Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Owned by Anna

Learn Fund Accounting NAV Calculation from a 20-Year Industry Expert Complete Online Training • Interactive Excel Workbook • Self-Paced

For women done waiting, ready to choose themselves. Bold, structured tools for reclaiming power. Not soft self-care—real rebuilding for real women.

Memberships

Skoolers

190k members • Free

19 contributions to NAV Skool

I just launched AIS Career Launch — Self-Serve (Junior Edition).

It’s a 14-day, 30-min/day system designed for juniors who want a simple, repeatable way to: - upgrade an ATS-friendly CV - sharpen LinkedIn positioning - build outreach + follow-up cadence - prepare STAR stories + interview answers - track applications and stay consistent I created two tracks: General Self-Serve (Junior Edition) Finance Self-Serve (Junior Edition) Both are $5 each and include the full template pack (PDFs + Docs + Sheets) so you can start immediately. If you’re early in your career (or mentoring someone who is), you can grab it here: https://lnkd.in/dDhsxG2w If you want me to expand this into a Guided version (live support + reviews), comment CAREER and I’ll share what’s coming next.

0

0

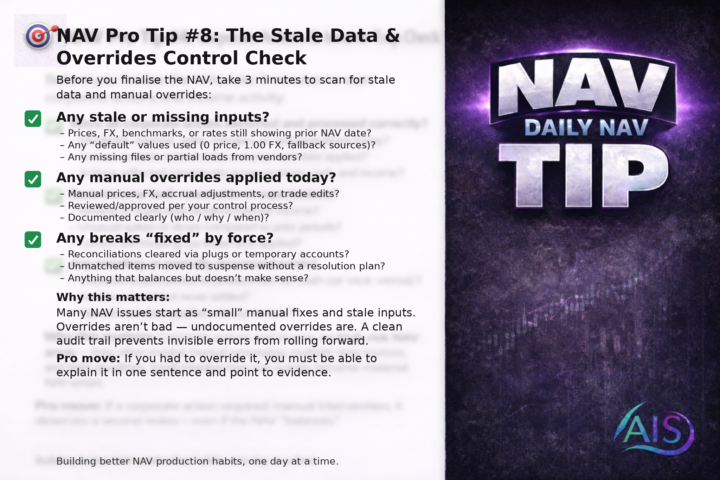

🎯 NAV Pro Tip #8: The Stale Data & Overrides Control Check

Before you finalise the NAV, take 3 minutes to scan for stale data and manual overrides: ✅ Any stale or missing inputs?– Prices, FX, benchmarks, or rates still showing prior NAV date?– Any “default” values used (0 price, 1.00 FX, fallback sources)?– Any missing files or partial loads from vendors? ✅ Any manual overrides applied today?– Manual prices, FX, accrual adjustments, or trade edits?– Were they reviewed/approved per your control process?– Are they documented clearly (who/why/when)? ✅ Any breaks “fixed” by force?– Reconciliations cleared via plugs or temporary accounts?– Unmatched items moved to suspense without a resolution plan?– Anything that balances but doesn’t make sense? Why this matters: Many NAV issues start as “small” manual fixes and stale inputs. Overrides are not bad — undocumented overrides are. A clean audit trail and a quick sanity check prevents invisible errors from rolling forward. Pro move: If you had to override it, you must be able to explain it in one sentence and point to evidence.

0

0

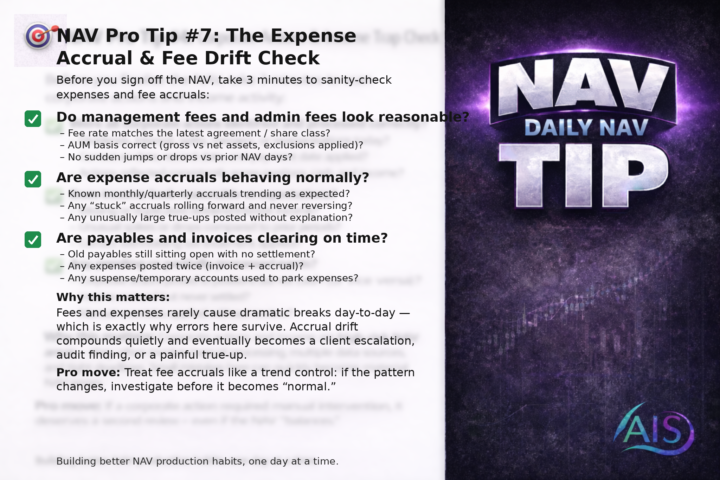

🎯 NAV Pro Tip #7: The Expense Accrual & Fee Drift Check

Before you sign off the NAV, take 3 minutes to sanity-check expenses and fee accruals: ✅ Do management fees and admin fees look reasonable?– Fee rate matches the latest agreement / share class?– AUM basis correct (gross vs net assets, exclusions applied)?– No sudden jumps or drops vs prior NAV days? ✅ Are expense accruals behaving normally?– Known monthly/quarterly accruals trending as expected?– Any “stuck” accruals rolling forward and never reversing?– Any unusually large true-ups posted without explanation? ✅ Are payables and invoices clearing on time?– Old payables still sitting open with no settlement?– Any expenses posted twice (invoice + accrual)?– Any suspense/temporary accounts used to park expenses? Why this matters: Fees and expenses rarely cause dramatic breaks day-to-day — which is exactly why errors here survive. Accrual drift compounds quietly and eventually becomes a client escalation, audit finding, or a painful true-up. Pro move: Treat fee accruals like a trend control: if the pattern changes, investigate before it becomes “normal.” Building better NAV production habits, one day at a time.

0

0

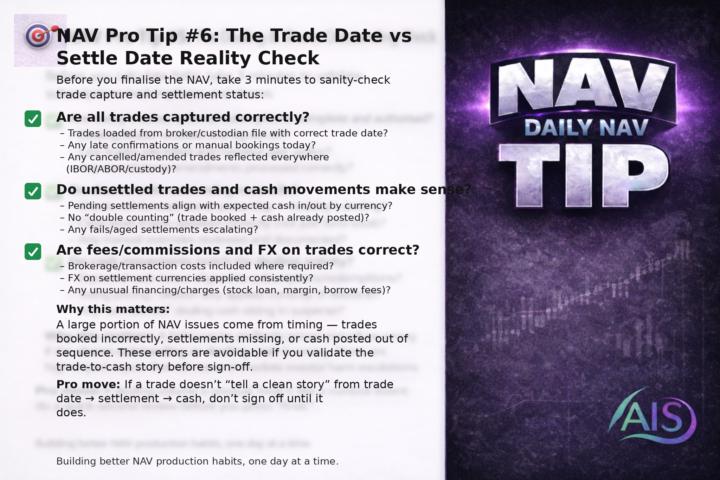

🎯 NAV Pro Tip #6: The Trade Date vs Settle Date Reality Check

Before you finalise the NAV, take 3 minutes to sanity-check trade capture and settlement status: ✅ Are all trades captured correctly?– Trades loaded from the broker/custodian file with the correct trade date?– Any late confirmations or manual bookings today?– Any cancelled/amended trades reflected everywhere (IBOR/ABOR/custody)? ✅ Do unsettled trades and cash movements make sense?– Pending settlements align with expected cash in/out by currency?– No “double counting” (trade booked + cash already posted)?– Any fails/aged settlements escalating? ✅ Are fees/commissions and FX on trades correct?– Brokerage/transaction costs included where required?– FX on settlement currencies applied consistently?– Any unusual financing/charges (stock loan, margin, borrow fees)? Why this matters: A large portion of NAV issues come from timing — trades booked incorrectly, settlements missing, or cash posted out of sequence. These errors are avoidable if you validate the trade-to-cash story before sign-off. Pro move: If a trade doesn’t “tell a clean story” from trade date → settlement → cash, don’t sign off until it does. Building better NAV production habits, one day at a time.

0

0

AIS Interview Toolkit

I've hired 100+ fund accountants over 20 years. Here's the ONE question that separates experts from pretenders: "A fund has €10M assets, €500K liabilities, and 100K shares. You just revalued €2M in USD securities using month-end FX rates. Walk me through the NAV impact." If they can't answer this in 30 seconds, I know. After two decades, I've compiled 150+ questions like this into a complete Fund Accounting AIS Interview Toolkit. 6 professional Excel templates: → 150+ technical + soft skills questions → Interview scorecards → Candidate comparison matrix → Complete hiring framework Stop gambling on hires. Start making data-driven decisions. #FundAccounting #AssetManagement #HiringManagers #Operations

0

0

1-10 of 19

@anna-balandynowicz-3605

Learn Fund Accounting NAV Calculation from a 20-Year Industry Expert Complete Online Training • Interactive Excel Workbook • Self-Paced

Active 1h ago

Joined Jan 2, 2026