Write something

Pinned

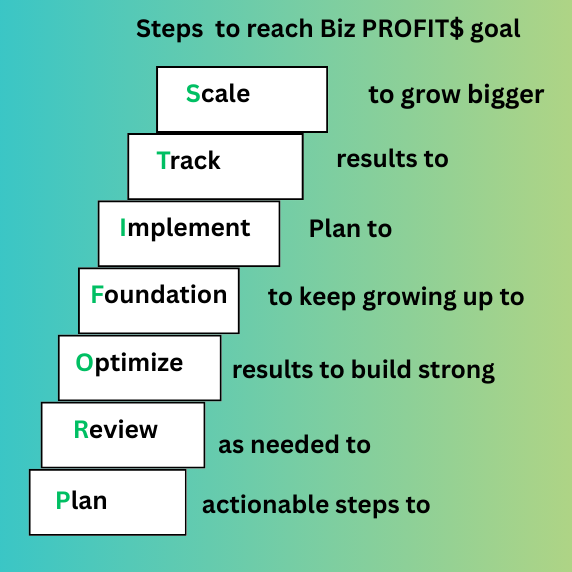

7 Steps to PROFIT$ goal & Quick Assessment to review your Plan the 1st Step

Here is the PROFIT$ Blueprint Foundation Tool to assess your 1st step PROFIT$ Plan. So you can keep going up the steps to reach your PROFIT$ goal.

0

0

Pinned

PROFIT$ Powerhouse Bundle FREE Tools to set PROFIT$ goals

Grab the PROFIT$ Powerhouse Bundle here 👉https://stan.store/BizGrowthAcademy/p/profit-blueprint-powerhouse-bundle I partnered with a group of powerful coaches and biz experts to bring you something special - the PROFIT$ Powerhouse Bundle. It’s a collection of tools, templates, planners and guides created by multiple coaches, all designed to help you plan, track, and grow your PROFIT$ goal. This bundle makes business growth simple, clear and doable. Grab the PROFIT$ Powerhouse Bundle here 👉https://stan.store/BizGrowthAcademy/p/profit-blueprint-powerhouse-bundle What’s inside the PROFIT$ Powerhouse Bundle tools and resources with a profit-focused action driven bundle designed to help you reach your PROFIT$ goal. FREE tools to help you: P - Plan actionable steps to reach your PROFIT$ goal R - Review as needed O- Optimize results F- Foundation building to keep growing your PROFIT$ goal I- Implement plan with resources to make execution more consistent T- Track results of marketing and sales so you can S- Scale to reach PROFIT$ goals Get ready to grow your PROFIT$ goal for 2026 with more clarity and actionable steps.

Question for Tax Pros & Firm Owners

I’ve noticed more discussions lately around CPA letterhead usage especially for IRS correspondence, bank verifications, and client representation letters. In practice, I’m seeing three recurring issues: 1. Many preparers aren’t sure when a CPA letterhead is actually required vs. optional 2. Others are using templates that don’t fully meet IRS or third-party expectations 3. Some are unknowingly exposing themselves to compliance or credibility risks with how their letters are structured What’s interesting is that none of this is clearly explained in one place, yet it directly affects how seriously clients, banks, and agencies take us as professionals. I’m curious: - Have you ever had a letter questioned, delayed, or rejected because of format or wording? - Do you follow a standard internal process, or does it change case by case? I’ve been digging deep into this lately, and the differences between a “good-looking” letter and a “defensible” one are bigger than most people think. Would love to hear how others here are handling it or what challenges you’ve run into. https://www.fiverr.com/s/qD76eBp

1

0

7 Steps to reach your biz PROFIT$ goal.

Here is a tool to give you content to improve your PROFIT$ goal. Get it here Be ready to grow your PROFIT$ goal for 2026. https://stan.store/BizGrowthAcademy/p/get-profit-blueprint-build-strong-biz-foundation-7hagwzv9

1

0

Profit Clarity Beats Profit Hype

One thing I appreciate about resources like the PROFIT$ Powerhouse Bundle is that it brings the focus back to structure, not just motivation. A lot of businesses don’t struggle because they lack ideas — they struggle because they don’t: clearly plan their profit targets review what’s actually working track numbers consistently or optimize based on real data Profit grows when systems are simple and visible. Curious to hear from the group 👇 What part of PROFIT$ do you feel needs the most attention right now — planning, tracking, or implementation? Tiny tweaks here can make a big difference going into 2026.

1-30 of 38

powered by

skool.com/biz-growth-academy-4752

The proven steps to create MAP (Momentum Action Plan) to reach your biz PROFIT$ goal.

Suggested communities

Powered by