prices up. What This Means for Key Stakeholders: Property Investors 🏢: Capital appreciation looks promising. However, watch out for upcoming Stamp Duty changes that may impact investment decisions. Landlords 🔑: Rising house prices could increase the value of your portfolio, but consider how this might affect rental yields and tenant affordability. First-Time Buyers (FTBs) 🏡: Higher wages are helpful, but rising prices and reduced Stamp Duty thresholds in April 2025 could make the market tougher to enter. Property Sourcers 🔍: The market’s tight supply means sharper skills are needed to spot lucrative deals. Estate Agents 🏠: Expect steady transaction levels as buyers try to beat the April 2025 Stamp Duty changes. Flippers 🔄: Rising prices offer strong profit opportunities, but careful budgeting is essential with increasing renovation costs. Cash Buyers 💰: While falling rates make financing easier for others, your ability to act quickly remains a huge advantage. Mortgage Brokers 🏦: Clients will be relying on you to navigate lower rates and secure competitive deals. Developers 🏗️: The demand for new homes remains high, creating potential for growth if you can manage supply constraints. Upcoming Changes to Watch: Stamp Duty 📜: From April 2025, the "nil rate" band for first-time buyers will drop from £425,000 to £300,000, impacting affordability. 💬 What’s your strategy for navigating the 2025 market? Are you buying, selling, or waiting? Share your insights and experiences below!

Well done to one of our students @fayokemi-hunja

first deal over the line small win and a good little fee well earned just in time for Xmas 🥳 and started an investors journey on his first property Portfolio and strongly looking for the next deal well done

Who Moved My Cheese?

WHO MOVED MY CHEESE? By Spencer Johnson MD This is a fantastic clip for mindset. Life doesn’t always go the way we want or expect it to. As humans, we are afraid of and anxious about change. When change does happen, we naturally resist that change. Change represents the unknown, which challenges our sense of safety and security. This is a story about change: SEEING it, ANTICIPATING it and ADAPTING to it. It is very motivating and changed the way I viewed things when it was first shown to me over 10 years ago (although I have had to come back to it to refresh my mindset on change - we are creatures of habit) Enjoy and let me know your thoughts. https://youtu.be/jOUeHPS8A8g?si=ekHS_kzYp2G4QBOY

How to assess if a house flip is profitable.

I am asked this a lot , below is the simple steps and in reality its also time against money if you can flip and do in 3 months is 10K not a bad deal for a months work and two months selling £20 sound better and £30 even more but its about how much you put in againset how much return you get , buy cheap and the returns are small , buy high and you rewards are bigger but so is the risk 1) Ignore asking price. 2) Reverse engineer. 3) What is the property selling when in good condition. 4) Start with end goal in mind. END Value £££ Minus - refurb - profit - legal cost - Broker fees - holding cost if using Bridging - loan interest - Stamp Duty - Other Small bills - council tax - gas - electric OFFER!!!!

1-10 of 14

@beverley-wilson-8059

I Am A Proud Mother! Building My Empire! On Fire 🔥 TAKE Action Action Action Action Action

Your Future Self Is Depending On You! Born To Win🙏🏾💜

Active 1d ago

Joined Nov 6, 2024

East London

Powered by