Aug 23 • General discussion

PAH3 (Porsche SE Holding) is Undervalued

Hello, thank you for accepting me into your Skool. My name is Valentin and I’ve been applying a Value strategy for over 10 years.

One of my strongest current convictions is Porsche SE (holding). It has a P/E ratio below 3, a balance sheet value net of debt well above its current share price, and a very manageable debt ratio.Just in H1 2025, they generated €1.11 billion in profit compared to a current market capitalization of only €5.7 billion.

Best regards,

2

4 comments

powered by

skool.com/painlesstraders-8746

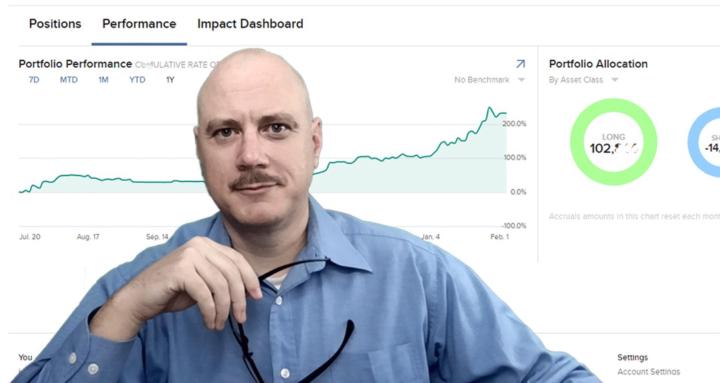

I've been trading for twenty years, I'll share my experience.

Suggested communities

Powered by