Activity

Mon

Wed

Fri

Sun

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

What is this?

Less

More

Memberships

Truth Seekers Society 🆓

9.3k members • Free

Legacy Wealth Academy

129 members • $5/m

20 contributions to Legacy Wealth Academy

🚨 Current Market Conditions: How to Sleep Better at Night

⚠️ Markets are up, then down. The news is filled with fear. Inflation, interest rates, and economic uncertainty are making people nervous. But here’s the truth: You don’t have to let the market dictate your financial future. Here are 4 simple, practical steps to protect your money and your peace of mind: 1️⃣ Keep More Cash in Safe Places • If your emergency fund is low, start by setting aside 3-6 months of expenses in a high-yield savings account or money market fund. • Don’t put all your extra cash into risky investments. You need liquid money for unexpected expenses. 2️⃣ Move Your Retirement Money Out of Risk • If you have an old 401(k), 403(b), or IRA, check how much is exposed to stock market losses. • Consider rolling some or all of it into a Fixed Indexed Annuity (FIA) – this locks in gains and protects against downturns. • We don’t charge any fees for rollovers, and unlike many agents and companies that prioritize commissions, we ensure every policy is structured in the best interest of the client. 3️⃣ If a Rollover Isn’t an Option, Reduce Market Risk • If your money is locked in a retirement account and you can’t move it, consider shifting a portion into bonds or cash positions within your portfolio to reduce risk. • Many people overlook the stability of bonds and money market accounts as a hedge against volatility when they can’t pull funds out. 4️⃣ Start Building a Tax-Free Retirement Plan • The stock market isn’t the only way to grow wealth. An Indexed Universal Life (IUL) policy allows your money to grow tax-free with no market loss risk. • Unlike traditional retirement accounts, you can access tax-free income later in life, without penalties or required withdrawals. 5️⃣ Cut Expenses & Increase Cash Flow • Look at your last 3 months of bank statements. Find subscriptions, unused memberships, or high-interest debt to eliminate. • If you own a business, optimize tax strategies to keep more of your money. Final Thought: You don’t need to be a stock market expert to win financially. You just need to be smart about where your money sits. If you’re unsure what to do, let’s chat about your options. Your future self will thank you!

🛡️ Unlock Massive Tax Savings with Conservation Easements

Did you know you can protect the environment and save big on taxes? Conservation Easements are a little-known but incredibly powerful tax strategy. Let’s dive into the details 👇 What Is a Conservation Easement? It’s a legal agreement where you donate land or the development rights of land to protect natural resources. In exchange, you get a charitable tax deduction based on the land’s value—often up to 5X your donation! How It Works 1️⃣ Donate Land or Rights: Preserve land for forests, wildlife habitats, or open spaces by donating it or its development rights to a qualified conservation organization. 2️⃣ Claim the Deduction: You can deduct up to 50% of your adjusted gross income, with any excess carried forward for up to 15 years. 3️⃣ Tax Savings Example: • Donation Amount: $100K • Deduction: $500K (depending on valuation) • If in a 40% Tax Bracket: You save $200K that would’ve gone to the IRS! Legal and Compliance Considerations This strategy can deliver huge benefits, but compliance is key: 🔹 IRS Guidelines: • The easement must serve a legitimate conservation purpose (e.g., preserving natural habitats or historical landmarks). • The donation must be permanent and recorded with appropriate legal documentation. 🔹 Qualified Appraisals: • The land’s value must be appraised by a certified professional to avoid IRS scrutiny. 🔹 Legitimate Organizations Only: • Donations must go to a qualified conservation organization or government entity. 🔹 Syndicated Easements: • These allow multiple investors to participate but come with stricter IRS reporting requirements. Be cautious of inflated valuations. Why Consider Conservation Easements? ✔ Reduce Your Tax Liability ✔ Preserve Natural Resources ✔ Create a Legacy of Environmental Impact A Word of Caution ⚠️ The IRS monitors these transactions closely. That’s why working with experienced legal and financial professionals is critical to maximize your benefits while staying compliant. Let’s talk about turning tax savings into lasting impact!

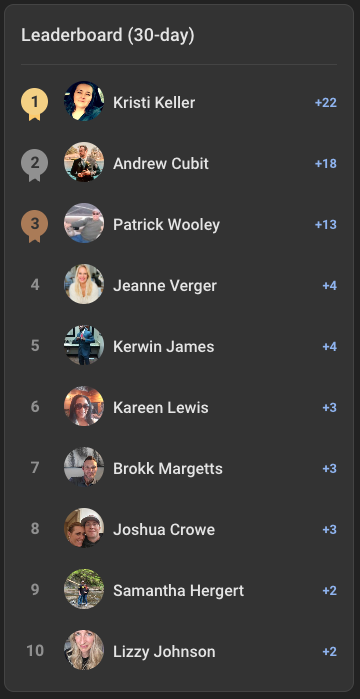

🎉 December Leaderboard: Top 5 Engagers! 🎉

Hey Legacy Wealth Academy family! 👋 Let’s take a moment to celebrate our Top 5 Engagers for December! Your energy and input keep this community thriving. 🙌✨ WHO'S NEXT?? (Get in here and join the conversation!) Here’s the Top 5 Leaderboard: 1️⃣ @Kristi Keller: +22 🏆 2️⃣ Andrew Cubit: +18 🔥 3️⃣ Patrick Wooley: +13 🎯 4️⃣ Jeanne Verger: +4 💡 5️⃣ Kerwin James: +4 🤝 @Andrew Cubit is no longer the reigning champ!!!??? Hmmmmmm... Congratulations to our December Winner: 🥇 Kristi Keller, your outstanding engagement has earned you the top spot! 🎉 A special gift is on its way to you next week! 🎁 🔥 Want to Rank Up in the Skool Community? Here’s How: ✔️ Start Discussions: Share insights, ask questions, or start conversations that bring value to the group. ✔️ Engage with Posts: Comment thoughtfully and support your fellow members. ✔️ Be Active Daily: Consistent activity is key—log in, contribute, and interact often. ✔️ Help Others: Answer questions, share tips, or offer encouragement to your peers. ✔️ Post Valuable Content: Share resources, strategies, or ideas that spark conversation. 💡 Pro Tip: Each interaction earns you points! The more you contribute, the higher you’ll climb on the leaderboard. The January race is ON! Will YOU be next month’s winner? Now’s the time to step up, connect, and take the lead. 🚀 Let’s make January even more impactful together! 💥 #LegacyWealth #Top5Engagers #RankUp #CommunityChallenge

🌟 What I'm Currently Investing In & Why 💰

I want to share a quick snapshot of what I’m personally investing in right now and why I’m bullish about these opportunities. 🌎📈 🚀 Crypto 🔹 XRP: Positioned as a leader in cross-border payments, XRP has massive potential in the financial world as blockchain adoption grows. 🌐 🔹 ETH (Ethereum): The backbone of decentralized applications (dApps), Ethereum’s upgrades are setting it up for scalable growth. 🚀 🔹 BTC (Bitcoin): The king of crypto! A trusted store of value with increasing institutional adoption. 💎 🔹 DOGE: A community-driven coin that continues to gain traction and could see utility expansion in the future. 🐕 🌟 Why Hold Crypto Now? The upcoming administration is signaling a more crypto-friendly approach, which could lead to mass adoption policies and regulatory clarity. This could be a huge catalyst for growth in the space. 📊 📈 Stock Investments 🔹 Apple (AAPL): A consistent leader in tech innovation, with massive potential in the AR/VR and AI sectors. 🔹 Tesla (TSLA): Pioneering the EV market and leading advancements in AI-powered autonomous driving. 🌍 🔹 NVIDIA (NVDA): The engine of the AI revolution, their GPUs are powering everything from AI development to the metaverse. 🤖 🌟 Why These Stocks? We’re in the early stages of the AI era, and these companies are shaping the future. Investing in them now is like catching a ride on a rocket that’s just taken off. 🛸 Their leadership and innovation give us a chance to capitalize on the next big tech wave. 💡 Takeaway: Whether it's crypto adoption or the AI revolution, the key is to position yourself early. These investments are more than just assets—they’re opportunities to ride the wave of innovation and wealth creation. Let me know what you’re investing in or if you have questions about these plays! Drop a 🚀 in the comments if you’re ready to level up your portfolio in 2025! 📢 Disclaimer: This is not financial advice. All investments carry risk, and you should do your own research or consult with a financial professional before making any investment decisions. Past performance is not indicative of future results. Invest responsibly! 🚨

🚀 COMMUNITY INPUT NEEDED: Monthly Live Zoom Calls?

Hey Legacy Wealth Academy! 👋 We’re always looking for ways to provide value and deepen our connections within the community. 🎯 I’m considering hosting a Live Zoom Call once a month, where we could: 1️⃣ Dive into financial strategies together. 2️⃣ Answer your burning questions live. 3️⃣ Collaborate and share insights as a community. But before moving forward, I want to hear from YOU! Would a monthly live Zoom call interest you? 🤔 Please drop a comment below with your thoughts and vote using these emojis: 👍 = Yes, I’m all in! 💡 = Maybe, I need more details. ❌ = No, not interested. Your feedback is what shapes the future of this group, so let me know! 💬

1-10 of 20

@kristi-keller-5657

Just a girl trying to save to retire with peace of mind.

Active 80d ago

Joined Dec 5, 2024

Powered by