Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

The REI Tribe

36 members • Free

4 contributions to The REI Tribe

Homeowners insurance companies are not your friend

Just a reminder that the PRIMARY job of insurance companies is to take money from your escrow every 6 months and do everything in their might to not pay you out when a claim has been submitted. They are not always right and you can use AI tools to call them out. My property is currently under construction and can be considered “vacant,” I had a thief that broke in and caused $24,000 in damages. I filed an insurance claim and it was denied because they “don’t cover vacant properties.” I sent the policy to chatgpt and chatgpt caught a loophole where they say “vacant homes that are currently under construction are not considered vacant.” I went ahead and submitted an appeal, they didn’t reply nor were not picking up my phone calls. I was ignored for almost 2 months. Ok cool, guess we going to do it the hard way. I filed a complaint to the states insurance administration and called a lawyer last week through LegalShield to send out a letter on my behalf. And LO AND BEHOLD… my first contact ever since my appeal 2 months ago… got an email this month saying the check is on its way. So lesson learned, these insurance companies will try you hoping you don’t challenge them. Don’t budge yall!

Protect Your Property: The Importance of Diligence in Tenant Application Review

As of late I’ve been seeing more and more potential tenants applying for units but submitting fake paystubs, so I thought I’d take some time to drop a few tips and tricks. As property managers and landlords, we all strive to find the best tenants for our properties. However, one concerning trend that has emerged is the submission of fake pay stubs by potential tenants. It’s essential to stay vigilant and informed to safeguard our investments and maintain the integrity of our rental spaces. Red Flags to Identify Fake Pay Stubs: 1. **Inconsistent Formatting:** Genuine pay stubs usually have a consistent format. If you notice discrepancies in font, spacing, or layout, it could be a sign of forgery. 2. **Unrealistic Income Figures:** If the reported income seems unusually high for the tenant's employment type or location, it warrants further investigation. Cross-reference the income with the tenant’s job title and industry standards. 3. **Missing Information:** Authentic pay stubs typically include the employer's name, address, and contact information. If any of this critical information is missing, it's a potential red flag. 4. **Incorrect Tax Deductions:** Pay stubs should show appropriate tax deductions based on the employee's income. If the deductions seem disproportionately low or absent, it raises suspicion. 5. **Poor Quality or Blurry Images:** If the submitted pay stub is of low quality or appears blurry, it might have been altered or created using basic software. The Importance of Diligence: While it might be tempting to quickly process applications to fill vacancies, thorough vetting is crucial. Taking the time to verify income and employment can save you from potential issues down the line, including: - **Delayed Rent Payments:** Tenants who misrepresent their financial situation may struggle to pay rent on time, impacting your cash flow. - **Legal Complications:** Accepting a tenant based on fraudulent documentation can lead to legal disputes and costly evictions.

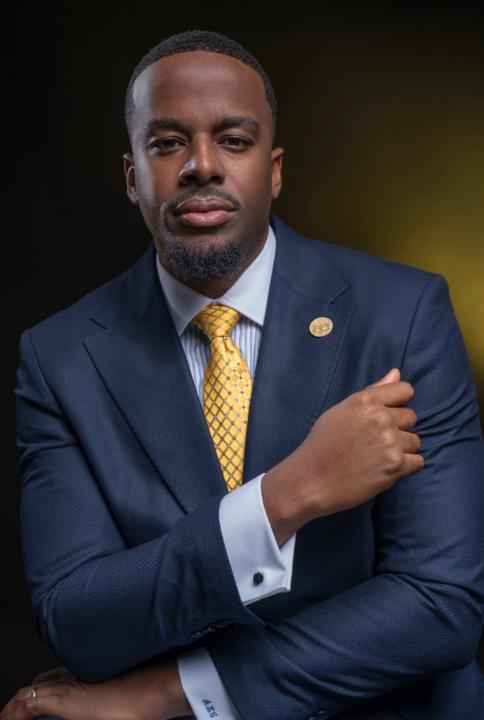

Introduction

My name is Andy Charles and I started investing in real estate almost 2 years ago with my first property in Baltimore, MD using a 203k FHA loan. I also run a vending machine business on the side IN THE DMV area and just recently received my real estate license a few weeks ago. Since starting my real estate investment journey I reconnected with Dyani who is an old co worker of mine and she has helped me map this journey for further investments as soon as my first property is finished construction. I consider myself a student to the game, I’m a fast learner and I’m here not only to make money but to listen and grow so that I can a secure a future for my wife and daughter. Let’s get to the bag y’all!

🚀 **Exciting Updates from My Real Estate Journey!** 🚀

At the start of 2025, I set a goal to add at least 6 more units to my portfolio, and I’m thrilled to share that as of May 14th, I'm already under contract for 4 units! 🎉 Plus, I made an offer on unit number 5 just last night! But that’s not all—I’m also venturing into a new project: launching my first crash pad! This has the potential to be the most exciting endeavor I tackle this year. By converting one of my new units into a crash pad, I’m set to open at least 4 additional streams of revenue, and I couldn’t be more excited about it! The unit I plan to transform could generate about $1,750 per month as a long-term rental, but as a crash pad, it’s expected to bring in around $6,400 monthly—plus extra revenue from vending machines! 💰 When people ask me why I love real estate, this is exactly it! I thrive on the creativity involved, the potential for cash flow, and the chance to maximize appreciation while others overlook these opportunities. I’m taking an asset that many may dismiss and using it to build a life of abundance for myself and my kids. Here’s to dreaming big and making it happen! 🌟 #RealEstate #CrashPad #CreativeInvesting #AbundanceMindset #BuildingWealth

1-4 of 4

@andy-charles-8995

I’m a real estate investor and licensed real estate agent in the Baltimore area. I also run a vending machine business in the DMV area

Active 22d ago

Joined Feb 23, 2025

Baltimore, MD