Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by John

For overwhelmed people in debt who want peace of mind, a clear path forward, and up to $6,000 less debt in 3 months.

Memberships

Abundance for All

9 members • Free

Tea Relief Society

203 members • Free

Chaos to Clarity Lab

47 members • Free

Business Builders Club

3.7k members • Free

137 contributions to Credit Avenger Academy

Why I Am Not Worthless

I am not worthless because I still have something powerful to give: choice. As long as I can make decisions that protect my future, I still hold the shield. ,As long as my actions—no matter how small—move me toward stability, freedom, or clarity, I am not worthless. If my life impacts even one person for the better, I matter.And if that one person is me, that still counts.Especially in this journey. If I can offer love, patience, understanding, encouragement, or even a quiet moment of strength, I’m not worthless. If I can show up one more day, try one more time, or take one more step, then I have worth. If I can trust my own judgment, respect my growing wisdom, and honor the battles I’ve survived, I’m not worthless.If others see that value too, that’s a bonus—but my self-respect is the real credit score that counts. I am not worthless. I am a work in progress. I am rebuilding. I am rising. I am a Credit Avenger.

Mindset Check: What’s Your Money Story?

Everyone wants to get out of debt and live free — but very few stop to ask the *real* question: **What story are you telling yourself about money?** Is it “I’m just bad with money,” “I’ll never get ahead,” or “Money controls me”? Here’s the truth I’ve learned in over 7 years working with people like you: ✅ Your financial reality isn’t fixed — it’s a *reflection* of your mindset and habits. ✅ Debt isn’t the enemy. It’s a symptom of how you’ve been managing your mindset with money. ✅ The moment you stop blaming your circumstances or luck and start owning your choices — you "change your financial destiny". I want to challenge you today: - What’s one limiting belief about money you’re absolutely ready to bust? - What’s one new habit or mindset shift you commit to in this group starting NOW? Remember, this is not about perfection. It’s about progress. Share your answers below — let’s fuel each other’s breakthroughs. Accountability is how we win this fight. #MindsetIsEverything #TakeBackControl #CreditAvenger

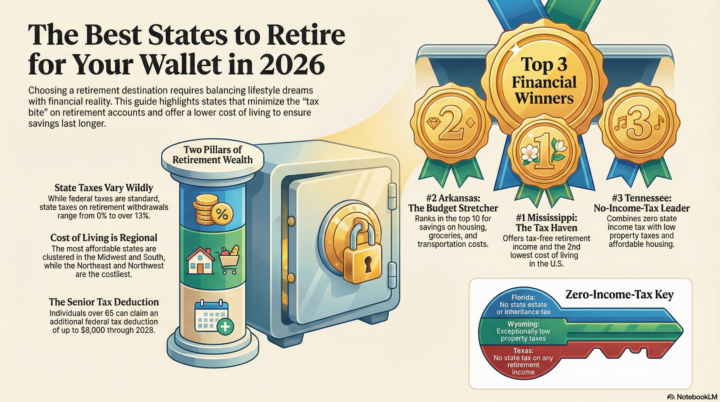

Best States to Stretch Your Retirement Savings

If you're mapping out your retirement plans or helping a client with theirs, location is one of the biggest levers you can pull to make a nest egg last longer. A recent 2026 analysis highlighted that "tax-friendly" doesn't always mean "budget-friendly"—you have to look at the whole picture, including housing, healthcare, and groceries. Here are the top 5 states identified for maximizing retirement wealth this year: 1. Mississippi - Why it wins: It has one of the most retiree-friendly tax policies. The state collects zero taxes on Social Security, pensions, IRAs, or 401(k) withdrawals. - The Trade-off: Sales taxes are on the higher side, but the low housing costs make it a financial powerhouse. 2. Arkansas - Why it wins: Consistently ranks in the top 10 for affordability (housing, groceries, transportation). While it has an income tax, retirees receive a $6,000 deduction ($12k for couples) and pay no tax on Social Security benefits. 3. Tennessee - Why it wins: No state income tax at all. It also boasts low property taxes and housing costs, ranking 8th overall for cost of living this year. 4. Wyoming - Why it wins: Another no-income-tax state with low property taxes. It's great for home ownership on a fixed income. - The Trade-off: Healthcare can be more expensive and less accessible than in other regions. 5. Georgia - Why it wins: People over 65 can deduct up to $65,000 in retirement income per person! Plus, groceries are exempt from sales tax, and Social Security is tax-free. Honorable Mentions: - Oklahoma: Ranked #1 for overall cost of living, though rising insurance costs kept it out of the top 5. - Florida: A classic choice with no state income tax, but coastal housing costs are climbing, so you might need to look inland to find deals. Where are you going to retire?

3

0

1-10 of 137

🔥

@johnpogue

The Credit Avenger-For overwhelmed people in debt who want peace of mind, a clear path forward, and up to $6,000 less debt in 3 months.

Active 4m ago

Joined Sep 16, 2025

Conroe Texas

Powered by