Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

REinvest Real Estate

204 members • Free

6 contributions to REinvest Real Estate

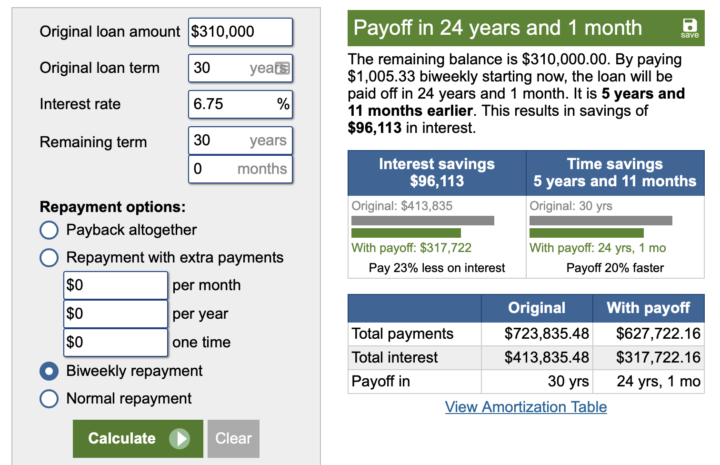

Mortgage hack

Did you know making mortgage payments 2x per month rather than 1x per month can save you 10s or 100s of thousands over the life of the loan? I did this example with @Inez St James last week. This is a great thing to call your clients about. Here's a link to the mortgage payoff calculator I used. Below is the summary email I sent to Inez. ** Note Inez is an agent, not a client, and we we're working on her retirement plan 😀 ** Also note, I had inserted the screenshots in between the lines of text in the email. Skool won't let me do that, so you'll have to click the pics attached. Here are the screenshots I took of the hacks to saving money on your mortgage. Scenario 1 costs you nothing, it's a no brainer if your lender will let you do it... Scenario 1: If you were to switch to bi-monthly payments, i.e. pay the same $2,900 per month but in 2x $1,450 per month payments.... This saves you $96,000 on the life of the loan, which is 5 years and 11 months! Scenario 2: If you were to make 1 extra lump sum mortgage payment per year, i.e. 1x $2,900... this saves you $121,700, i.e. 7 years and 8 months! Scenario 3: If you were to take that extra $2,900 per year and split it up into monthly payments, so pay an extra $250 per month... This saves you $129,100 i.e. 8 years!! What I couldn't calculate, and what is the best overall option is a combo of scenarios 1 and 3 ... make payments 2x per month, and add $125 per month to each payment. That should save you close to $200k over the life of your loan? This is a guess by adding Scenarios 1 + 3 and rounding down significantly...

What last minute tax deductions are you getting?

Have you been thinking about a business purchase but delaying? Now may be a good time to pull the trigger so you can take the expense in 2024. Doing so will reduce your taxable income in 2024. Examples of business expenses to consider are: electronics like computers, printers, AirPods, tools if you own rentals or flip houses, staging furniture if that’s a service you provide, marketing collateral like open house signs and business cards, to name a few. What am I missing? Is there anything you’re going to buy before January 1st?

Do you start something new, or clean up old tasks?

It's the end of the year and I find I'm struggling with that decision. My "the efficient business owner part of me" says lead generate, advertise, and drive revenue. Do the 20% of tasks that drive 80% of the results. Another part of me says "you've put off so much admin while finishing the book and prepping for the event and you can't do that any longer". Is anyone else facing this issue, or a similar one? How are you working through it?

1 like • Dec '24

@Lou Raven My main focus is to be consistent. My first 4 months were really solid last year closing half of my deals by April. Once Jackie went back to work it became a lot tougher. I'll be keeping the same lead sources but maintaining my schedule being more BOLD. A word I'm using to surround my year of 2025.

Share Your Yearly Goals!

What you focus on expands! By sharing your goals with the group and you'll be 1 step closer to meeting them. So tell us, what are your sales goals this year? Do you have other personal goals?

Shout out to Ben for leading his client like a pro!

Contrary to what they may think, your clients don't always know whats best! And it can be difficult to lead them to the next steps to take in a way that builds trust and rapport with you... even if it is not what they want to hear. Great work, @Benjamin Lemieux !!! Has anyone else dealt with a stubborn seller in this market trying to price too high? @Sean Richard Any recent memorable FSBO cold calls we could all learn from?

2 likes • Oct '24

Thank you! My biggest takeaway was probably just the consistent follow up and being able to really provide the reasoning for the price point he needs to list at. He was hoping for too high of a sale price in my opinion based on the homes condition and the limited buyer pool that will be interested due to the fact this isn't property wont qualify for conventional financing. I showed him comps, and we discussed the after rehab value. We also discussed what investors will need to put into budget wise. After doing that he admitted to being unrealistic with his price as well as having the time to fix it himself and has agreed to either do a price reduction to my suggested list price 2 weeks in or just start at my suggested list price.

1-6 of 6

@benjamin-lemieux-7044

CT EXP Agent/RE Investor. Dedicated to delivering a high level of customer service to my clients

Active 133d ago

Joined Jul 31, 2024

Middletown CT

Powered by