Oct '25 • Resources & Templates 📚

Why banks don't want you using ChatGPT

No bankruptcy.

No hit to your credit.

No costly attorneys.

7 prompts that turn the tables:

1. “Draft an email offering to settle my balance for 50% if I can pay in full today.”

→ Reps often take this seriously.

2. “Lay out the exact steps to request a lower APR on my [Bank] card.”

→ Cuts down massive interest charges.

3. “Show me what hardship programs my card issuer offers and how to qualify.”

→ Hidden options most people never hear about.

4. “Write me a call script to remove late fees from my account.”

→ Quick win—done in minutes.

5. “Find nonprofit credit counseling groups that negotiate with lenders.”

→ Many offer help at no cost.

6. “Compare the best balance transfer cards with 0% APR for 12–18 months.”

→ Gives breathing room with no interest piling up.

7. “Create a system to track progress and rebuild credit after debt payoff.”

→ Keeps you consistent and moving forward.

Save these. Try them out. Your debt plan will never look the same again!

7

3 comments

powered by

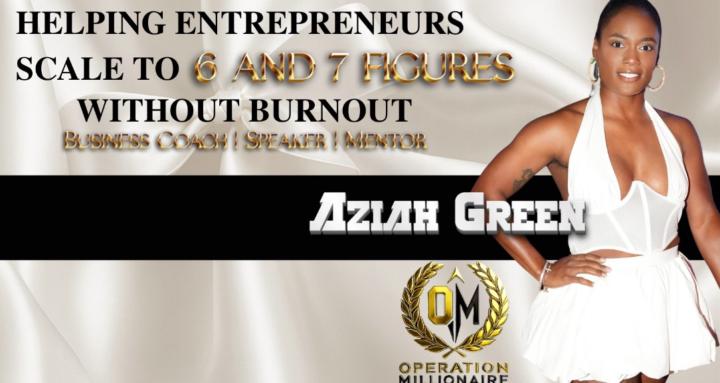

skool.com/operation-millionaire-5121

A Business Operations and Brand Acceleration Ecosystem for Founders ready to install Real Systems, Scale Revenue, and Operate like CEOs.

Suggested communities

Powered by