May 29 • GENERAL TAX BIZ DISCUSSION

📲 3 Automations Every Tax Business Should Set Up Before Tax Season

If you want to save time and scale faster this upcoming tax season, automation is your best friend. Here are 3 powerful automations to get in place now — before the rush hits:

1️⃣ New Lead Text & Email Follow-Up - Set up a workflow that automatically sends a welcome text + email to every new lead. Include your calendar link and a brief intro. Strike while they’re hot — speed = trust!

2️⃣ Appointment Reminders - Stop no-shows cold. Automate SMS and email reminders 24 hours and 1 hour before every scheduled consult. Add a “Confirm Appointment” button or reply option to increase show-up rates.

3️⃣ Client Onboarding Flow - Once someone pays, don’t leave them hanging. Trigger an onboarding email with next steps, a client portal link, document checklist, and FAQ. Make it seamless from day one.

✨ These automations can be built easily in a CRM. Who has a CRM already set up? Drop a “👀” below!

5

5 comments

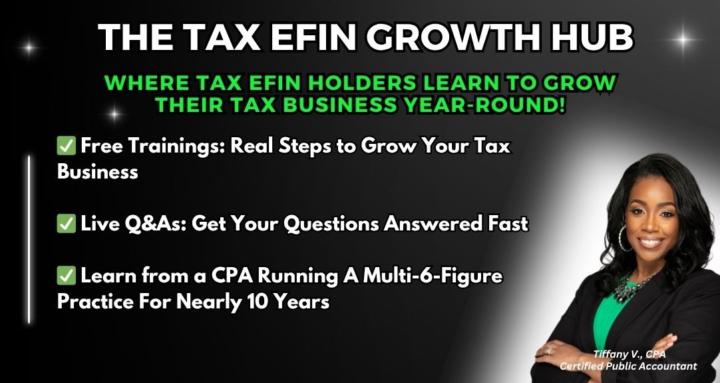

skool.com/taxefinhub

Where Tax EFIN Holders Learn To Grow Their Business With Proven Annual Coaching, No Back End Fees, Automation, and High-Volume Scaling Strategies.

Powered by