Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

Fruitful Real Estate

1.8k members • Free

Service Business Ads

1.4k members • Free

The AI Advantage

69.3k members • Free

Multifamily Wealth Skool

13.5k members • Free

The Finance Playbook

77 members • Free

The Founders Club

61.4k members • Free

Trading Fanatics

10.8k members • Free

The Vault

25.5k members • Free

Growthsolutions.io Community

885 members • Free

9 contributions to Fruitful Real Estate

Invite a friend and get paid!

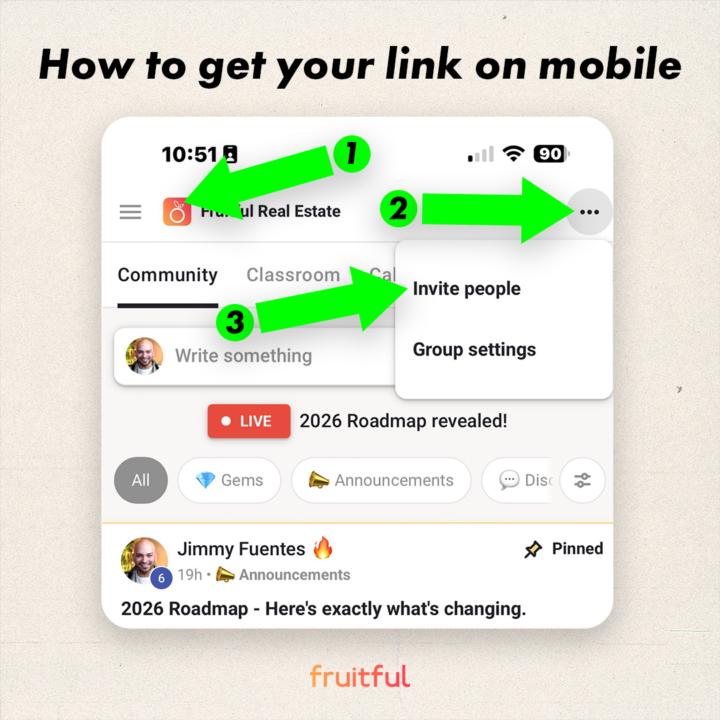

Step 1: Get your invite link. (see image) ⚠️ IF YOU DON'T USE YOUR LINK, YOU WON'T GET PAID. Skool manages all the payouts. We don't and can't control any of it. Step 2: Share it with someone. That's it. Step 3: Comment "Done" in this post once you find/get your custom link. P.S. You get 20% of any workshop and any paid tier (recurring until they cancel). FOR LIFE. 🫶

Final course feedback:

I would say this course has been helpful to me in a few aspects, especially in giving certain tips. That will definitely be used to our advantage. Although I will say that this course lacked some significant examples. If you were to show that in a slightly greater detail, say I opened these credit cards and this is what happened, and then my rating shot up and then I was able to approve my loans/LOC’s easily with this lender, for example. That would make understanding and applying the concepts easier. Also not this course is more generalist than specialist, so specialist examples would be appreciated. Also more resources could prove helpful also

3

0

Title: 3. Predictable Funding Machine (as a multifamily investor/developer)

My biggest takeaway is to stay on top of the credit paying off and to repair the portfolio. (also have several credit cards, assuming little unpaid debt can show that you are one to repay easily and that boosts your lender’s view of you.) My biggest concern/challenge is learning how to do it, and doing it.

3

0

Title: 2. $1 Million in Funding Assignment (as a multifamily investor/developer)

My biggest takeaway is how one can build lending credibility (mostly socially) via logging and documenting, even if no deals have been made, and how either bluffing it out could get some capital. (Although I did get a spiel from one of my partners stating that one should also be honest about that experience, or lack thereof, especially for larger deals such as multifamily or commercial as that could backfire horribly). My biggest concern/challenge is discovering this and implementing it on a larger scale.

3

0

Title: 1. Time Traveler Assignment (as a multifamily investor/developer)

My biggest takeaway is the fact that one could get away with buying some shell corps and use them to get lines of credit and bypass the 2 year rule for businesses and lending. My biggest concern/challenge is finding those tricks, as well as identifying legal issues that could arise from their implementation.

3

0

1-9 of 9

Active 6d ago

Joined Dec 21, 2025

Powered by